[ad_1]

Introduction: Mortgage fears and London Tech Week

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK borrowers face further interest rate hikes this year as the fight against inflation continues.

A Bank of England policymaker is warning this morning that the UK central bank may need to make “further increases” to borrowing costs as it tries to ease the cost of living crisis.

Jonathan Haskel, a member of the Bank’s Monetary Policy Committee, suggests that more than one increase in interest rates may be needed.

Writing in The Scotsman today, Haskel says the BoE mustn’t allow inflation to become ‘embedded’ in the economy, saying:

We are monitoring indicators of inflation momentum and persistence closely.

My own view is that it’s important we continue to lean against the risks of inflation momentum, and therefore that further increases in interest rates cannot be ruled out.

As difficult as our current circumstances are, embedded inflation would be worse.

Expectations of higher interest rates has caused turbulence in the mortgage market in recent weeks.

Ian Stuart, CEO of HSBC UK Bank, told Radio 4’s Today programme that inflation is looking sticky, and probably won’t fall “quite as fast” as hoped.

That means that borrowing costs are unlikely to start falling again soon.

Stuart explains:

Well, I don’t have a crystal ball. But…. inflation is not falling as quickly as a lot of people have predicted.

So as long as that is the case, then our house view is that rates will probably increase a little bit more and will probably stay a little bit higher for longer.

Bank of England base rate is currently 4.5%, the highest level since 2008.

The money markets are anticipating that rates could hit 5.5% by the end of the year, meaning people who must remortgage their loans face higher repayment costs.

Stuart says:

So, not the mortgage news we’d be looking for.

He doesn’t believe rates will fall back to 1%, and warns that rates won’t start to fall until inflation is much lower than it is today (it was 8.7% in April).

Mortgage rates in UK have jumped sharply in recent weeks due to sticky inflation.The market expects BOE to increase the rate to 5-5.5%. The current rate is 4.5%. How far mortgage rate will go up if the benchmark rate has to increase to 5.5%? Ticking timebomb in UK property market pic.twitter.com/Qb4GgdGtaw

— Winston (@WKyaw7) June 5, 2023

Stuart explained that HSBC was forced to ‘put a pause on business’ coming in from brokers last Thursday, due to a supply and demand issue as people tried to secure mortgages.

The Nationwide Building Society raised its mortgage rates last week, adding to the pressure on the market.

New analysis suggests that around 2.6 million households with a mortgage could have to pay thousands of pounds more in repayments next year.

The Times reports today:

City figures said the mortgage market was going through a “complete reset” and that only a third of borrowers who are on cheap fixed-term deals had come off them so far.

Analysis by Capital Economics found that a third of such households, equivalent to 3.2 million, are paying interest rates of 3 per cent or more. By the end of next year that will have risen to 5.8 million as the impact of higher interest rates passes through to the market.

Also coming up today

London’s Queen Elizabeth II Centre is hosting London Tech Week, the 10th gathering of the UK’s largest technology event.

PM Rishi Sunak, chancellor Jeremy Hunt and Secretary of State for Science, Innovation and Technology Chloe Smith are attending, as Britain pitches itself as a tech superpower and “the best place in the world to invest”.

Asia Pacific (APAC) investors with over £100bn of funds will be there, the government reports, and could put money into fintech, clean tech, life sciences and Artificial Intelligence firms.

An ‘elevator pitch’ will be run at the London Eye, where 25 tech firms will have 30 minutes to pitch their latest innovations to investors before their pods circle back to the ground…..

The agenda

-

Morning: London Tech Week panel discussion with Secretary of State for Science, Innovation and Technology Chloe Smith chancellor Jeremy Hunt, and HSBC and SVB UK.

-

9am BST: Prime minister Rishi Sunak gives keynote address to open London Tech Week

-

9am BST: China’s new yuan loan for May

-

1pm BST: India’s industrial production data for April

-

3pm BST: Bank of England policymaker Catherine Mann gives a webinar

-

4pm BST: US consumer inflation expectations data

Key events

Pound hits one-month high

In the financial markets, the pound has hit a one-month high against the US dollar today.

