[ad_1]

Key events

The sharp decline in UK mortgage lending to just £700m in February suggests house prices have further to fall, said Thomas Pugh, economist at the tax and consulting firm RSM UK.

Admittedly, a small rise in mortgage approvals, the first since August, suggests that demand may have already reached its nadir. But higher interest rates and falling real incomes will limit buyers’ ability to meet high prices. We expect a peak to trough fall in house prices of between 5% and 10%.

Meanwhile, the sharp drop in lending to the private sector suggests that banks were already curtailing lending, even before the latest issues in the financial sector. We estimate that the tightening in financial conditions around the recent turmoil is equivalent to a 25bps increase in interest rates.

There was also little sign that the recent upticks in consumer confidence have led to households borrowing more or saving less. Indeed, consumer credit growth was slightly lower in February than in January. What’s more, consumer savings rose from £3.3bn in January to £3.6bn in February. And it seems that those households with savings are moving them to longer term accounts that pay more interest, rather than spending them. Net flows into time deposits remained strong at £6.8 billion in February, but this was largely offset by net flows of interest-bearing sight deposits at -£6.1 billion in February.

We are yet to see most of the impact of the huge rise in interest rates over the last year and real incomes are likely to drop further in the first half of 2023. Even if the UK does avoid a technical recession of two consecutive quarters of negative GDP growth, we will still enter a ‘slowcession’, where growth essentially flatlines. It will probably be the end of 2024 before the UK economy is back to its pre-pandemic size, representing four years of stagnation.

Hunt: Treasury yet to decide on DHSC funding to pay for NHS pay deal

Jeremy Hunt is being quizzed by MPs on the Commons Treasury committee about the spring budget.

He said the Treasury has not yet decided how much funding the Department of Health and Social Care will get to fund a pay deal for NHS workers.

He explained that government departments normally fund pay settlements from the money they get in the spending review. But in exceptional circumstances they can speak to the Treasury about extra help.

He said this is a special situation because of high inflation. There will be a discussion about how much help health will get, but this hasn’t happened yet.

You can read more on our politics live blog with Andy Sparrow:

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, has also looked at the data.

The continued weakness of house purchase mortgage approvals in February confirms that buyers are waiting for affordability to improve, either via a large correction in house prices or a larger fall in mortgage rates than seen to date, before re-entering the market.

Households showed further signs in February of drawing on the savings they accumulated during the pandemic to sustain their consumption.

Ashley Webb, UK economist at Capital Economics, said:

February’s money and credit data release suggests that higher interest rates were a further drag on lending in February, particularly in the housing market. That’s before the recent concerns over the health of global banks, which may prompt UK banks to tighten credit conditions further. Our hunch is that the economy will still enter a recession later this year.

Mortgage approvals rose for the first time in six months from 39,600 in January to 43,500 in February. But that still leaves them languishing around 35% below pre-pandemic levels. And the monthly increase in net mortgage lending eased from £2bn to £700m… And with interest rates likely to stay high for all this year, housing market activity will likely remain weak for some time yet.

But higher interest rates still appear to be less effective elsewhere in the economy so far. The 1.2% month-on-month surge in retail sales volumes in February suggests households continued to spend in February. And today’s data release suggests households partly financed that spending by increasing borrowing.

Overall, it’s clear that higher interest rates are weighing on the housing market. But they appear to be having less of a drag in other areas of the economy as households continue to borrow to support spending. However, the recent tightening in financial conditions might cause banks to restrict their credit supply, which would amplify the drag on real activity, or at least bring it forward.

UK mortgage lending lowest since 2016 excluding Covid

Mortgage lending in the UK fell sharply last month to the lowest level since the summer of 2021 – and was the lowest since 2016 if the Covid period is excluded – while mortgage approvals rose for the first time since August.

The latest Bank of England figures out this morning show that net mortgage lending to individuals fell from £2bn in January to £700m in February, the lowest since July 2021. Excluding the Covid pandemic, this is the lowest level of net borrowing since April 2016 when it was also £700m.

Mortgage approvals for house purchases increased to 43,500 in February, from 39,600 in January. This marked the first monthly increase since August 2022.

The ‘effective,’ or actual interest rate paid on newly drawn mortgages increased by 36 basis points, to 4.24% in February.

The data also showed consumers borrowed an additional £1.4bn in consumer credit in February, on a net basis, compared with £1.7bn borrowed during January. This was split between £600m of borrowing on credit cards and £800m of borrowing through other forms of consumer credit such as personal loans.

Flora Bocahut, equity analyst at Jefferies, has sent us her thoughts on the new UBS boss.

Sergio Ermotti is well-known, having been UBS CEO for nine years and restructured the bank.

Ermotti is well-known and, in our view, benefits from a strong & adequate track record for the upcoming (challenging) task of restructuring & integrating Credit Suisse, having been previously UBS CEO for 9 years and having already tackled the restructuring of the bank, redefined the strategy, downsized the investment bank and refocused the capital allocation towards wealth management.

