[ad_1]

Senior economists expect global recession in 2023 – Davos survey

The global economy is likely to fall into recession in 2023, according to a poll of senior economists ahead of the World Economic Forum at Davos, Switzerland.

The World Economic Forum (WEF) is due to start in earnest later today, the first time the winter gathering of politicians and business leaders has taken place since coronavirus pandemic lockdowns began.

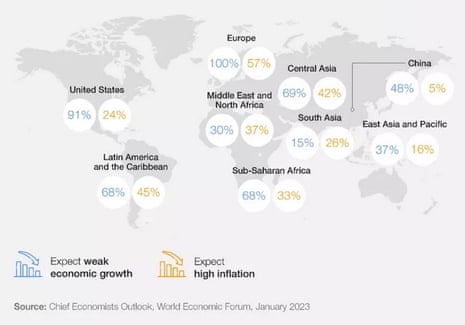

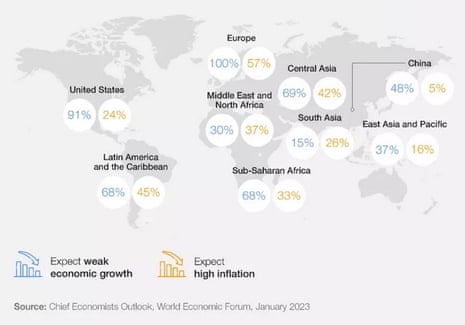

The majority of 22 chief economists surveyed by the WEF believe a global recession is likely in 2023. All of the chief economists surveyed expect weak or very weak growth in 2023 in Europe, while 20 said they expected weak or very weak growth in the US.

There are several definitions of what constitutes a “global recession”. The most obvious is a decline in global economic output. But the International Monetary Fund (IMF) used to say that 3% growth was equivalent to a recession (while taking into account other factors such as demographic change and business investment). The IMF has forecast that around a third of the global economy will enter a recession in 2023, and its outlook for global GDP is growth of 2.7%.

The economists came from a panel that includes the chief economists of companies such as Bank of America, Barclays, Google and Unilever, and non-governmental organisations like the International Monetary Fund and the United Nations Development Programme.

Saadia Zahidi, WEF’s managing director, said:

The global economy is in a precarious position. The current high inflation, low growth, high debt and high fragmentation environment reduces incentives for the investments needed to get back to growth and raise living standards for the world’s most vulnerable.

Leaders must look beyond today’s crises to invest in food and energy innovation, education and skills development, and in job-creating, high-potential markets of tomorrow. There is no time to lose.

Key events

Filters BETA

Here is an evergreen line from the UK prime minister’s spokesperson this morning: there are still gaps between the UK and EU on Brexit talks.

But this time may be somewhat different. For a few days now there have been hints that Rishi Sunak’s government is approaching a deal on the Northern Ireland protocol, the rules govering post-Brexit trade with the nation. Reuters reported that the spokesperson at the daily briefing was managing expectations on progress:

Significant differences remain between Britain and the European Union in talks over how to resolve the post-Brexit trade row relating to Northern Ireland, Prime Minister Rishi Sunak’s spokesman said on Monday.

The spokesman said he would guide reporters away from media speculation that the negotiations were about to enter the final so-called ‘tunnel’ phase.

Sterling fell 0.2% on Monday against the dollar to $1.2199, and it dipped 0.1% against the euro to €1.1266.

Lenders for Matalan have agreed to take ownership of the fashion chain in a recapitalisation process which will end founder John Hargreaves’ control of the retailer.

A group of lenders, led by Invesco, Man GLG, Napier Park and Tresidor, have sealed the deal after Matalan launched a sales process in September, writes the Press Association.

The transaction is due to complete on 26 January.

The lenders have cut the group gross debt by £257m to £336m and agreed up to £100m in new growth funding as part of the deal.

In a statement Stephen Hill, Matalan’s chief financial officer, thanked Hargreaves and said:

Matalan is a fantastic business and I am pleased that with the support of our first lien noteholders, its ongoing future has been secured via a materially lower level of debt and a reset balance sheet.

It is clear in our third quarter and recent trading performance that whilst the market remains challenging, customers have demonstrated a strong affinity to our brand and proposition, evidenced from our robust and ongoing sales growth. However, the business must continue to adapt its approach to such market conditions, increasing its level of agility and margin resilience.

Summary

Nobody has never really explained why World Economic Forum has to set up in a posh Swiss ski resort each year, but there is no denying that it business leaders and politicians see it as an important part of the calendar (or at least an important opportunity to wax lyrical about more than just shareholder concerns).

Davos has been cancelled for a couple of years (glorified video conferences don’t really count), so the global elite certainly have a lot of meaty items on the agenda. The Guardian’s economics editor Larry Elliott writes:

The war in Ukraine. A rapidly slowing economy, fragmentation and de-globalisation. The rising cost of living. Climate change.

