[ad_1]

Bank stocks slide amid fears of global crisis

Banking stocks have tumbled in the UK and the rest of Europe at the end of a turbulent week dominated by fears of a global banking crisis.

The Euro Stoxx banks index has fallen 5.4%. France’s Société Générale lost almost 7% and UBS, which orchestrated a rescue takeover of Credit Suisse this week, also slid 7%. Deutsche Bank tumbled nearly 13%.

Here in London, the British banking index lost 4.5%, falling for a third day. The FTSE 100 index has lost almost 2% to 7,355, dragged lower by Barclays (down 5.2%), NatWest Group, Standard Chartered and the insurer Prudential. Analysts at HSBC cut their price target on Barclays.

Oil stocks BP and Shell fell about 4% as oil prices tumbled amid fears of oversupply. Brent crude is down $2.5 at $73.38, a 3.3% drop, while US light crude has slid 3.6% to $67.48 a barrel.

US energy secretary Jennifer Granholm said refilling the country’s strategic petroleum reserves may take several years, dampening demand prospects.

Yields on US government bonds have fallen sharply, as investors sought refuge in government debt, regarded as a safe haven in tumultuous times. Two-year Treasury yields dropped as much. as 23 basis points to 3.56%, the lowest level since September.

Key events

Unite: Bailey fails to understand ‘depth of profiteering crisis’

Phillip Inman

Unite, the UK’s largest private sector union, has commented on Andrew Bailey’s interview with the BBC this morning in which he warned companies to be restrained when they consider increasing prices.

The Bank of England governor said he was concerned that companies would maintain high price increases, keeping inflation higher for longer and forcing the central bank to impose further interest rate rises.

The union said a “grudging acknowledgement” by Bailey that companies have played a role in rising prices was a “welcome development”.

But the union’s general secretary Sharon Graham said Bailey had failed to understand “the depth of the profiteering crisis”.

Graham said:

Andrew Bailey’s lacklustre acknowledgement of the role price rises are having on inflation is a step forward after years of targeting workers.

However, the Governor of the Bank of England is still refusing to acknowledge the depth of the crisis. The UK is in the grip of a profiteering epidemic – it is greedflation, not workers’ wages, that is fuelling the cost of living crisis.

The profits of Britain’s biggest firms have spiked 89 per cent: to claim that there is no evidence of excessive profiteering just isn’t credible.

Policy makers seem determined to remain prisoners of a broken economy. They need to wake up.

Our full story on Bailey’s comments is here:

“A see-saw session on Wall Street overnight spoke to an edgy market mood and the FTSE 100 started the day firmly on the back foot on Friday,” said AJ Bell investment director Russ Mould. He’s summed up today’s main news.

Barclays topped the losers’ list [earlier, now it’s NatWest Group], reflecting the tricky position for the banks, with some European shares in the sector chalking up big losses on lingering fears of contagion and the threat of regulatory intervention. It is difficult to see a path through the current turmoil around inflation, rates, geopolitical tensions and the recent banking crisis which doesn’t involve some pain.

At best there is a good deal more uncertainty than there was a month ago and if there’s one thing which markets cannot stand it is uncertainty. We may be close to the end of the rate hiking cycle, certainly the Federal Reserve hinted as much earlier this week, but we are certainly not out of the woods yet.

UK retail sales topped expectations in February as they rose from January’s lows, though they were still weaker year-on-year, and despite some improvement consumer confidence could still be characterised as fragile at best.

European PMI data shows a big divergence between the services and manufacturing sector. It could be the latter is a canary in the coal mine for a more pronounced economic slowdown.

The next big economic announcement looks to be the PCE data in the US a week today – this is the Fed’s preferred measure of inflation and if it comes in higher than forecast it could lead to a sudden about-turn on the Fed’s recent shift in tone.

Here’s our full story on retail sales: There was a better-than-expected boost for retail sales in Great Britain in February as shoppers turned to discount department stores and secondhand shops, and chose to dine in more and cut back on eating and drinking in pubs and restaurants.

The Office for National Statistics (ONS) said retail sales increased by 1.2% last month compared with January, well ahead of economists’ forecasts of a 0.2% rise, bouncing back to pre-pandemic levels despite the cost of living crisis.

In other news, just 1% of the estimated £1.1bn lost from the government’s Covid business support programme in England as a result of fraud and error has been recovered so far, the public spending watchdog has said in a report urging ministers to learn lessons from the scheme, reports the Guardian’s political correspondent Peter Walker.

