[ad_1]

Hunt economic advisor: Bank of England must create recession to curb inflation.

The Bank of England must “create a recession” to curb inflation, according to Karen Ward, chief market strategist EMEA at JP Morgan Asset Management.

Ward, who is also a member of chancellor Jeremy Hunt’s economic advisory council, told Radio 4’s Today programme there are “certainly signs” that a price-wage spiral is emerging, which the central bank “has to nip in the bud”.

Speaking after inflation remained stubbornly high at 8.7% in May, Ward explained:

“The difficulty for the Bank of England – I mean, no-one envies them their job at the moment – is they have to therefore create a recession.

“They have to create uncertainty and frailty, because it’s only when companies feel nervous about the future that they will think ‘Well, maybe I won’t put through that price rise’, or workers, when they’re a little bit less confident about their job, think ‘Oh, I won’t push my boss for that higher pay’.

“It’s that weakness in activity which eventually gets rid of inflation.”

One of the Chancellor’s economic advisers, has called for the Bank of England to ‘create a recession’ to curb inflation.

Speaking to @MishalHusain, Karen Ward, who works for JP Morgan, said: ‘It’s that weakness which eventually gets rid of inflation.’#R4Today pic.twitter.com/CxGqzdPbBv

— BBC Radio 4 Today (@BBCr4today) June 21, 2023

Ward is also a member of The Times’s shadow monetary policy committee, a group of experts who are today calling for the actual MPC to raise interest rates by half a point tomorrow, to 5%.

Ward argued that the Bank of England’s “earlier hesitancy” has put it in an uncomfortable spot.

With her shadow MPC hat on, Ward told The Times:

It hoped for too long that inflation would go away on its own accord and underestimated the second-round effects now evident in accelerating wage growth.

It did not adhere to the “stitch in time saves nine” principle and now will have to raise rates by more and cause a deeper downturn to bring inflation back to target.

Key events

UK exporters have been hit by falling exports this month, but price pressures appear to be easing too.

The Confederation of British Industry (CBI)‘s monthly healthcheck of UK factories has found that order books recoveedred last month. However, the export order balance fell again to -29 from -26, the weakest since February 2021.

Total order books were reported as below “normal” in June, to a broadly similar extent as in May. Export order books were also seen as below normal, deteriorating further from last month. #ITS pic.twitter.com/kWmSajP1L3

— CBI Economics (@CBI_Economics) June 21, 2023

And on inflation….UK manufacturers expect to raise prices by the smallest amount since February 2021 over the next three months.

The CBI’s monthly index of manufacturers’ average selling price expectations slowed to +19 in June from +21 in May, its lowest in more than two years but well above its long-run average of +7.

CBI deputy chief economist Anna Leach said:

“Total order books have improved a touch in recent months, but they remain fairly soft. And although output expectations have turned positive again, growth is expected to be quite weak in the three months to September.”

The latest CBI Industrial Trends Survey found that output volumes fell in the three months to June. Manufacturers expect output to return to growth in the three months to September. #ITS pic.twitter.com/w16HPKCTy6

— CBI Economics (@CBI_Economics) June 21, 2023

Rising interest rates, and rising prices, are both hurting the budgets of low-income families.

New research from the Joseph Rowntree Foundation this morning show that the numbers of low-income households going without essentials or in arrears has not improved for over a year.

Latest inflation out today still at 8.7%.

Chart below shows comulative inflation, earnings growth & benefit uprating since Apr 2021.

This is why people are hurting. pic.twitter.com/eL67iE9Svb

— Alfie Stirling (@alfie_stirling) June 21, 2023

JRF senior economist Rachelle Earwaker warns that 5.5 million low-income households have had to cut down on or skip meals because they can’t afford food. Four million reported going hungry, and 2.7 million have reported having a poor diet because of the cost of living crisis.

Earwaker adds:

Low-income households are struggling to afford their bills, with 4.5 million in arrears, and 2.6 million holding high cost credit loans with loan sharks, doorstep lenders, payday lenders or pawnshops.

