[ad_1]

Bank of England chief economist sees ‘significant’ response to mini-budget

The Bank of England is likely to deliver a “significant policy response” to last week’s announcement of tax cuts by finance minister Kwasi Kwarteng, its chief economist says.

But Huw Pill also argued that the Bank should wait until its next scheduled meeting in the first week of November (rather than through an emergency rate hike).

Pill told the CEPR Barclays Monetary Policy Forum that:

“It is hard not to draw conclusion that this will require a significant monetary policy response.”

💥BoE’s Pill: “Hard not to draw conclusion that this will require significant monetary policy response.”

— Andy Bruce (@BruceReuters) September 27, 2022

A ‘significant’ response is central bank-speak for a large interest rate rise.

Pill explains that the Bank’s monetary policy committee is not indifferent to the repricing of financial assets [which have plunged alarmingly since Friday morning’s mini-budget].

And he said he wanted to ‘flag clearly’ that the government’s fiscal announcement will “act as a simulus”.

That’s a sign that Pill thinks monetary policy must respond to Kwarteng’s tax cuts plan, with higher interest rates.

BoE’s Pill says there is “clearly” a UK-specific element to repricing assets

— Andy Bruce (@BruceReuters) September 27, 2022

“We are certainly not indifferent to the repricing of financial assets that we’ve seen.”

“We cannot be indifferent”

— Andy Bruce (@BruceReuters) September 27, 2022

BoE’s Pill: We are relying on communication and expectations until Nov meeting – this relies on confidence in UK economic framework

— Andy Bruce (@BruceReuters) September 27, 2022

Key events

Filters BETA

The FTSE 250 share index has dropped to a new 22-month low, extending its losses following Huw Pill’s speech.

The FTSE 250 contains more domestically-focused firms than the blue-chip FTSE 100, making it more vulnerable to a British economic downturn.

It’s down 1.5% today, at levels last seen in November 2020 (before the first successful Covid-19 vaccine results).

UK MID-CAP INDEX EXTENDS LOSSES AFTER BOE CHIEF ECONOMIST HUW PILL REMARKS, LAST DOWN 1.5%

— *seven (@sevenloI) September 27, 2022

Real Estate Investment Trusts, which own UK property assets, are among the top falls – some down over 7% today.

That shows that their underlying assets, such as shops and warehouses, have fallen in value due to the looming surge in interest rates.

Huw Pill added that while the BoE’s next scheduled policy announcement (on the first Thursday in November), seemed like a long way away, it is better for central banks to take a “more considered approach, a lower frequency approach,”

In the meantime the BoE would rely on communicating its intentions, the BoE’s chief economist added.

#BoE‘s Pill: Best For MonPol To Take Lower Frequency, More Considered Approach

– MonPol Has Limitations For Fine Tuning Short Term Developments

– Relying On Communication In Run-Up To Nov. Meeting In The Meantime— Marco Ða ℂosta (@TraderMarcoCost) September 27, 2022

That strategy could some under serious market pressure over the next five weeks, though. If the pound starts sinking to new lows, nearer to parity, the Bank will face more calls for action.

Overnight, a former BoE policymaker, David Blanchflower, predicted that the markets would force the UK’s top fiscal and monetary policymakers into a change of heart:

my suspicion is the markets will force the triumvirate of dopes in charge of uk Econ policy to go into full retreat tis week – Trusstless, Kamikaze and U-turn Bailey

— Professor Danny Blanchflower economist & fisherman (@D_Blanchflower) September 26, 2022

NEW: Huw Pill, BoE chief economist, warns of interest rate rises following Kwasi Kwarteng’s (not very mini) budget.

“Hard not to draw conclusion that this will require significant monetary policy response.”

— Pippa Crerar (@PippaCrerar) September 27, 2022

Bank of England chief economist sees ‘significant’ response to mini-budget

The Bank of England is likely to deliver a “significant policy response” to last week’s announcement of tax cuts by finance minister Kwasi Kwarteng, its chief economist says.

But Huw Pill also argued that the Bank should wait until its next scheduled meeting in the first week of November (rather than through an emergency rate hike).

Pill told the CEPR Barclays Monetary Policy Forum that:

“It is hard not to draw conclusion that this will require a significant monetary policy response.”

