[ad_1]

Britain’s economy growing at fastest pace in a year: PMIs show

Newsflash: The UK private sector is growing at its fastest pace in a year, as companies are boosted by a pick-up in new orders.

The latest survey of British purchasing managers has found that business activity is growing for the third month running this month, and at the fastest pace since April 2022.

The UK’s dominant service sector is driving the recovery, with companies reporting that consumer spending was resilient. This should cool concerns that the UK risks falling into recession this year.

Data provider S&P Global says that a “further robust rise” in new orders dded to signs of an improving economic landscape.

But while there was strong growth in the service economy, factory production is falling again this month. Goods producers said that demand had been hit by “customer destocking” and efforts to cut costs.

Overall, the Flash UK PMI composite output index rose to 53.9 so far this month, up from March’s 52.2, a 12-month high. Any reading over 50 shows growth.

#UK private sector firms signalled a further increase in business activity with the rate of expansion accelerating to its fastest in a year (#PMI at 53.9; Mar: 52.2). The rate of input cost inflation slowed, but output charges increased steeply. Read more: https://t.co/lByqsf9t6N pic.twitter.com/eU9raeLl9R

— S&P Global PMI™ (@SPGlobalPMI) April 21, 2023

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence says the repost shows growth accelerating this month:

Growth is lopsided, however, with surging demand for services contrasting with an ongoing downturn in demand for goods, Williamson points out, adding:

“However, for now the key takeaway is that the economy as a whole is not only showing encouraging resilience but has gained growth momentum heading into the second quarter, the latest PMI reading broadly indicative of GDP rising at a robust quarterly rate of 0.4%.

Key events

Although UK private sector output is rebounding this month, there’s a stark difference between manufacturers and services firms, says Dr John Glen, CIPS chief economist:

Glen explains:

Services saw the fastest new order growth for 13 months as consumer confidence grew and spending on a few more luxuries increased.

Whereas the manufacturing sector received another body blow and became more entrenched in contraction with a fall in new orders and another round of job shedding.

Stronger supply chain deliveries boosting operations was not even enough to improve manufacturers’ fortunes as consumers chose holidays over white goods.

Price rises could lead to May interest rate hike

UK firms also continued to lift their prices this month, adding to pressures on households.

The PMI report shows that private sector firms “once again sought to defend margins” from rapidly increasing staff costs, especially those in the service economy. Price rises accelerated slightly this month.

That, and the pick-up in growth last month, is likely to spur the Bank of England to raise interest rates for the 12th time in a row next month, when it sets borrowing costs on 11 May.

S&P Global Market Intelligence’s Chris Williamson says:

Inflationary pressures have meanwhile continued to cool in manufacturing, but price pressures have picked up in services following the resurgence of demand.

This combination of faster growth and elevated price pressures put a twelfth rate hike by the Bank of England an increasingly done deal when it next meets on 11th May, and will add to speculation that further hikes may be needed

Britain’s economy growing at fastest pace in a year: PMIs show

Newsflash: The UK private sector is growing at its fastest pace in a year, as companies are boosted by a pick-up in new orders.

The latest survey of British purchasing managers has found that business activity is growing for the third month running this month, and at the fastest pace since April 2022.

The UK’s dominant service sector is driving the recovery, with companies reporting that consumer spending was resilient. This should cool concerns that the UK risks falling into recession this year.

Data provider S&P Global says that a “further robust rise” in new orders dded to signs of an improving economic landscape.

But while there was strong growth in the service economy, factory production is falling again this month. Goods producers said that demand had been hit by “customer destocking” and efforts to cut costs.

Overall, the Flash UK PMI composite output index rose to 53.9 so far this month, up from March’s 52.2, a 12-month high. Any reading over 50 shows growth.

