[ad_1]

Introduction: UK house prices slide 1.4% in November

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices fell at the fastest pace in almost two and a half years last month, as the turmoil folllowing September’s mini-budget hit the sector.

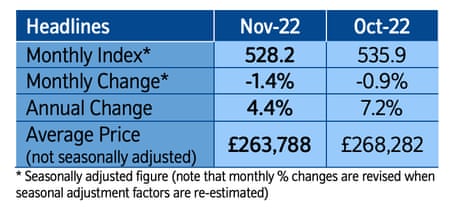

Average house prices fell by 1.4% on a seasonally adjusted basis in November, figures just released by Nationwide building society show.

That follows a 0.9% drop in October, indicating that the housing market is cooling after strong growth since the pandemic began.

That’s the biggest monthly fall since June 2020, and dragged annual house price growth down to 4.4% in November, from 7.2% in October.

💥 UK house prices slide 1.4% in November from October, the biggest monthly drop since June 2020 – @AskNationwide

💥 Annual house price growth cools to 4.4% in Nov vs 7.2% in Oct.

— Andy Bruce (@BruceReuters) December 1, 2022

The average property price dropped to £263,788, from £268,282, as the surge in mortgage rates made it harder for buyers to afford a home.

Robert Gardner, Nationwide’s Chief Economist, explains that “The fallout from the mini-Budget continued to impact the market” last month.

While financial market conditions have stabilised, interest rates for new mortgages remain elevated and the market has lost a significant degree of momentum. Housing affordability for potential buyers and home movers has become much more stretched at a time when household finances are already under pressure from high inflation.

Data from the Bank of England this week showed a sharp fall in mortgage approvals in October, after the mini-budget caused chaos in the market by driving up borrowing costs.

The market looks set to remain subdued in the coming quarters, Gardner predicted:

Inflation is set to remain high for some time and Bank Rate is likely to rise further as the Bank of England seeks to ensure demand in the economy slows to relieve domestic price pressures.

“The outlook is uncertain, and much will depend on how the broader economy performs, but a relatively soft landing is still possible.

He points out, though, that longer term borrowing costs have fallen back in recent weeks and may moderate further, as investors dial down their expectations for future Bank of England interest rate rises.

On Monday, property website Zoopla reported that many home-sellers were accepting bids below their asking prices,

The agenda

-

7am GMT: Nationwide house price index for November

-

9am GMT: Eurozone flash manufacturing PMI for November

-

9.30am GMT: UK flash manufacturing PMI for November

-

10am GMT: Eurozone unemployment report

-

1.30pm GMT: US PCE measure of inflation

-

3pm GMT: US flash manufacturing PMI for November

Key events

Filters BETA

America’s manufacturing sector has contracted for the first time since June 2020.

Data provider S&P Global reports that output declined in November, as new orders fell at a faster speed.

It’s US manufacturing PMI has fallen to 49.0, from 50.2 in October, a level that shows activity fell.

The downturn was the sharpest since May 2020, and driven by declines in output and new orders, reports S&P Global, adding that:

Demand conditions weakened in domestic and external markets, as new export orders fell further. Employment growth slowed as pressure on capacity dwindled and backlogs of work contracted strongly.

On a more positive note, supply chains improved for the first time since October 2019, with price pressures softening as a result of reduced demand for inputs from firms. Input costs rose at the slowest rate for two years.

⚠️ BREAKING: US ISM MANUFACTURING PMI ACTUAL 49.0 (FORECAST 49.7, PREVIOUS 50.2) $MACRO

— Breaking Market News ⚡️ (@financialjuice) December 1, 2022

Over on Wall Street, the S&P 500 index has opened 0.3% higher.

The share index is up 11 points at 4,091.

U.S. stock index futures ticked higher Thursday after the Federal Reserve’s preferred inflation gauge showed inflation cooling in October, while reports suggested China is taking steps to relax its Covid restrictions to allow its economy to recover: https://t.co/ljVUSCucLC pic.twitter.com/EdXPV1xYZw

— MarketWatch (@MarketWatch) December 1, 2022

Afternoon summary

Here are today’s main stories….

Europe’s energy squeeze intensifies:

CHART OF THE DAY: Electricity prices in the Nordic region have jumped to sky high levels so far this week, overshadowing the tightness in Germany, France and the UK. On a weekly average, Nordpool day-head is just under €350 per MWh, its second highest weekly ever | #EnergyCrisis pic.twitter.com/sBeI8UwsvB

— Javier Blas (@JavierBlas) December 1, 2022

Next has confirmed it has acquired some of the assets of collapsed fashion brand Joules, in a partnership with its founder Tom Joule, for £34m.

Next are also buying Joules’ head office for £7m cash.

Administrators for Joules will shut 19 shops today, cutting 133 jobs.