The “overwhelming majority” of fraud and error occurred during the initial incarnation of the grant scheme launched in March 2020, which did not require prepayment checks, the National Audit Office (NAO) said in its report on the rushed-through efforts.

The total of £1.1bn lost in grants amounted to just under 5% of the total for the scheme, according to business department statistics. The latest figures of retrieved money, collated by the newly renamed Department for Business and Trade (DBT) and cited by the NAO, showed that only £11.4m of that has been recovered – 1% of the amount lost.

Service sector powers eurozone growth but factories struggle

In the eurozone as a whole, business activity rose strongly to the highest since last May, powered by a revival in the services sector.

The S&P Global PMI’s flash reading showed the composite index at 54.1, up from 52 in February. The services index strengthened to 55.6 from 52.7 in February, while manufacturing weakened, with the index dipping below the 50 mark that divides growth from contract (49.9 versus 50.1 in February).

This suggests that the economy is reviving after falling into decline late last year. Inflationary pressures have continued to ease, with input prices even falling sharply in manufacturing.

Jobs growth has accelerated and business confidence has remained resilient despite concerns stemming from recent banking sector stress and higher borrowing costs.

However, the overall rate of growth remains modest and driven solely by the service sector, with manufacturing suffering a further loss of new orders, meaning current output is only being sustained via backlogs of previously placed orders.

Also, despite easing further, overall input cost and selling price inflation rates remain elevated by historical standards.

German business activity at 10-month high

In Germany, Europe’s biggest economy, business activity also picked up to a 10-month high in March, with inflation falling but still high due to price pressures in the services sector, according to the flash reading from S&P Global.

Key findings:

-

Flash Germany PMI Composite Output Index at 52.6 (Feb: 50.7). 10-month high.

-

Flash Germany Services PMI Activity Index at 53.9 (Feb: 50.9). 10-month high.

-

Flash Germany Manufacturing Output Index at 50.1 (Feb: 50.2). 2-month low.

-

Flash Germany Manufacturing PMI at 44.4 (Feb: 46.3). 34-month low.

The rate of growth picked up in Germany’s private sector, but remained modest overall. The pace of job creation also picked up, though firms were a tad less optimistic about the year-ahead outlook.

Inflation, as measured by prices charged by firms, remained elevated due to stubbornly high pressures in the service sector. Overall inflation eased to a near two-year low, though, as raw material costs declined for manufacturers and supplier delivery times shortened.

French businesses expand at fastest pace since May

While French protests over plans to raise the pension age from 62 to 64 continue, as more than a million took to the streets yesterday and Bordeaux town hall was set on fire, there’s some good news on the French economy today.

Strong services activity growth in March has led the French economy to expand at the fastest pace since May, according to a closely-watched survey from S&P Global. Its purchasing managers’ index for the private sector was above the 50 mark that divides growth from contraction for a second month, and rose to a 10-month high.

Key findings:

-

Flash France PMI Composite Output Index at 54.0 (Feb: 51.7). 10-month high.

-

Flash France Services PMI Activity Index at 55.5 (Feb: 53.1). 10-month high.

-

Flash France Manufacturing Output Indexat 46.9 (Feb: 45.0). 2-month high.

-

Flash France Manufacturing PMI at 47.7 (Feb: 47.4). 2-month high.

S&P Global said:

France’s private sector saw a notable improvement in activity levels at the end of the first quarter. This marked the second successive month of growth, albeit one that was entirely driven by services businesses as factory production fell for a tenth month running. Supporting faster activity growth was a rejuvenation in demand, as seen through an expansion in new orders for the first time since mid-2022.

Subsequently, surveyed companies saw their backlogs of work rise and raised staffing levels accordingly. A cooling of price pressures was also recorded in March, with rates of input cost and output price inflation slowing to 18- and seven-month lows respectively amid receding supply-chain frictions.

European stocks, oil prices, sterling fall

Stock markets are in the red again, with the FTSE 100 index down 67 points, or 0.9%, at 7,431, dragged down by banks NatWest Group, Barclays, Standard Chartered and the insurer Prudential, as concerns over the banking sector persist.

Germany’s Dax has lost 133 points, or 0.9%, to 15,076 while France’s CAC fell 65 points, or 0.9% to 7,072 and Italy’s FTSE MiB has tumbled 309 points to 26,173, a 1.2% drop.

Crude oil prices have also fallen, with Brent crude, the global benchmark, down 0.4% at $75.59 a barrel.