Ermotti, a Swiss national, was appointed CEO of UBS in 2011, having previously worked at Merrill Lynch for 16 years (from 1987 to 2004), holding various positions esp. in equity derivatives up to becoming Co-Head of Global Equity Markets and a member of the Executive Management Committee for Global Markets & Investment Banking at Merrill Lynch in 2001.

In 2005, he joined Unicredit, initially as Head of Markets & IB, up until becoming Deputy CEO in charge of CIB & Private Banking in 2007 (to 2010). He joined UBS in 2011, initially as CEO for EMEA, then as interim & permanent Group CEO later that same year. He left UBS in 2020 to join Swiss Re (where he is currently the Chairman of the Board), succeeded as UBS Group CEO by Ralph Hamers (who was previously the CEO of ING Group).

Here is our full story on Next.

Next said it expected to raise prices more slowly in the coming year in a sign of easing inflation, as the clothing and homeware retailer reported record annual profits of £870m.

The FTSE 100 company increased profits by 5.7% in the year to 31 January, while total sales from trading rose by 8.4% compared with the previous year to £5.1bn, it said on Wednesday.

However, Next warned of a “very challenging” 2023 as its shoppers struggle with the cost-of-living crisis, with sales forecast to fall by 1.5% this year, while profits will also drop back. Its shares fell 5.7% on the news.

Retailers and consumers have been struggling with surging prices triggered by the recovery from the coronavirus pandemic and the Russian invasion of Ukraine.

European stocks have made modest gains, as the major bourses continue to drift higher following last week’s turmoil.

The FTSE 100 has ticked up 0.6% to 7,527, its highest level since last Thursday. We’re seeing similar upwards drifts for the Dax and CAC, too, as investors put banking stresses behind them.

US futures are up, pointing to a higher open on Wall Street later.

Neil Wilson, chief market analyst at Markets.com, said about UBS’s decision to bring back ex-boss Sergio Ermotti to take the reins once more:

It’s like calling back Fergie to manage Scotland. Ok it’s not, but I figured we need some analogy that references Scotland + football after last night’s heroics from Steve Clarke’s men.

UBS shares rallied 2% to above 18 Swiss francs in early trade as the bank named ex-boss Sergio Ermotti as new CEO, taking over from Ralph Hamers on 5 April.

Investors seem to be saying they like the prospect of the old hand on the tiller. UBS faces no small challenge in digesting Credit Suisse. Hamers can’t feel too good about being strong-armed into buying a mare and then not even getting to ride her.

The perception – rightly or wrongly – will be that Hamers was not considered right to lead the new behemoth through what’s going to be a tricky period of consolidation, integration and, no doubt, litigation.

Bupa Dental Care to cut 85 practices amid UK dentist shortage

Bupa Dental Care is to cut 85 dental practices this year in a move that will affect 1,200 staff across the UK, amid a national shortage of dentists and “systemic” challenges across the industry.

The private healthcare group said patients at the affected practices had not been able to access the NHS dental service they need.

The provider, which provides private and NHS dental care, has not been able to recruit enough dentists for NHS care in many practices for months and in some cases years, it said.

Bupa said the 85 practices will be closed, sold or merged later this year, bringing the total number of practices in the UK down to 365. All the practices will remain open as usual in the meantime.

Next CEO: UK downturn won’t be long-lasting

The boss of the fashion and homewares retailer Next said he does not think the downturn in the UK economy will be long lasting.

Lord Simon Wolfson told Reuters:

We’ve never thought that the downturn would be long-lasting.

Yesterday, Next bought the Cath Kidston brand name for £8.5m, after the vintage-inspired British retailer fell into administration for the second time in two years.

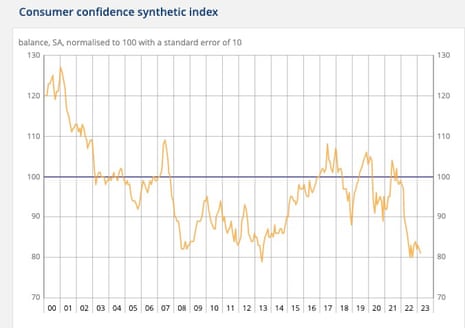

In France, household confidence slipped slightly in March.

According to the economics institute Insee (Institut national de la statistique et des études économiques), its monthly indicator dropped one point to 81 in March and remained well below its long-term average of 100 between 1987 and 2022.

Households’ balances of opinion on their future and past financial situation are stable, as is the one on major purchases intentions, all three remain well below their long-term average.

The share of households considering it is a good idea to save has fallen again after a sharp increase in February. The balance of opinion has declined four points but remains well above its long-term average.

In Germany, consumer confidence continues to improve as energy prices ease, although a full recovery is still some way off.

The GfK institute’s closely watched index recorded an unexpected rise to -29.5 going into April, from a revised reading of -30.6 in March. Markets had expected a drop to -33.1.

April’s rise is the sixth monthly improvement in a row, but the pace has slowed noticeably compared with previous months.