John Coldham, retail partner at the law firm Gowling WLG, says:

Next is continuing its acquisition spree, increasing its competitiveness by building a strong stable of respected brands from across the spectrum of homewares and fashion.

The global interest in the Joules brand in the bidding process just goes to show what reach Next may be able to achieve internationally as well as at home. Retail is an unforgiving environment at the moment, but strong brands are one of the keys to encouraging consumers to keep coming back.

The pound continues to rally, against the euro as well as the dollar:

Pound up above $1.22 vs US$ today. Highest level since early Aug. Partly seems to be a story of dollar weakness, but worth noting sterling also up vs euro, to nearly €1.17 pic.twitter.com/qUFV8ZPyrK

— Ed Conway (@EdConwaySky) December 1, 2022

The US Federal Reserve’s preferred measure of inflation has slowed.

The PCE index, which measures prices paid for domestic purchases of goods and services, rose by 6% in the 12 months to November, down from 6.3% in October.

Core PCE slowed to 5% from 5.2%, which may reassure central bank policymakers that recent interest rate rises are cooling inflationary pressures.

The Fed’s preferred #inflation gauge rose at a slower pace in November, with the PCE +6% vs. +6.3% in Oct. Core rate also slowed down. Jobless claims pulled back from a 3-month high -16K to 225K. #DOW +15

— Jason Brooks (@brookskcbsradio) December 1, 2022

Core PCE: increasing at a 4.8% three month average and is up 4.984% on a year ago basis. Sequential slowing in the one of the Fed’s key policy variables. My sense is that it’s going to sticky around 4%. And everyone should start looking at services ex-housing going forward.

— Joseph Brusuelas (@joebrusuelas) December 1, 2022

U.S. TREASURY YIELDS FALL AFTER PCE DATA; 10-YEAR YIELD DOWN 12.50 BPS ON DAY AT 3.576%

Stock News Alerts In Bio

— Yelpful Stock Alerts (@FastestAlert) December 1, 2022

US weekly jobless claims drop

Fewer Americans filed new claims for unemployment support last week.

There were 225,000 initial claims filed in the week to November 26th, down from 241,000 the previous seven days.

However, the number of people receiving support for at least two weeks jumped by over 110,000, to 1,337,838

“Waves of industrial action are having a crippling effect on British businesses”, reports Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown:

She points out that problems are set to pile up further as fresh strikes hit the UK in December.

Already in October, one in eight companies said they were affected by walk outs (see earlier post). The toxic combination of rail and postal strikes are taking a heavy toll on firms, with a quarter of those affected unable to obtain the necessary goods for their business.

Another 24% of businesses said they were unable to operate fully, while 23% couldn’t get hold of the services they needed.

Next picks up collapsed fashion chain Joules from administration

Sarah Butler

Next has picked up collapsed fashion chain Joules from administration, saving more than 100 shops and hundreds of jobs, the Guardian understands.

Sources said Next placed a last-minute bid in the early hours of Thursday morning, trumping one placed by South Africa’s Foschini Group, the owner of Hobbs and Whistles.

Joules called in administrators last month, putting 1,600 jobs and the future of the retailer’s 132 shops at risk, after failing to secure emergency funding. Shops have continued to trade as administrators from Interpath Advisory said they would “assess options for the business”.

Joules, which is best known for its jackets and patterned wellington boots, has been struggling for months with falling sales. It has attributed the slower trade to the cost of living crisis and the UK’s dry and hot summer, which reduced demand for its posh wellies.

Bloomberg’s John Stepek points out that UK house price rises are lagging behind annual inflation:

House prices in the UK fell last month by 1.4%. That’s the second monthly drop in a row, at least according to Nationwide.

And if you leave out the period of 2020 when the housing market was basically shut down, it’s the largest monthly fall seen since February 2009. Which was, of course, in the wake of the financial crisis.

So quite a big fall then. It means house prices are now just 4.4% higher than they were last November (and that’s just in nominal terms. If you take inflation at well over 10% into account, we’re already down significantly in “real” terms).

Looking back at this morning’s drop in house prices… Nathan Emerson, Chief Executive of Propertymark, the UK professional body for estate agents, says the market is ‘rebalancing’.

“Our agents report a rebalance within the market as competition for homes starts to slow, so it is no surprise that the house price growth is also slowing in line with this.

“This knock-on effect being seen in prices achieved is positive as we need to see this settle in line and a return to a more realistic and sustainable market. However, prices remain higher than last year, and with the Stamp Duty threshold raised, it remains a good time to buy or sell a property.”

Next snaps up collapsed fashion retailer Joules, says Sky News

Revealed: Next has managed to secure a deal to snap up the fashion retailer Joules out of administration, trumping rival bidder Foschini Group at the last minute of a fraught auction process.

— Mark Kleinman (@MarkKleinmanSky) December 1, 2022

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)