In the past, the mood at Davos has oscillated between extreme optimism and unbridled gloom, depending on the state of the world economy. This year it looks certain to be the latter. As Klaus Schwab, founder and executive chair of the WEF put it last week, “economic, environmental, social and geopolitical crises are converging and conflating”. The aim of this year’s Davos, he added, was to get rid of the “crisis mindset”.

That will be easier said than done. Before there existed a “crisis mindset” there was a “Davos mindset”, in which the annual get-togethers fostered an inclusive form of globalisation, and attendees from around the world worked collaboratively to tackle cross-border problems such as climate change.

But as the risks to peace, prosperity and the future of the planet have increased so the willingness to cooperate – the spirit of Davos, as Schwab likes to put it – has ebbed.

You can read the full piece here:

There are some positive sentiments from the economists surveyed by the World Economic Forum. For a start, the cost of living crisis – caused by inflation of energy prices in particular – may be approaching its peak.

Two-thirds of the 22 senior economists surveyed expect the crisis to be less severe by the end of 2023.

Of course, the problem with inflation being past its peak is that it can still be quite high. The pace of the inflation slowdown will be an important factor in how far living standards fall during 2023.

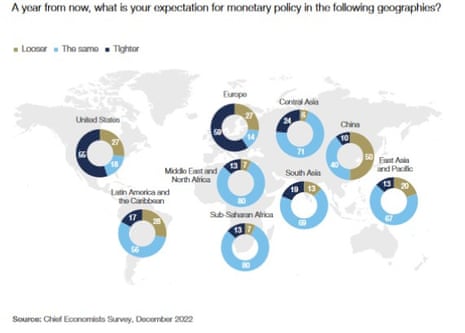

Central bankers have a tricky task on their hands. Do they raise interest rates rapidly to make sure that inflation comes down – but at the cost of slower growth? Or do they hold off on increases in the hope that inflation will fall back as energy prices drop?

There is further tightening to come in the US and Europe, where the Federal Reserve, the European Central Bank and the Bank of England (BoE) have all recently raised rates sharply. The BoE’s dilemma is illustrative: in November it warned of a “prolonged recession” while also raising rates.

China is the only part of the world where most of the economists believe that monetary policy will be looser rather than tighter. That monetary policy support might well be necessary to sustain the Chinese economy as it abandons Xi Jinping’s “zero Covid” strategy and reopens with tens of millions of coronavirus infections.

Senior economists expect global recession in 2023 – Davos survey

The global economy is likely to fall into recession in 2023, according to a poll of senior economists ahead of the World Economic Forum at Davos, Switzerland.

The World Economic Forum (WEF) is due to start in earnest later today, the first time the winter gathering of politicians and business leaders has taken place since coronavirus pandemic lockdowns began.

The majority of 22 chief economists surveyed by the WEF believe a global recession is likely in 2023. All of the chief economists surveyed expect weak or very weak growth in 2023 in Europe, while 20 said they expected weak or very weak growth in the US.

There are several definitions of what constitutes a “global recession”. The most obvious is a decline in global economic output. But the International Monetary Fund (IMF) used to say that 3% growth was equivalent to a recession (while taking into account other factors such as demographic change and business investment). The IMF has forecast that around a third of the global economy will enter a recession in 2023, and its outlook for global GDP is growth of 2.7%.

The economists came from a panel that includes the chief economists of companies such as Bank of America, Barclays, Google and Unilever, and non-governmental organisations like the International Monetary Fund and the United Nations Development Programme.

Saadia Zahidi, WEF’s managing director, said:

The global economy is in a precarious position. The current high inflation, low growth, high debt and high fragmentation environment reduces incentives for the investments needed to get back to growth and raise living standards for the world’s most vulnerable.

Leaders must look beyond today’s crises to invest in food and energy innovation, education and skills development, and in job-creating, high-potential markets of tomorrow. There is no time to lose.

Amigo Holdings has been in a rolling state of crisis since 2019 when regulators promised to crack down on unaffordable lending. The lender has now said it has been unable to find a big investor willing to back it.

Shares have plunged by 20% on Monday after the warning. Amigo said it would have to wind down the business if it could not find an investor by 26 May. Possible investors are wary because of the cost of living crisis.

Amigo specialises in guarantor loans – where a family member or friend is on the hook if the borrower defaults. The loans, which are aimed at “sub-prime” people who would probably not be able to borrow otherwise, often have very high interest rates.

On Monday it said:

To date it has been unable to secure a commitment from a cornerstone investor to underwrite the whole of the capital raise. A number of investors have expressed possible interest in making a minority investment. Amigo is therefore assessing whether there is sufficient interest for a syndicate of such investors to be formed in order to support a £45m capital raise.

Amigo has been running a pilot scheme since October which has allowed it to lend again under close scrutiny from the Financial Conduct Authority, the City regulator. The cost of living crisis has made that more difficult because it has made loans less affordable, the company said.

