[ad_1]

By Francesco Casarella

Investing.com — Once again, it seems counterintuitive, unthinkable, yet it is so: investing in times of war … pays off!

In fact, the mental mistake we often make (the mental “shortcut”) is to make the war connection = money is lost because the markets go down.

Yet, once again, knowing the history and dynamics of the market can help us not to fall into these generalizations that ultimately only make us lose money.

So let’s see what happened …

The graph

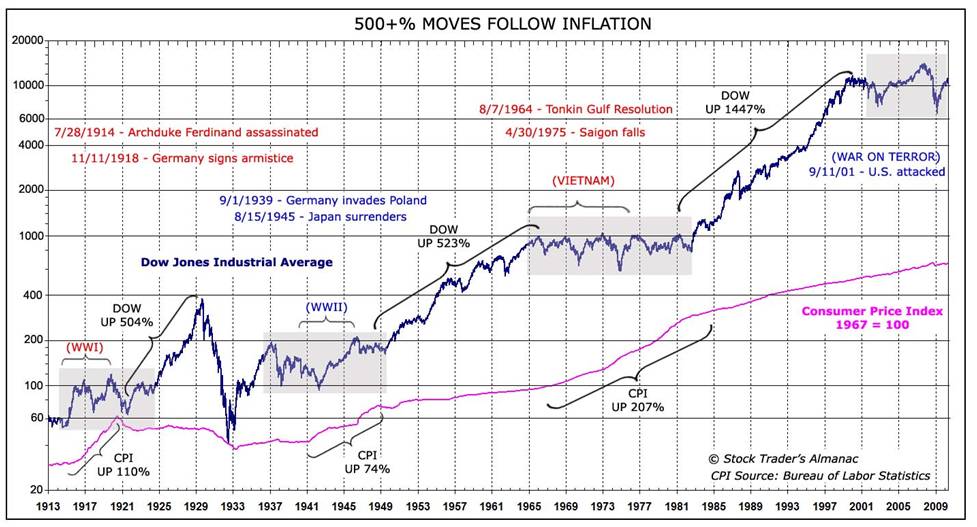

What you see in the image below, is the chart of the American in times of war, in particular, there are 3 very important events (and probably more extensive than the Russia-Ukraine conflict).

- WWI

- Second World War

- War in Vietnam

Source Bureau of labor statistic

Even just looking at the graph, with the war periods highlighted in grey, we can see how the values at the end of the war were in line with and often higher than at the beginning, and this on all three occasions mentioned above.

The numbers

So let’s go see the precise numbers in each of the 3 conflicts …

WWI

In the 6 months following the outbreak of World War I, the Dow Jones Industrial Average lost 30%. At that time, since the war had seriously affected the financial world, it was decided to close the stock market (even today, if you notice, many securities are suspended in the prices).

After another 6 months, when it reopened in 1915, the Dow Jones hit its all-time high in a single year: + 88%!

At the end of the conflict, which lasted from 1914 to 1918, the American index gained a total of 43%, or an annualized 8.7%.

Second World War

When Hitler invaded Poland on 1/9/1939, the market in the following session of 9/5/1939 went up by 10%. With the attack on Pearl Harbor (December 1941), shares initially opened lower (by just 2.9% however) but recovered in less than a month. When the Allied Forces invaded France in 1944, the Dow Jones Industrial Average recorded a 5% increase in the following month.

As in the First World War, at the end of the conflict, which lasted from 1939 to 1945, the Dow Jones earned 50% overall, equal to 7% annualized.

Vietnam War

Although more limited (and perhaps similar to that between Russia and Ukraine), the Vietnam War also had similar trends for the stock markets. In 1965, when American troops arrived in Vietnam, the Dow Jones closed the year with a 10% gain. At the end of the conflict, in 1973, the market achieved an overall performance of 43%, equal to 5% annualized.

Therefore, considering all 3 periods, we can say that the stock market has achieved an average of 45% overall and about 7% annualized.

Conclusions

Now, as always, we don’t have to take the data from the past and think that the future will be exactly the same. What we can say, however, is that history and numbers show that it is wrong to say that money is lost in times of war, just in case the opposite is true!

However, the real question that we must ask ourselves, in the rebound of + 88% of the First World War, in the rebound of April 2020 post-Covid, is the following: was I on the market at that time or was I out of it for fear?

Those are moments for which we cannot afford if we really want to reach important milestones in terms of results, to stay out of the markets.

Investing is always profitable with the right time horizon, and perhaps in times of war, it can be even more so.

“This article has been written for informational purposes only; it does not constitute a solicitation, offer, advice, consultancy or investment recommendation as such does not want to incentivize the purchase of assets in any way. Remember that any type of asset is valued from multiple points of view and is highly risky and therefore, every investment decision and related risk remain with you

[ad_2]

Source link