#UK private sector firms signalled a further increase in business activity with the rate of expansion accelerating to its fastest in a year (#PMI at 53.9; Mar: 52.2). The rate of input cost inflation slowed, but output charges increased steeply. Read more: https://t.co/lByqsf9t6N pic.twitter.com/eU9raeLl9R

— S&P Global PMI™ (@SPGlobalPMI) April 21, 2023

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence says the repost shows growth accelerating this month:

Growth is lopsided, however, with surging demand for services contrasting with an ongoing downturn in demand for goods, Williamson points out, adding:

“However, for now the key takeaway is that the economy as a whole is not only showing encouraging resilience but has gained growth momentum heading into the second quarter, the latest PMI reading broadly indicative of GDP rising at a robust quarterly rate of 0.4%.

Eurozone recovery unexpectedly gathering pace

The eurozone’s economic recovery has unexpectedly strengthened this month, lifted by a jump in activity at service sector firms.

The flash Composite Purchasing Managers’ Index (PMI), compiled by S&P Global, has jumped to an 11-month high of 54.4 in April from March’s 53.7.

That indicates that the economy is accelerating this month.

Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, which co-produces the report, explains:

“The HCOB Purchasing Managers’ Indices for the euro zone show a very friendly overall picture of an economy that continues to recover,”

“However, a closer look reveals that growth is very unevenly distributed. For example, the gap between the partly booming services sector on the one hand and the weakening manufacturing sector on the other has widened further.”

The pound has dipped in the financial markets this morning, after UK retail sales fell in March.

Sterling lost half a cent to below $1.24 this morning, away from the 10-month highs around $1.255 seen a week ago.

⚠️ STERLING DIPS AGAINST U.S. DOLLAR AFTER DATA SHOWS UK MONTHLY RETAIL SALES FELL MORE THAN EXPECTED IN MARCH; LAST DOWN 0.2% AT $1.24205

— PiQ (@PriapusIQ) April 21, 2023

The pound had been the best-performing G10 currency this year, as it recovered from its losses during 2022.

Victoria Scholar, Head of Investment at interactive investor, explains:

Poor weather in the UK weighed on retail sales in March following an increase in the previous month, particularly on non-food items. It was the sixth wettest March on record since 1836, with retailers such as garden centres and jewellery stores negatively. Food store sales volumes also declined in March, partly because of the recent food shortages.

Food store sales are still down 3% versus pre-pandemic levels from February 2020 because of food price inflation and the cost of living crisis. One bright spot came from motor fuel sales which rose by 0.2% in March versus a fall of 1.2% in February but remains 8.5% below pre-covid levels.

The pound sold off slightly after the data, but cable (GBPUSD) is still up 2.7% this year. However the greenback is on track for its first weekly gain in a month.”

Radio and television presenter Greg James points out that Elon Musk also experienced a loss yesterday, when the largest and most powerful rocket ever built blew up.

I lost my blue tick but your rocket blew up so who’s the real loser

— Greg James (@gregjames) April 20, 2023

Although the test flight of the Starship rocket only lasted around four minutes, SpaceX and NASA say it was a success, and will have yielded plenty of useful data.

Although the Starship spacecraft failed to separate from the lower-stage Super Heavy rocket, it did take-off – succeeding in not blowing up the launch pad. So it’s an important milestone in SpaceX’s ambition of sending astronauts back to the moon and ultimately to Mars.

As Bill Blain, strategist at Shard Capital, puts it:

“Fail Fast” is Elon Musk’s unofficial motto, but it would be too cheap a shot to describe the first flight of SpaceX’s impressive Starship on a Heavy Booster in such terms.

Yesterday, the massive rocket suffered a “rapid unscheduled disassembly” 4 mins into its first flight, but Space X will have learnt an incredible amount that it will put right for the next launch. I am not normally given to saying this about Musk – but respect for getting the 400 ft thing in the air.

The Pope has also been blessed with one of Musk’s ‘grey ticks’ (for those with government or multilateral organization accounts).

God’s gaze never stops with our past filled of errors, but looks with infinite confidence at what we can become.

— Pope Francis (@Pontifex) April 20, 2023

Researcher John Scott-Railton has been examining the confusion caused by the removal of the old verification on Twitter.

He shows how smaller US government agencies, and those overseas, are now unverified, which risks creating confusion for users.