Sterling has been lifted by hopes that Britain’s economy will avoid a recession, and expectations that interest rates will keep rising for longer in the UK than the US.

The pound hit $1.2595 this morning, the highest since 11 May, taking some support from Jonathan Haskel’s warning that future rate rises can’t be ruled out.

The CBI has revised up its growth forecasts for the UK this year, from a 0.4% decline to show growth of 0.4% this year.

But, the CBI adds that 2023 will be challenging for households and businesses. For the first time since the recession of the early 1980s, it expects real household incomes – a measure of living standards – to fall for two successive years.

2023 will remain challenging for the CBI too, despite the embattled lobby group winning a crucial confidence vote last week.

Bloomberg reports that the CBI has been abandoned by major sponsors of its annual conference, saying:

Recruitment specialist Hays Plc sponsored the conference for about a decade but has since quit the CBI and won’t take part this year, a spokesperson said. The other leading sponsor, Accenture Plc, terminated its membership in April.

Sunak defends role over Johnson resignation honours

Rishi Sunak may have wanted to talk tech today, as he spoke warmly of the entreprenurial attitude in California today, and the UK’s pioneering role in the Industrial Revolution.

Asked about how to grow UK tech, Sunak says:

Fundamentally it requires entrepreneurs to just keep going, to be not content with building the £100 million business and then the £1 billion business but just to keep growing.

“That, I found in California, is very much the attitude, the sky is the limit. Everyone thinks they can create a 100 billion-dollar company and actually changing that culture is tough for government to do.”

He also cited his push to make everyone learn maths until the age of 18 (despite criticism of the plan), saying the UK is currently an outlier on this issue.

But he couldn’t avoid the current political turmoil.

He was asked at London Tech Week about former PM Boris Johnson’s resignation honours list, published hours before Johnson stropped out of parliament after receiving the privileges committee findings into the Partygate scandal.

Sunak says that he refused a request from his predecessor to intervene, saying:

“Boris Johnson asked me to do something that I wasn’t prepared to do, because I didn’t think it was right.

That request was either to overrule the House of Lords Appointments Commission (which did not support eight of Johnson’s nominations for peerages) or to make promises to people, Sunak says, adding:

“I wasn’t prepared to do that because I didn’t think it was right, and if people don’t like that, then tough.”

“Boris Johnson asked me to do something I didn’t think was right. (Overruling HOLAC). If people don’t like it, then tough”. Sunak at London Tech Week

— alan rusbridger (@arusbridger) June 12, 2023

This wins some clapping, with Sunak adding:

When I got this job, I said I was going to do things differently because I wanted to change politics, and that’s what I’m doing.

Our Politics Live blog has more details:

Asked about the opportunities of AI, Sunak suggests it could allow a ‘personalised tutor’ for students, and also reduce teachers’ workload, and help with marking and lesson planning.

Sunak cites Babbage letter as inspiration for tech leadership….

Rishi Sunak then tells an anecdote about how he recently saw a letter from Charles Babbage, the inventor, from the 1830s thanking the then-chancellor for funding his Difference Engine.

That letter, in a British Library collection, showed that the government broke with convention by funding this cutting-edge idea, Sunak says.

That was a decisive moment. The British government broke with the conventions of the time, and for a decade backed this breakthrough technology.

He’s determined that future researchers in 200 years will find evidence that the current government, and the tech sector, met the current opportunities with the same “courage, vision and determination”.

Babbage’s largest project, the Difference Engine no. 1, was a machine intended to save the government money by preventing critical errors in tables calculated and copied by hand. Effectively it would have worked as a calculator.

However, the story doesn’t have a happy ending, as the Whipple Museum reminds us.

Funding was officially cut off in 1842 at which time he [Babbage] had spent over £17,000, ten times as much as originally intended.