The JRF are calling for the Government to implement an Essentials Guarantee, to ensure that the basic rate of Universal Credit will at least always covers life’s essentials.

📈 Today’s about more than #inflation – we’ve just published the latest edition of our #CostOfLiving tracker.

📢 “We are seeing these levels of hardship persist & it has become a horrendous new normal”

– Senior Economist @r_earwakerWhat this looks like & what can be done – 🧵:

— Joseph Rowntree Foundation (@jrf_uk) June 21, 2023

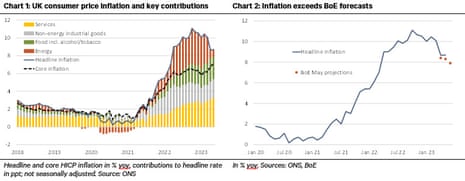

UK inflation surprised to the upside today, for the fourth month in a row, reports Berenberg Economics.

They have now lifted their forecasts for UK interest rates – predicting Bank Rate will have risen to 5.25% (was 5.0%) at the end of 2023 and 4.0% (was 3.5%) one year later.

Berenberg warns that UK inflation is changing its nature, and becoming more domestically driven, saying:

By and large, imported inflation caused by last year’s spike in energy and food prices is receding on trend as energy prices correct and the 2022 surge in these prices washes out of the yoy comparison. The yoy rate for goods prices eased to 9.7% from 10.0% despite higher prices for used cars.

However, the more domestically driven increase of services prices advanced from 6.9% to 7.4%. Many services are labour intensive and thus affected by strong wage gains. As reported last week, the rise in weekly average earnings (ex-bonus) accelerated to 7.5% in April from 7.1% in March.

Helped by resilient gains in employment (1.2% yoy in April), most households continue to open their wallets despite the gradually building headwind from higher mortgage rates.

Resolution Foundation’s chief executive, Torsten Bell, points out that there are winners from higher interest rates:

This is wrong but does make an important (currently totally ignored) point that there are winners for every loser from higher rates. They broadly are:

– foreigners

– older households

– really rich households (where volume of assets with higher returns outweighs mortgage hit) https://t.co/5QHBjK7cE2— Torsten Bell (@TorstenBell) June 21, 2023

Another big winner from this rate rise cycle? Employer sponsors of defined benefit pension schemes who overnight will no-longer have to contribute billions into those schemes to close their deficits – this effect is huge and basically never discussed https://t.co/BHam7jXy8f

— Torsten Bell (@TorstenBell) June 21, 2023

But he’s not impressed by claims that Liz Truss and Kwasi Kwarteng are somehow vindicated over last year’s mini-budget debacle:

Those people arguing that rates rising now shows Trussonomics/the associated rate rise wasn’t that bad have lost the plot. The idea stubborn inflation today (which is why rates are rising) supports case for what was a massive (£45bn) fiscal stimulus is galactic level stupidity

— Torsten Bell (@TorstenBell) June 21, 2023

Had big tax cuts/looser fiscal policy gone ahead we’d be looking at even bigger rate rises right now

— Torsten Bell (@TorstenBell) June 21, 2023

Sticky inflation is extending the cost-of-living crisis for everyone in Britain, and hardening the mortgage crunch for the seven million households who have a mortgage.

That’s the warning from the Resolution Foundation today.

James Smith, Resolution’s research director,

“The latest data will reinforce market expectations of how high interest rates will go, and put more pressure on the Bank. This is bad news for anyone with a mortgage, who will be looking out for more positive signals before their current deal comes to an end.”

Resolution have calculated that mortgage repayments are set to rise by £15.8bn a year by 2026, meaning an average hit of £2,900 for households remortgaging.

Three-quarters of that £15.8bn hit will fall on the richest 40% of households, they add, as higher-income households are more likely to have a mortgage.

But rising prices hit poorer households more.

They add:

Inflation rates for the poorest tenth of households are 25 per cent higher than those for the richest tenth of households as they spend more of their income on food and energy bills.