US public safety agencies are all over the map,

A good # of the biggest federal ones have a grey badge.

But the lower you go into regional offices, state & local, the worse it looks.

And situation is even more dire internationally. pic.twitter.com/FshAf0OB9R

— John Scott-Railton (@jsrailton) April 20, 2023

For every sector of officialdom, from federal all the way to towns Musk made a mess.

Replicated in every country around the world.

I’m picking national customs services at random to make the point. pic.twitter.com/kFatzM9Z4h

— John Scott-Railton (@jsrailton) April 20, 2023

This ‘recklessness’ by Elon Musk could have serious consequences if there is an emergency or national disater, fears Scott-Railton, who is a senior researcher at The Citizen Lab:

The weakness in UK retail sales in March was “widespread”, says Paul Dales of Capital Economics, although it can partly be blamed on the bad weather:

Food sales dropped by 0.7% m/m, partly due to shortages on the shelves, and sales fell in four of the other six main categories.

The 3.2% m/m and 1.7% m/m respective declines in department store and clothing sales were reportedly due to March being the wettest March in 40 years.

Despite the poor weather keeping shoppers at home, online sales dipped by 0.8% m/m. Household goods and fuel sales eked out rises of 0.1% m/m and 0.2% m/m respectively.

However, Dales is encouraged that retail sales rose over the last quarter, by 0.6%.

That’s the first rise in a full quarter since Q2 2021 and suggests that the 18-month retail “recession” may have come to an end.

UK department stores felt the brunt of the bad weather in March, with sales volumes dropping by 3.2% for the month.

Clothing shops reported a 1.7% fall, while sales volumes at other non-food stores, such as jewellery stores and garden centres, fell by 0.6%.

Government accounts on Twitter have grey ticks that note their connection with government agencies, which should help users spot the real Joe Biden from presidential impersonators, for example.

UK prime minister Rishi Sunak has the grey tick too, as does the @10DowningStreet account…. and Labour leader Keir Starmer, and Liberal Democrat leader Ed Davey too.

But the grey tick may not extend to every politician.

The Australian prime minister, Anthony Albanese, has been given a grey tick, but the opposition leader, Peter Dutton, has a blue tick indicating he has subscribed to Twitter Blue.

Here’s a guide to spotting who’s really who on Twitter:

The drop in UK retail spending last month means that sales volumes are 0.7% below their levels before the Covid-19 pandemic began:

Darren Morgan, ONS director of economic statistics, says:

“Retail fell sharply in March as poor weather impacted on sales across almost all sectors.

“However, the broader trend is less subdued as a strong performance from retailers in January and February means the three-month picture shows positive growth for the first time since August 2021.

“In the latest month, department stores, clothing shops and garden centres experienced heavy declines as significant rainfall dampened enthusiasm for shopping.

“Food store sales also slipped, with retailer feedback suggesting the increased cost of living and climbing food prices are continuing to affect consumer spending.”

While losing their blue tick could prick the egos of some Twitter users, it also increases the risks of impersonation by fake accounts.

Overnight, the US Citizenship and Immigration Services warned its followers to watch out for imposters.

Though we have lost our checkmark, this is the official USCIS twitter account. Please beware of imposter accounts.

When in doubt, visit https://t.co/069mgZuKzZ for the latest immigration and citizenship information, with direct links to our social media.

— USCIS (@USCIS) April 20, 2023

Twitter has previously advised government entities to apply for a free blue check through a special program, but some have reported they had thus far been unable to do so, my colleague Kari Paul explains, adding:

Experts have stated that the failure to verify such entities increases the risks of scams and even threatens to collapse disaster response online, with agencies like the National Weather System now check-less.

Musk chips in, for a few celebs….

Horror novelist Stephen King found that he still has a blue tick following the purge of legacy verified accounts on Thursday.

Last November, King had declared he wouldn’t sigh up for Twitter Blue, telling his seven million followers that Musk should pay him for producing content on the social media site.