GfK consumer expert Rolf Buerkl said:

The anticipated loss of purchasing power is preventing a sustained recovery of domestic demand.

This is also indicated by the still very low level of consumer confidence.

The income outlook is currently benefiting from noticeably lower prices for energy, especially for gasoline and heating oil. Nevertheless, inflation will remain high.

The subindex measuring income expectations was the main contributor to the increase in sentiment, rising to its highest level in 10 months.

European stocks have opened slightly higher, the third day of gains.

The UK’s FTSE 100 index is up 21 points, or 0.3%, to 7,506, while Germany’s Dax and France’s CAC rose 0.7%, and Spain’s Ibex and Italy’s FTSE MiB advanced 05%.

The pound has slid 0.2% against the dollar to $1.2313.

Victoria Scholar, head of investment at the trading platform interactive investor said:

Ermotti previously served as chief executive of UBS from 2011 until 2020 and is currently the chairman of Swiss Re. Ralph Hamers who has been in the top job since November 2020 is stepping down ‘in light of the new challenges and priorities facing UBS’. Ermotti said ‘the task at hand is an urgent and challenging one’.

Having steered UBS through the aftermath of the 2008 global financial crisis and a rogue-trading scandal, Ermotti is a dab hand at crisis management. He also helped UBS to navigate through the onset of the pandemic and the corresponding market volatility throughout most of 2020.

The new CEO will have the immediate challenges of cutting staff, reducing Credit Suisse’s investment bank, finding other synergies between the two lenders and convincing shareholders about the prospects of the combined entity.

Introduction: UK chain Next expects to raise prices more slowly; UBS appoints new CEO to steer Credit Suisse takeover

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Some calm has returned to stock markets and European markets notched up some modest gains yesterday but struggled for direction.

The UK high street chain Next has said it expects to raise its prices more slowly over the year ahead as it revealed better-than-expected annual profits of £870m.

Like-for-like price inflation in the spring and summer collections is expected to be +7% and, in the autumn/winter, +3%, down from +8% and +6% respectively.

We now believe price rises in the second half will be materially lower than we initially feared.

Next cited a significant reduction in the cost of container freight as shipping capacities return to normal, as well as improving factory gate prices (the price at which it purchases the goods in the country of origin). The majority of these benefits will be felt in the second half of the year.

In a surprise move, UBS has brought back its former boss Sergio Ermotti (who currently chairs the reinsurance group Swiss Re) and appointed him as chief executive, to steer its massive takeover of Credit Suisse.

He will replace the current CEO Ralph Hamers on 5 April. Hamers, who succeeded Ermotti in November 2020, will stay on as adviser during a transition period, Switzerland’s largest bank said in a statement.

Ermotti previously ran the bank for nine years and oversaw a restructuring of the investment bank. UBS said:

This unique experience, together with his deep understanding of the financial services industry in Switzerland and globally, make Sergio Ermotti ideally placed to pursue the integration of Credit Suisse.

The move comes less than two weeks after UBS agreed to take over Credit Suisse in a in a £2.65bn deal forced through by Swiss authorities who feared that a failure to protect depositors would trigger a global banking meltdown.

Here’s an old tweet from Tracy Alloway, co-host of Bloomberg’s Odd Lots podcast:

Ermotti said:

The task at hand is an urgent and challenging one.

In order to it in a sustainable and successful way, and in the interest of all stakeholders involved, we need to thoughtfully and systematically assess all options.

The task involves combining two banks with $1.6 trillion in assets, more than 120,000 staff and a complex balance sheet. Hamers has no big M&A experience.

Later this morning, we will get lending data from the Bank of England that will give an insight into the state of the UK housing market and consumer lending more generally.

Michael Hewson, chief market analyst at CMC Markets UK, said:

UK mortgage approvals have seen a sharp slowdown in the last few months as higher interest rates and the rising cost of living serves to crimp demand, even as the lead-up to Christmas tends to see a slowdown in demand.

In January mortgage demand fell to its lowest level since 2020 at 39.6k, and today’s February numbers aren’t expected to see a significant pickup with expectations of around 40k.

In January net consumer credit saw a sharp pickup to £1.6bn, after a slowdown at the end of last year that saw consumer borrowing slow to £800m from £1.5bn. This stop start nature of consumer borrowing points to a UK consumer that is very sensitive to the rising cost of living, and while consumer confidence has improved in recent months it remains very fragile.

Today’s consumer credit numbers for February are expected to show a modest slowdown to £1.2bn, with recent trends in retail sales showing that discretionary demand has started to pick up as energy prices have fallen back.

The Agenda

-

9.30am BST: Bank of England Mortgage approvals and consumer credit for February

-

9.45am BST: MPs on Treasury committee grill Jeremy Hunt on spring budget

-

10.30am BST: Bank of England Minutes of financial policy committee meeting

-

2pm BST: Swiss National Bank Quarterly bulletin

-

3pm BST: Federal Reserve vice-chair for supervision, Michael Barr, testifies on SVB collapse

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)