Ben Franklin, research director at the Centre for Progressive Policy says the UK’s high food price inflation, and stubbornly high core inflation, are ‘particularly devastating’ news.

Inflation numbers are bad today. Two particularly devastating charts in today’s ONS release. First – food price inflation. Price rises may have slowed but only to 18.4% year on year. The poorest suffer most from food price inflation. pic.twitter.com/0tQtjJU8uX

— Ben Franklin (@bjafranklin) June 21, 2023

And second – core inflation (which excludes energy, food, alcohol and tobacco) remains stubborn and doesn’t appear to have peaked. pic.twitter.com/vU8MLoCzZs

— Ben Franklin (@bjafranklin) June 21, 2023

While BoE thinks inflation likely to come down rapidly by the end of this year and hit the 2% target by end of 2024 – the persistence of these numbers is worrying.

— Ben Franklin (@bjafranklin) June 21, 2023

And even if inflation does come down to something like the BoE’s forecast, the effects of 2022 and 2023 will still be felt as prices will be permanently higher. All of which means the cost of living will continue to play a key role in the lead up to the next General Election.

— Ben Franklin (@bjafranklin) June 21, 2023

Although food price inflation slowed last month, to 18.3% per year from 19%, there were still some sharp increases in the prices of staples compared with last year.

The annual rate of inflation fell for eggs, potatoes, meat, bread, butter and coffee, for example:

-

Eggs: April 37.0%, May 28.8%

-

Low-fat milk: April 33.5%, May 28.5%

-

Yogurt: April 24.0%, May 23.4%

-

Potatoes: April 24.8%, May 22.4%

-

Fruit and vegetable juices: April 21.1%, May 18.0%

-

Ready meals: April 20.8%, May 16.8%

-

Meat: April 17.2%, May 16.3%

-

Bread: April 18.6%, May 15.3%

-

Margarine and other vegetable fats: April 19.0%, May 15.2%

-

Tea: April 19.1%, May 14.6%

-

Butter: April 20.1%, May 14.1%

-

Chocolate: April 14.9%, May 11.7%

-

Pizza and quiche: April 11.9%, May 9.4%

-

Coffee: April 15.3%, May 9.2%

But shoppers were hit by rising inflation on other products:

-

Sugar: April 47.4%, May 49.8%

-

Olive oil: April 46.4%, May 46.9%

-

Sauces, condiments, salt, spices and culinary herbs: April 33.9%, May 35.1%

-

Cheese and curd: April 30.6%, May 33.4%

-

Pasta and couscous: April 27.7%, May 28.5%

-

Jams, marmalades and honey: April 17.9%, May 22.9%

-

Crisps: April 14.5%, May 17.8%

-

Fish: April 14.2%, May 16.6%

-

Rice: April 14.9%, May 16.1%

-

Breakfast cereals and other cereal products: April 8.1%, May 12.3%

-

Fruit: April 10.8%, May 11.2%

-

Dried fruit and nuts: April 7.2%, May 10.3%

Rents climb at fastest rate since at least 2016

UK tenants were hit by the fastest increase in rents in at least seven years last month.

Private rental prices paid by tenants in the UK increased by 5.0% in the 12 months to May 2023, the Office for National Statistics reports.

That is the largest annual percentage change since the data series began in January 2016.

The ONS reports that rental prices in London grew at the fastest rate in a decade, saying:

In the 12 months to May 2023, rental prices for the UK (excluding London) increased by 4.9%, up from an increase of 4.8% in the 12 months to April 2023.

Private rental prices in London increased by 5.1% in the 12 months to May 2023, up from an increase of 5.0% in the 12 months to April 2023. This is the highest annual percentage change in London since October 2012.

Commenting on today’s house price data for April and rents data for May, Aimee North, Head of Housing Market Indices at the ONS, said: (1/2) 💬 pic.twitter.com/Q8CT9zLFJF

— Office for National Statistics (ONS) (@ONS) June 21, 2023

Yesterday, property portal Zoopla reported that the average UK tenant now spends more than 28% of their pay before tax on rent, the highest in a decade.