Somewhat embarrassingly, the British government purchased a difference engine based on Babbage’s original design made by Swedes Georg and Edvard Schuetz, which they demonstrated at the World’s Fair in 1855.

Difference Engine no. 1 remained unfinished in Babbage’s lifetime, as he moved onto an even more challenging idea, the Analytical Engine, which actually included its own memory.

Sunak then announces the launch of HSBC Innovation Banking, following the rescue of tech-focused lender Silicon Valley Bank earlier this year.

This new unit will focus on banking services to the startup, investor, and wider tech community.

On AI, Sunak then pledges to “lead” on the issue at home, where the government is working with artificial intelligence firms….

We’ll lead on AI at home🇬🇧@DeepMind, @OpenAI and @AnthropicAI will give us early access to their models to help us understand any potential risks.

And we’re launching two new fellowships to enhance machine learning in drugs and food design, and AI scientist training.

— Rishi Sunak (@RishiSunak) June 12, 2023

…and abroad, by hosting a global AI summit later this year (which he compares to the COP summits on climate change).

We will lead on AI overseas🌍

I want to make the UK not just the intellectual home, but the geographical home of global AI safety regulation.

That’s why the UK will host the first ever global summit on AI safety later this year.

— Rishi Sunak (@RishiSunak) June 12, 2023

Sunak speaks at London Tech Week

Prime minister Rishi Sunak is speaking at London Tech Week now.

Sunak says we are at at “moment of huge opportunity”, with the “technonic plates of technology” are shifting (he cites AI, quantum computing, synthetic biology and semiconductors”.

We must act, and act quickly, if we want not only to retain our position as one of the world’s tech capitals, but to go even further and make this the best place in the world to start, grow and invest in tech businesses.

Sunak says he feels a sense of urgency about this, as it can help grow the economy.

He then suggests that artificial intelligence could surpass industrial revolution in the speed and breadth of the changes it will bring, as he pitches the UK as the home of artificial intelligence (AI) regulation (see earlier post).

Rishi Sunak says AI and associated tech may lead to economic changes that could “surpass the Industrial Revolution in speed and breadth”. Quite a statement. pic.twitter.com/p0VwnusLSw

— Robert Peston (@Peston) June 12, 2023

He then pitches the UK’s “leadership” as an asset when trying to attract tech investment (after a weekend where his government came under pressure following the resignation of Boris Johnson, and two other MPs).

Sunak says:

Do you trust the people in charge to really get what you’re trying to do.

With this government and with me as your prime minister, you can.

In the travel sector, the boss of Heathrow has pledged that strikes by security guards at Heathrow are unlikely to cause flight cancellations.

More than 2,000 members of the Unite union will walk out for 31 days from June 24 in a dispute over pay.

For the first time, security officers based at Terminal 3 will join their colleagues from Terminal 5 and campus security who have already taken industrial action.

Heathrow chief executive John Holland-Kaye said that having kept running through earlier strikes over Easter, the airport is well-prepared.

“We have delivered excellent service to passengers, with no cancellations, over eight days of strikes on the busiest days in May, and do not anticipate cancellations as a result of strikes during the summer holiday getaway.”

Last week, Mr Holland-Kaye urged Unite to put the airport’s latest proposal of a 10% pay increase and £1,150 lump sum to a vote of its members.

He claimed:

“We know that most of our colleagues would accept the offer that we have on the table”.

Sunak to pitch UK as ‘geographical home’ of AI regulation

Rishi Sunak will tell technology leaders he wants to make the UK both the intellectual and the geographical home of artificial intelligence (AI) regulation.

In a speech to open London Tech Week on Monday, the Prime Minister is set to say that the “extraordinary” possibility of AI advances must be carried out “safely” as he positions Britain as a potential home of a global regulator.

It comes after the Conservative Party leader used a trip to the US last week to announce that the UK will host the first global summit on AI safety.

The Prime Minister, in pre-briefed comments ahead of his appearance at the 10th London Tech Week, will say:

“Already we’ve seen AI help the paralysed to walk and discover superbug-killing antibiotics — and that’s just the beginning.