Danny Malone, Amigo’s chief executive, said it was “disappointing that we have so far been unable to identify the requisite equity backers for the business”.

We realise that the economic backdrop since we announced the scheme has changed substantially. This has made the process of raising equity capital to support the scheme conditions significantly more challenging than expected.

The FTSE 100’s three-year high was on Friday, at 7,864.95 points.

Today’s trading has already come within a whisker of that, at 7,863.51 points.

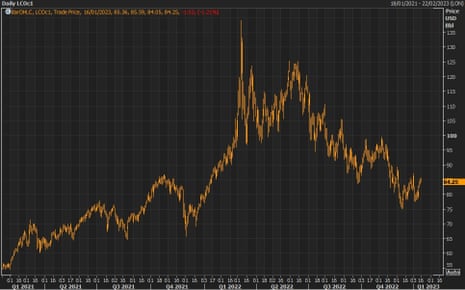

What would it take to propel the FTSE 100 to a record high today? One possibility is higher oil prices, which would buoy BP and Shell, the index’s two big fossil fuel companies.

But oil prices are down today. Futures prices for Brent crude oil, the North Sea benchmark, are down by 1.3% to $84.10 a barrel, while West Texas Intermediate, the North American benchmark, is down 1.2% at $78.83 a barrel.

Those are still historically very high prices, but notably they are still below the levels of late February 2022, when Vladimir Putin launched the full-on assault on Kyiv that caused prices to surge well over $100 a barrel.

The FTSE 100 has edged up this morning by 0.2% – or about 15 points.

It has been a strong start to the year for London’s benchmark index. It has gained 5.5% in 2023 so far.

At 7,858 points on Monday morning it is within touching distance of its record intraday high. That was 7,903 points set in May 2018, before it closed at 7844.07.

It isn’t all a cheery message: the FTSE 100 has benefited from a weaker pound. But the index has been helped by slowing inflation, which could mean central banks do not need to raise interest rates quite so quickly.

Marks & Spencer to open 20 new stores

Marks & Spencer has said its plan to open 20 new shops across the UK will create 3,400 jobs.

The food and clothing retailer is one of the UK’s most prominent household names – even if it is only a member of the FTSE 250 index of mid-sized businesses. It wants to open eight full-line stores in shopping centres such as the Bullring in Birmingham and the Trafford Centre in Manchester, as well in as retail parks and high streets across key cities.

It also will open 12 new food halls, including in Stockport, Barnsley and the seaside town of Largs in North Ayrshire, Scotland.

The new openings will bring investment in new stores to £480m, M&S said, according to the Press Association.

The company is in the middle of cutting back its larger full-line store numbers by 67 to 180 over the next five financial years. However, it is also looking at targeting more prominent urban areas for its bigger shops as part of a strategy of combining online sales with the in-built marketing boost from having shops in busy locations.

M&S chief executive Stuart Machin said:

Stores are a core part of M&S’s omni-channel future and serve as a competitive advantage for how customers want to shop today.

Our store rotation programme is about making sure we have the right stores, in the right place, with the right space and we’re aiming to rotate from the 247 stores we have today to 180 higher-quality, higher-productivity full-line stores that sell our full clothing, home and food offer whilst also opening over 100 bigger, better food sites.

The outperformance of our recently relocated and renewed stores give us the confidence to go faster in our plan.

Household energy bills to remain above pre-Ukraine invasion levels – oil boss

Good morning, and welcome to our rolling, live coverage of business, economics and financial markets.

Household energy prices may remain higher than the levels seen before Russia’s invasion of Ukraine as countries pay for the costs of the green transition, according to the boss of Equinor, one of the world’s biggest energy companies.

Anders Opedal, Equinor’s chief executive, said there will be “more and more normal prices in a couple of years’ time”.

Russia’s full-scale invasion of Ukraine in early 2022 roiled global energy markets, causing wholesale energy prices to surge. Those higher prices were quickly passed on to consumers across the world, causing inflation to accelerate and cutting the amount households have available to spend. However, analysts are hoping prices will fall back.

Yet Europe is going through a “rewiring” of its energy system, with a need for massively increased renewable energy investment, Opedal said in an interview on Monday with BBC Radio 4’s Today programme. The Norwegian state-owned oil and gas company is one of the dominant players in extracting polluting fossil fuels from the North Sea, but it has also invested a relatively small amount in renewable energy.

Opedal said:

We need to do the industry in a totally different way, maybe using hydrogen and so on. This will require a lot of investment and these investments need to be paid for, so I would assume that the energy bills may slightly be higher than in the past, but not as volatile and high as we have today.

We need to treat energy as something that is not abundant. It is actually something that has a lot of value, and we have had a lot of cheap energy in the past. We probably wasted some of it.

It’s a fairly quiet day on the economic data front, but we will bring you more shortly on Marks & Spencer’s plans to hire 3,400 more workers, and controversial sub-prime lender Amigo Holdings’ struggles to raise new investment.

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)