House price inflation slowed in April, new official data shows.

The Office for National Statistics reports that average UK house prices increased by 3.5% in the 12 months to April, down from 4.1% in the year to March.

The average UK house price was £286,489 in April, which is £9,000 higher than 12 months ago, but £7,000 below the recent peak in September 2022.

It was slightly higher than the £285,057 recorded in March.

Average house prices increased over the 12 months to £306,000 in England (3.7%), £213,000 in Wales (2.0%), £187,000 in Scotland (2.0%) and £172,000 in Northern Ireland (5.0%).

The North East saw the highest annual percentage change of all English regions in the 12 months to April (5.5%), while London saw the lowest (2.4%).

Hunt economic advisor: Bank of England must create recession to curb inflation.

The Bank of England must “create a recession” to curb inflation, according to Karen Ward, chief market strategist EMEA at JP Morgan Asset Management.

Ward, who is also a member of chancellor Jeremy Hunt’s economic advisory council, told Radio 4’s Today programme there are “certainly signs” that a price-wage spiral is emerging, which the central bank “has to nip in the bud”.

Speaking after inflation remained stubbornly high at 8.7% in May, Ward explained:

“The difficulty for the Bank of England – I mean, no-one envies them their job at the moment – is they have to therefore create a recession.

“They have to create uncertainty and frailty, because it’s only when companies feel nervous about the future that they will think ‘Well, maybe I won’t put through that price rise’, or workers, when they’re a little bit less confident about their job, think ‘Oh, I won’t push my boss for that higher pay’.

“It’s that weakness in activity which eventually gets rid of inflation.”

One of the Chancellor’s economic advisers, has called for the Bank of England to ‘create a recession’ to curb inflation.

Speaking to @MishalHusain, Karen Ward, who works for JP Morgan, said: ‘It’s that weakness which eventually gets rid of inflation.’#R4Today pic.twitter.com/CxGqzdPbBv

— BBC Radio 4 Today (@BBCr4today) June 21, 2023

Ward is also a member of The Times’s shadow monetary policy committee, a group of experts who are today calling for the actual MPC to raise interest rates by half a point tomorrow, to 5%.

Ward argued that the Bank of England’s “earlier hesitancy” has put it in an uncomfortable spot.

With her shadow MPC hat on, Ward told The Times:

It hoped for too long that inflation would go away on its own accord and underestimated the second-round effects now evident in accelerating wage growth.

It did not adhere to the “stitch in time saves nine” principle and now will have to raise rates by more and cause a deeper downturn to bring inflation back to target.

Here’s a breakdown of the price moves that kept UK inflation disappointingly high in May, at 8.7%:

-

Food and non-alcoholic beverages: up by 18.3% over the last year, down from 19% in April

-

Alcoholic beverages and tobacco: up by 9.3% over the last year, down from 9.1% in April

-

Clothing and footwear: up by 7.1% over the last year, up from 6.8% in April

-

Housing, water, electricity, gas and other fuels: up by 12.1% over the last year, down from 12.3% in April

-

Furniture, household equipment and maintenance: up by 7.5% over the last year, matching April’s reading

-

Health: up by 8.3% over the last year, up from 7% in April

-

Transport: up by 1.2% over the last year, down from 1.5% in April

-

Communication: up by 9.1% over the last year, up from 7.9% in April

-

Recreation and culture: up by 6.7% over the last year, up from 6.3% in April

-

Education: up by 3.2% over the last year, matching April’s reading

-

Restaurants and hotels: up by 10.3% over the last year, up from 10.2% in April

-

Miscellaneous goods and services: up by 6.8% over the last year, matching April’s reading

Buy-to-let mortgages have also become pricier.

Moneyfacts reports:

-

The average 2-year buy-to-let residential mortgage rate today is 6.44%. This is up from an average rate of 6.40% on the previous working day.

-

The average 5-year buy-to-let residential mortgage rate today is 6.31%. This is up from an average rate of 6.29% on the previous working day.