“The possibilities are extraordinary. But we must — and we will — do it safely.

“I want to make the UK not just the intellectual home, but the geographical home of global AI safety regulation.”

Interest in AI across politics has soared (as in the financial markets), as fears grow that the technology’s rapid advancement could spin out of control.

The UK government hope to persuade other countries to use the UK as a base for a new global AI regulator, but experts have warned that success is unlikely….

ING: No UK interest rate cuts until 224

Sticky UK wage growth means no rate cuts for the Bank of England until this time next year, analysts at ING have predicted this morning.

In a new research note, ING say that last month’s ‘shock inflation reading’ of 8.7% sent Bank of England expectations soaring.

ING believe that the UK could be closer to the peak in interest rates than markets are assuming [the City is anticipating four more rate hikes from 4.5% to 5.5%].

They say:

A 25bp rate hike in June could easily be the last – if not, in August – and it will depend on how many more CPI [inflation] surprises we get through the summer.

But, the “slow downtrend in wage growth” suggests that rate cuts are unlikely to be a story for this year.

ING adds:

We’ve pencilled in the first cut for around this time next year, though eventually, we do expect a series of rate cuts that take Bank Rate down to the 3% area – some distance further than markets are currently pricing.

Homeowners are being hit with a “Tory mortgage penalty” of £7,000 per year, with interest rates triple what they were two years ago, the Labour party have warned.

Analysis by Labour suggests the average homeowner is forking out an extra £150 every week since what officials called the “kamikaze mini-Budget” in the autumn.

It means the average household with a mortgage now pays £223 a week in mortgage interest payments – an increase of £7,000 per year, party officials said.

Labour said those with a 75% loan to value (LTV) ratio mortgage faced average interest rates of up to 4.63% in April.

The same deal had an interest rate of 1.49% in April 2021, said the party – a third of what it increased to 24 months later.

Pat McFadden, shadow chief secretary to the Treasury, has blamed what he called the “reckless economic gamble” taken by the Conservatives during September’s mini-Budget.

“This Tory mortgage penalty has increased the cost of home ownership by thousands of pounds a year, causing huge worry for families, while putting the prospect of owning a home further out of reach for many others.

“Rishi Sunak might want to forget the economic misery the Conservatives have inflicted, but the public can’t forget about it as their outgoings soar.

“Labour will make our economy stronger and more secure, and stop working people paying the price for 13 years of Tory failure.”

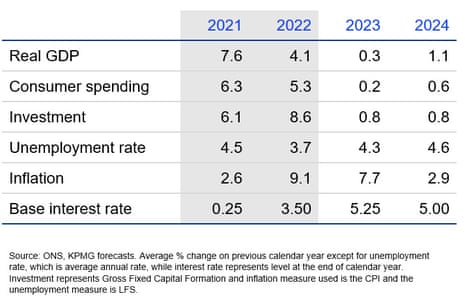

KPMG: Stickier inflation means higher interest rates

Economists at KPMG are also warning that UK interest rates will continue to rise this year, due to stubborn inflation.

Their latest economic forecasts, released this morning, show a brighter growth picture -but high inflation for longer than hoped.

KPMG say:

-

Given the latest surveys, we no longer expect a recession in the UK, but growth is forecast to remain sluggish by historical standards.

-

Inflation is on the way down, but the pace of moderation is slower than we previously thought. This will likely necessitate further interest rate increases and more pain to come for borrowers.

-

The upside revision to our forecast means no plain sailing. Risks remain skewed to the downside, with ongoing fragilities potentially yet to be fully uncovered.

Yael Selfin, chief economist at KPMG UK, said:

“We’ve seen a slightly stronger momentum for the UK economy but risks are still elevated on the downside. A stickier inflation will see monetary policy tightening even further, increasing the risk of unwelcome side effects among other potential headwinds.”