King, who had promised to be ‘gone like Enron’ if Elon Musk started charging a fee for verification, insists he hasn’t subscribed….

My Twitter account says I’ve subscribed to Twitter Blue. I haven’t.

My Twitter account says I’ve given a phone number. I haven’t.— Stephen King (@StephenKing) April 20, 2023

…prompting Musk to reply that King was ‘welcome’:

The world’s second-richest man appears to be chipping in for a few accounts, including basketball player LeBron James and actor William Shatner, as the Verge explains here.

I’m paying for a few personally

— Elon Musk (@elonmusk) April 20, 2023

Elon Musk’s Twitter pulls plug on ‘verified’ blue ticks

Kari Paul

Twitter has finally removed its “legacy” blue checks from formerly verified Twitter accounts, as policies implemented under new owner Elon Musk began to take hold, my colleague Kari Paul writes.

Musk, who purchased the company for $44bn in 2022 and has thus far struggled to make it profitable, has been threatening to remove what he called “legacy blue checks” for months now. The checkmark previously denoted accounts that had been verified for authenticity and was given to accounts of celebrities, journalists and media outlets.

Now users seeking verification will have to pay for Twitter Blue, a controversial $8 a month subscription program under which any account can obtain a blue checkmark.

The rollout of the changes on Thursday was chaotic. Numerous high-profile users took to the platform to assert they would not pay for blue checkmarks under the new policy, while others announced they would leave the platform entirely.

Nonprofit organizations Human Rights Watch and the NAACP have tweeted they will not be paying for Twitter Blue.

Famous names such as Hillary Clinton, Bill Gates, Kim Kardashian and Justin Bieber are among those who are no longer verified.

Economist Mariana Mazzucato is one of many criticising the move, accusing Musk of ‘capricious whim’:

Lost my @Twitter blue tick tonight due to capricious whim of little boy @elonmusk. So be it. But why oh why would anyone pay for his little games, greed and short attention span. An insult to human intelligence. Play on.

— Mariana Mazzucato (@MazzucatoM) April 20, 2023

Introduction: UK retail sales drop in wet March

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

British consumers bought less stuff last month, as inflation ate into household budgets and wet weather drove shoppers from the high street.

Retail sales volumes across Great Britain dropped by 0.9% in March, new figures from the Office for National Statistics show.

That follows a 1.1% rise in February 2023, which had lifted hopes for economic growth this year.

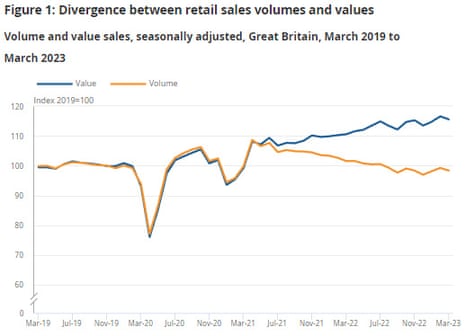

On an annual basis, overall retail sales volumes fell by 3.1% last monh compared to March 2022. But, shoppers spent 4.5% more to buy less, reflecting price increases over the last year – as this chart shows:

The ONS reports that sales volumes at “non-food stores” fell by 1.3% during March, following a rise of 2.4% in February. Retailers blamed “poor weather conditions throughout most of March” for affecting sales.

Food store sales volumes fell by 0.7% in March 2023, following a rise of 0.6% in February 2023.

Food prices have been rocketing higher, with food and drink inflation at a 45-year high over 19%.

But, there are some signs that consumer confidence is improving. The consumer confidence index issued by market researcher GfK has risen by six points to minus 30 in April.

That follows a two-point increase in the previous month, and could be an early sign of an economic recovery.

The latest PMI surveys from the UK, across the eurozone, and the US, will show how companies are faring this month.

The agenda

-

7am BST: UK retail sales figures for March

-

9am BST: Eurozone ‘flash’ purchasing manager surveys for April

-

9.30am BST: UK ‘flash’ purchasing manager surveys for April

-

2.45pm BST: US ‘flash’ purchasing manager surveys for April

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)