The pound is trading 0.3% lower against the dollar at $1.2250 but has edged up 0.1% versus the euro to €1.1353.

Bailey went on to say that the economic picture has brightened considerably.

The prospects for the economy in terms of growth are now better, considerably better, and it is reasonable to say that there’s a pretty strong likelihood that we will avoid a recession this year.

But we’ve still got to put in place the conditions for much stronger growth in the economy and sustainable growth in the economy.

We’ve got to build a new engine of growth in this country to grow the economy.

Michael Hewson, chief market analyst at CMC Markets UK, tweeted:

Here are more comments from Bank of England governor Andrew Bailey, speaking on BBC radio 4’s Today programme.

We’ve got to get inflation down. Inflation is too high at the moment. Now we think that it will fall sharply really from the early summer throughout the rest of the year. And we’re pretty confident about that.

But it hasn’t come down yet and we had some news earlier this week which was a bit higher than we expected it to be, there were probably some temporary factors in there. But there was a message in there that we’ve not got to the point where we’re getting the sharp fall that we expect. We weren’t expecting it immediately but we’ve got to see that happen. That’s my message, that’s what lies behind the [rate] increase [on Thursday].

Inflation “is way too high at the moment and we’ve got to get it back to the 2% target.”

I believe there are powerful forces that will bring it down because unless something really bad happens over the rest of this year, we’re going to see a reversal of what we saw last year in terms of energy prices.

In an appeal to businesses, he said:

I would say to people who are setting prices: Please understand if we get inflation embedded interest rates will have to go up further.

When companies set prices I understand that they have to reflect the costs that they face. But what I would say please is that when we are setting prices in the economy and people are looking forwards we do expect inflation to come down sharply this year and I would just say please bear that in mind.

Former Guardian journalist Tom Clark, a fellow of the Joseph Rowntree Foundation and a contributing editor to Prospect, tweeted:

Good that after months of high inflation A Bailey has moved the “moral suasion” from wages alone to prices too

(Though he must know that unless the economy is rife with monopolies there’s zero chance of the sermon working…)

— Tom Clark (@prospect_clark) March 24, 2023

Victoria Scholar, head of investment at interactive investor, has looked at consumer confidence and the wider economy.

Sentiment improved to a one-year high but remains gloomy by historic standards. The personal finance measure however remains low as inflation erodes take home pay and cost-of-living pressures persist.

Economic data, though still weak, has started to show incipient signs of improvement in the UK with house prices, retail sales, confidence and PMI figures picking up off the lows as the mini-budget chaos fades into the rear-view mirror and the Bank of England approaches the end of the rate hiking cycle. Inflation however remains a sticking point, having unexpectedly picked up again in February, going against recent months of improvement since October’s peak.

UK consumer confidence improves

The jump in retail sales came as consumer confidence improved slightly. GfK’s consumer confidence index rose by two points to -36 in March.

Joe Staton, client strategy director at GfK, said:

A small improvement in the overall index score this month masks continuing concerns among consumers about their personal financial situation. This measure best reflects the financial pulse of the nation and it remains weak, with the figure for the coming year down three to -21 and an unchanged score for the past 12 months of -26.

Forecasts that headline inflation will fall this year have proved premature, given Wednesday’s announcement of an unexpected increase. Wages are not keeping up with rising prices and the cost-of-living crisis remains a stark reality for most.

The recent budget will bring relief to some sections of the population, but for now many people are simply looking to survive day-by-day. Just having enough money to live right and pay the bills remains the number one concern for consumers across the UK.

Nicholas Hyett, investment analyst at the investment service Wealth Club, said:

The UK is finding its shopping habit hard to kick it would seem. Retail sales volumes have come in stronger than expected for the second month this year despite the cost of living squeeze.

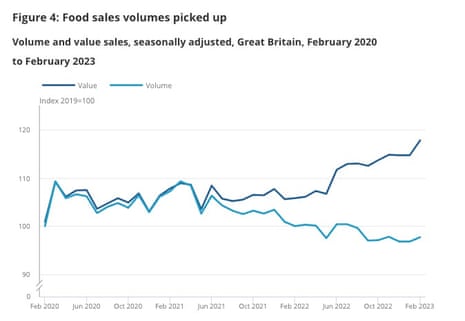

But beneath that headline, there’s clear evidence that shoppers are being careful with their money. Growth in non-food sales was driven by discounters and second hand shops, while the rise in food volumes is attributed to people choosing to eat in and avoid pricey meals out. Shoppers may be more willing to spend, but only when there’s a bargain to be had.