Introduction: Mortgage fears and London Tech Week

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK borrowers face further interest rate hikes this year as the fight against inflation continues.

A Bank of England policymaker is warning this morning that the UK central bank may need to make “further increases” to borrowing costs as it tries to ease the cost of living crisis.

Jonathan Haskel, a member of the Bank’s Monetary Policy Committee, suggests that more than one increase in interest rates may be needed.

Writing in The Scotsman today, Haskel says the BoE mustn’t allow inflation to become ‘embedded’ in the economy, saying:

We are monitoring indicators of inflation momentum and persistence closely.

My own view is that it’s important we continue to lean against the risks of inflation momentum, and therefore that further increases in interest rates cannot be ruled out.

As difficult as our current circumstances are, embedded inflation would be worse.

Expectations of higher interest rates has caused turbulence in the mortgage market in recent weeks.

Ian Stuart, CEO of HSBC UK Bank, told Radio 4’s Today programme that inflation is looking sticky, and probably won’t fall “quite as fast” as hoped.

That means that borrowing costs are unlikely to start falling again soon.

Stuart explains:

Well, I don’t have a crystal ball. But…. inflation is not falling as quickly as a lot of people have predicted.

So as long as that is the case, then our house view is that rates will probably increase a little bit more and will probably stay a little bit higher for longer.

Bank of England base rate is currently 4.5%, the highest level since 2008.

The money markets are anticipating that rates could hit 5.5% by the end of the year, meaning people who must remortgage their loans face higher repayment costs.

Stuart says:

So, not the mortgage news we’d be looking for.

He doesn’t believe rates will fall back to 1%, and warns that rates won’t start to fall until inflation is much lower than it is today (it was 8.7% in April).

Mortgage rates in UK have jumped sharply in recent weeks due to sticky inflation.The market expects BOE to increase the rate to 5-5.5%. The current rate is 4.5%. How far mortgage rate will go up if the benchmark rate has to increase to 5.5%? Ticking timebomb in UK property market pic.twitter.com/Qb4GgdGtaw

— Winston (@WKyaw7) June 5, 2023

Stuart explained that HSBC was forced to ‘put a pause on business’ coming in from brokers last Thursday, due to a supply and demand issue as people tried to secure mortgages.

The Nationwide Building Society raised its mortgage rates last week, adding to the pressure on the market.

New analysis suggests that around 2.6 million households with a mortgage could have to pay thousands of pounds more in repayments next year.

The Times reports today:

City figures said the mortgage market was going through a “complete reset” and that only a third of borrowers who are on cheap fixed-term deals had come off them so far.

Analysis by Capital Economics found that a third of such households, equivalent to 3.2 million, are paying interest rates of 3 per cent or more. By the end of next year that will have risen to 5.8 million as the impact of higher interest rates passes through to the market.

Also coming up today

London’s Queen Elizabeth II Centre is hosting London Tech Week, the 10th gathering of the UK’s largest technology event.

PM Rishi Sunak, chancellor Jeremy Hunt and Secretary of State for Science, Innovation and Technology Chloe Smith are attending, as Britain pitches itself as a tech superpower and “the best place in the world to invest”.

Asia Pacific (APAC) investors with over £100bn of funds will be there, the government reports, and could put money into fintech, clean tech, life sciences and Artificial Intelligence firms.

An ‘elevator pitch’ will be run at the London Eye, where 25 tech firms will have 30 minutes to pitch their latest innovations to investors before their pods circle back to the ground…..

The agenda

-

Morning: London Tech Week panel discussion with Secretary of State for Science, Innovation and Technology Chloe Smith chancellor Jeremy Hunt, and HSBC and SVB UK.

-

9am BST: Prime minister Rishi Sunak gives keynote address to open London Tech Week

-

9am BST: China’s new yuan loan for May

-

1pm BST: India’s industrial production data for April

-

3pm BST: Bank of England policymaker Catherine Mann gives a webinar

-

4pm BST: US consumer inflation expectations data

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)