-

There are currently 2,456 buy-to-let mortgage products available. This is down from a total of 2,525 on the previous working day.

Mortgage rates rise again

Just in: UK fixed-term mortgage rates have climbed again, which will add to concerns about a ‘timebomb’ in the housing market.

The average 2-year fixed residential mortgage rate has risen to 6.15% today, data provider Moneyfacts reports, up from 6.07% on Tuesday.

At the start of May, two-year fixed mortgages were averaging 5.26%, before starting to climb as the financial markets realised UK inflation was looking worryingly sticky.

The average 5-year fixed residential mortgage rate jumped too, to 5.79%, up from 5.72% yesterday.

Almost 150 mortgage products were pulled from the market since yesterday, as lenders rushh to reprice deals.

There are currently 4,498 residential mortgage products available, Moneyfacts reports, down from 4,641 on Tuesday.

The surge in mortgage rates is splitting, some of whom want ministers should intervene to defuse Britain’s mortgage timebomb, by reintroducing tax relief on mortgage interest.

Yesterday Jake Berry, the influential chair of the the Northern Research Group of Tory MPs, told chancellor Jeremy Hunt:

“People are very concerned about what is being described as the mortgage bomb about to go off.

If we don’t help families now, all the other money that we have spent to help them will have been wasted if they lose their home.”

UK national debt hits 100% of GDP, highest since 1961

The UK’s debt pile reached more than 100% of economic output for the first time since 1961 as government borrowing more than doubled in May, according to official figures this morning

The Office for National Statistics (ONS) said net debt reached £2.6 trillion as of the end of May, estimated at 100.1% of gross domestic product (GDP).

Public sector debt excluding public sector banks was £2,567.2 billion at the end of May 2023, provisionally estimated at 100.1% of GDP.

This ratio was last above 100% in March 1961. pic.twitter.com/O3QlKc4ZyY

— Office for National Statistics (ONS) (@ONS) June 21, 2023

It is the first time the debt-to-GDP ratio has risen above 100% since March 1961, except for during the pandemic, but this was later revised lower due to stronger GDP figures.

It came as government borrowing soared year-on-year to £20bn in May, pushed higher by the cost of energy support schemes, inflation-linked benefit payments and interest payments on debt.

Public sector net borrowing (excluding public sector banks) was £20.0 billion in May 2023.

This was the second highest May since monthly records began, partly because of the cost of the energy support schemes.

➡️ https://t.co/KkU7l2RaKT pic.twitter.com/Xbhj8sdYu0

— Office for National Statistics (ONS) (@ONS) June 21, 2023

May’s borrowing figure was £3bn lower than in April but £10.7bn higher than a year ago and the second-highest May borrowing since monthly records began in 1993.

Economists had predicted borrowing of £19.5bn for May.

Chancellor Jeremy Hunt said the Government has been taking “difficult decisions” to balance the books following the pandemic and Russian President Vladimir Putin’s invasion of Ukraine.

Hunt said:

“We rightly spent billions to protect families and businesses from the worst impacts of the pandemic and Putin’s energy crisis.

“But it would be manifestly unfair to leave future generations with a tab they cannot repay.

“That’s why we have taken difficult but necessary decisions to balance the books in order to halve inflation this year, grow the economy and reduce debt.”

Today’s inflation figure of 8.7% is “a shocker”, says Professor Costas Milas of the University of Liverpool’s Management School.

He believes it will prompt the Bank of England (BoE) into raising interest rate by half a percentage point tomorrow, to 5%, telling us:

The BoE predicted, only last month, an inflation rate of 8.22% for the second quarter of 2023.

For this to materialize, inflation needs to increase by 7.3% in June. This huge drop from the current 8.7% rate is almost unlikely to happen.

To defend its credibility, I sense the MPC will most likely feel “obliged” to raise tomorrow it’s base rate by 0.5 percentage points and assess the very effect in August’s Monetary Policy Report (and next decision). There is no interest rate decision in July….

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)