[ad_1]

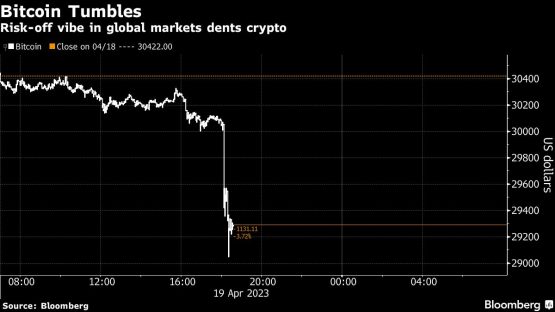

Bitcoin dropped back below the closely watched $30 000 level amid a wider retreat in cryptocurrencies, as stubbornly high UK inflation fanned fears of higher-for-longer interest rates.

The largest token fell as much as 4.5% before paring some of the slide to trade at about $29 340 as of 9:50 a.m. in London on Wednesday. Ether shed 5% and smaller tokens like Solana and Avalanche suffered steeper declines.

UK consumer-price data on Wednesday showed inflation remained above 10% in March, adding to recent signs that central banks will have to keep lifting borrowing costs. That’s giving traders pause after Bitcoin surged about 80% this year, a rally driven in large part by speculation that rate cuts were imminent.

The sudden selloff triggered liquidations of $175 million worth of long positions across crypto markets, data from Coinglass showed.

“This seems to be a classic liquidation and structural market reaction,” said Vetle Lunde, senior analyst at K33 Research.

© 2023 Bloomberg

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)