Longer term, sales volumes remain lower than they were this time last year. With the Bank of England expecting the UK economy to hold up better than previously expected, that provides room for several months more sales growth. Whether shoppers find the confidence to return to the mid-market space though remains to be seen.

Aled Patchett, head of retail and consumer goods at Lloyds Bank, is more upbeat:

A rise in sales for February suggests that consumer confidence is heading in the right direction after a difficult few months. While inflation remains higher than hoped, retailers will be buoyed to see consumers spending on little luxuries and celebrations.

Those in the industry will be hopeful that warmer temperatures and a fall in gas prices will be the spark needed to free up disposable income amongst consumers and leads to a longer period of growth.

Despite a surprise uptick in inflation earlier this week, we still expect levels to wane later in the year. Retailers will be hoping it’s the shot in the arm consumers need to loosen their grip on purse strings.

Ashley Webb, UK economist at Capital Economics, said it’s too soon to conclude February’s rebound in retail sales will be sustained.

At face value, these data further add to the view that the recent resilience in activity is still holding up. But when households’ finances are under pressure, it is possible that any improvement in retail sales will be just be met by a softening in non-retail spending (such as restaurants).

And although the worst of the falls in real household incomes are in the past, the full drag on activity from higher interest rates has yet to be felt. As such, the coming months may still be a struggle for retailers as the economy tips into recession.

British retail sales stronger than expected, lifted by discount stores

Retail sales in Great Britain were much stronger than expected last month, as people turned to discount stores and cut back on eating out and takeaways because of cost-of-living pressures.

Retail sales volumes increased by 1.2% in February from the month before, compared with January’s 0.9% rise (revised higher from 0.5%) and analyst expectations of a 0.2% gain. It was the biggest monthly rise since October. The figures were released by the Office for National Statistics.

However, sales were down 0.3% in the three months to February when compared with the previous three months.

The ONS director of economic statistics, Darren Morgan, said:

Retail grew sharply in February with sales returning to their pre-pandemic level.

However, the broader picture remains more subdued, with retail sales showing little real growth, particularly over the last eighteen months with price rises hitting consumer spending power.

Introduction: Bank of England chief warns of further rate hikes if firms raise prices

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Andrew Bailey, the governor of the Bank of England, has appealed to businesses to avoid price rises but expressed confidence that the rises in the cost of living would slow sharply in the early summer.

Speaking on BBC radio 4’s Today programme, he admitted that inflation had not yet eased, after it unexpectedly rose to 10.4% in February. The Bank raised interest rates to 4.25% yesterday.

Companies should set prices in a way that do not embed inflation at current levels because it could hurt people and would mean higher interest rates, he said.

If all prices try to beat inflation then we will get domestic inflation that will start repeating itself. Higher inflation really benefits nobody and particularly hurts the least well-off in society.

Rising inflation hits the least well-off hardest because they spend a bigger proportion of their income on food and energy.

Bailey said he hasn’t seen evidence of profiteering by companies, but other policymakers are worried that after the pandemic and Brexit, businesses face less European competition, which makes the UK more inflation-prone.

Last year, Bailey called on workers not to ask for big pay rises, sparking a backlash from unions. As wage growth has evaporated, he’s now asking firms to stop raising prices further.

Andrew Bailey explains why we have raised rates by 0.25% today. Inflation is still too high, but we continue to expect it to fall sharply from the middle of this year. Raising interest rates is the best way we have of making sure that happens. pic.twitter.com/kwhowGRZoa

— Bank of England (@bankofengland) March 23, 2023

His comments came as government figures released on Thursday showed that the average council tax in the UK will exceed £2,000 for the first time next month.

As local authorities struggle under growing financial pressures, it emerged that the average bill for band D properties will go up by £99 to £2,065 for 2023-24.

In towns and cities areas outside London bills rise by 5.1% to an average of £2,059, while rural parts of the country will see an increase of 5% to just below £2,140.

The Agenda

-

8.15am GMT: France S&P Global PMIs flash for March

-

8.30am GMT: Germany S&P Global PMIs flash for March

-

9am GMT: Eurozone S&P Global PMIs flash for March

-

9.30am GMT: UK S&P/CIPS Global PMIs flash for March

-

12.30pm GMT: US Durable goods orders for February

-

1.45p GMT: US S&P Global PMIs flash for March

-

4pm GMT: Bank of England policymaker Catherine Mann speaks

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)