💥BoE’s Pill: “Hard not to draw conclusion that this will require significant monetary policy response.”

— Andy Bruce (@BruceReuters) September 27, 2022

A ‘significant’ response is central bank-speak for a large interest rate rise.

Pill explains that the Bank’s monetary policy committee is not indifferent to the repricing of financial assets [which have plunged alarmingly since Friday morning’s mini-budget].

And he said he wanted to ‘flag clearly’ that the government’s fiscal announcement will “act as a simulus”.

That’s a sign that Pill thinks monetary policy must respond to Kwarteng’s tax cuts plan, with higher interest rates.

BoE’s Pill says there is “clearly” a UK-specific element to repricing assets

— Andy Bruce (@BruceReuters) September 27, 2022

“We are certainly not indifferent to the repricing of financial assets that we’ve seen.”

“We cannot be indifferent”

— Andy Bruce (@BruceReuters) September 27, 2022

BoE’s Pill: We are relying on communication and expectations until Nov meeting – this relies on confidence in UK economic framework

— Andy Bruce (@BruceReuters) September 27, 2022

The surge in UK long-dated bond yields is quite serious…..

30-year gilt yield yields now up by 30 bps. Horrid.

— Andy Bruce (@BruceReuters) September 27, 2022

UK gilts under pressure again

Kwarteng’s comments haven’t brought any obvious relief to the bond market.

UK gilt prices are falling again, pushing up the yield (or interest rate) on 10-year gilts to the highest since late 2008, at 4.377%

The 30-year gilt yield has continued to rise, hitting the highest level since 2007 at 4.838%.

The gap between UK and safe-haven German government debt has widened too – to the most since 1991.

That shows that investors are imposing a higher risk premium to hold UK assets, as confidence in Britain remains in shorter supply.

Indeed, it costs London twice as much as Berlin to borrow for a decade. UK 10-year gilts are trading at a 4.28% yield, compared to just 2.15% for German bunds.

Here are some photos from Kwasi Kwarteng’s meeting with top bosses from the UK’s financial services industry.

As flagged earlier, the meeting was meant to be a polite conversation about Kwarteng’s plans to unleash growth. It looked rather more fraught due to the plunge in sterling, and the surge in bond yields.

As Bloomberg reported this morning, before the meeting:

Two veteran financiers said the chancellor’s offhand tone also appeared to ignore the seriousness of loading Britain up with debt. That will have rattled watching investors, they added, complaining that Kwarteng – who did a PhD thesis on a 17th-century sterling crisis – hasn’t shown enough willingness to be guided by what’s actually happening in the markets.

That won’t help as he turns to the City for assistance selling the £100 billion ($106.5 billion) or more in government bonds needed to fund his plan, they added.

The chancellor also insisted that he was right to announce tax cuts last Friday, telling leading bankers, insurers and asset managers that:

“We have responded in the immediate term with expansionary fiscal stance on energy because we had to. With two exogenous shocks – Covid-19 and Ukraine – we had to intervene. Our 70-year-high tax burden was also unsustainable.

“I’m confident that with our growth plan and the upcoming medium-term fiscal plan – with close co-operation with the Bank – our approach will work.”

But as you already know far too well, almost all those tax cuts go to the richest 5%….

Kwasi Kwarteng also told City investors that he will produce a ‘credible plan’ to start bringing down debt, as a share of the economy, at his planned statement in November (two whole months away…)

“Cabinet ministers will set out more supply-side measures over coming weeks to make meaningful change. Right across Government, departments have to be focussed on this.

“As I said on Friday, every department will be a growth department.

“We are committed to fiscal discipline, and won’t re-open the spending review. We have a Medium Term Fiscal Plan coming on 23 November, alongside an OBR forecast. That will be a credible plan to get debt to GDP falling.

Kwarteng: I’m confident our plan will work

UK chancellor Kwasi Kwarteng has told leading bankers, insurers and asset managers at today’s meeting that he is “confident” that his economic strategy will work.

In his meeting with City chiefs this morning, Kwarteng said he was confident that the long-term strategy to drive economic growth through tax cuts and supply side reform would work.

In an attempt to reassure the City of London, rocked by days of turmoil, the chancellor reiterated the government’s commitment to fiscal sustainability (days after annoucing unfunded tax cuts that will require a surge in borrowing…).

He also argued that supply side reforms would cool inflation, as increased capacity brings down prices.

Kwarteng said:

“I’m confident that with our growth plan and the upcoming medium-term fiscal plan — with close co-operation with the Bank — our approach will work.”

⚠️ UK FINANCE MINISTER KWARTENG TOLD LEADING BANKERS, INSURERS AND ASSET MANAGERS HE IS “CONFIDENT” THAT HIS ECONOMIC STRATEGY WILL WORK – FT

– Reuters via https://t.co/ymHY6xloQb

— PiQ (@PriapusIQ) September 27, 2022

It shows that Kwarteng plans to stick to his economic strategy in the face of a market selloff that sent the pound crashing.

But of course it’s the confidence of international markets – not the chancellor – that really matters, and will determine whether the crisis abates, or intensifies.

What would it take to prompt the Bank of England into an emergency rate hike, ahead of their scheduled meeting in early November?

Professor Costas Milas of the University of Liverpool’s Management School tells us that a credit rating downgrade could be a possible trigger for emergency action to boost sterling.

He explains:

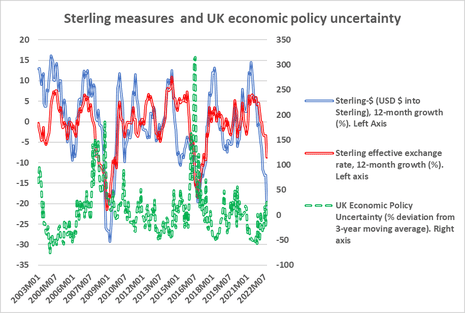

I believe that the Bank of England will have to act if credit rating agencies (CRAs) downgrade the UK sovereign debt. This, in my view, is likely. CRAs usually take action when either economic policy uncertainty rises significantly and/or debt rises to unsustainable levels.

Economic policy uncertainty (measured here) is at its highest level since the beginning of the COVID-19 pandemic.

This is ‘hammering’ both the sterling effective exchange rate and sterling against the dollar. At the same time, UK debt will rise significantly following the chancellor’s min-Budget.

What remains to be seen is how high the UK debt will go since, currently, we do not have official estimates of the additional debt burden. Something that will tempt CRA’s to think seriously about a credit rating downgrade.

The Treasury and the Bank of England could, and should, have done a better job in helping the UK through the very difficult winter ahead, argues Dario Perkins, managing director for Global Macro at TS Lombard.

It should have been possible to find a monetary-fiscal policy mix that helped get the UK economy through this winter without a crisis or deep recession.

But this ain’t it— Dario Perkins (@darioperkins) September 27, 2022

Perkins, a former Treasury economist, has also argued that the UK is now suffering from a “Moron Risk Premium” (MRP).

Basically, because the markets think government policy is fundamentally incoherent, and don’t trust the Bank of England to step in, they downgrade UK assets across the board, from the pound to gilts.

The problem isn’t that the UK budget was inflationary, its that it was moronic. And a small open economy that seems to be run by morons gets a wider risk premium on its assets – currency down, yields up https://t.co/Oyc8rIOc2h

— Dario Perkins (@darioperkins) September 24, 2022

Economist Jonathan Portes has covered this compelling theory in the i, here.

As an aside, Perkins also came up with the superb “Paolo Maldini guide to central banking”, coined after the legendary defender known for his superb positioning and timing.

The idea is simple: once inflation is a problem, there is no real chance of a “soft landing” because the central bank has already messed up.

More here: Don’t Bet On A Soft Landing

These days, Italian defenders use cruder tactics when they’re caught out of position – and the Bank may have to do the same to pull back runaway inflation….

This is an important point about the pound’s modest recovery today:

The £ has had a better day today, but that’s because currency markets expect a) Bank to raise interest rates & b) massive cuts in public spending to pay for massive tax cuts. Both moves penalise ordinary people; both work against growth. If neither happen £ will fall again.

— Ben Fenton (@benfenton) September 27, 2022

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)