[ad_1]

Key events

Filters BETA

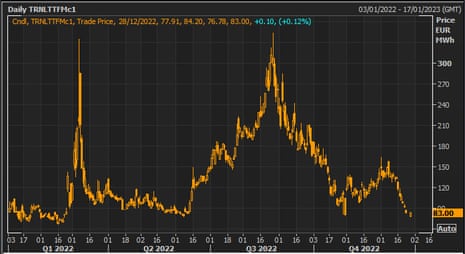

The Financial Times points out that the fall in European whosesale gas prices came after warmer than usual temperatures across northwest Europe, which are expected to linger into the new year.

As the warm weather reduces heating demand, Europe has been able to build up its gas inventory again after drawdowns from mid-November, including during the cold snaps in the early weeks of December.

Since Christmas Eve, Europe has been sending more gas into its storage facilities than it has taken out of them, with storage levels increasing 0.28 per cent to Monday. Capacity stood at 83.2 per cent full as of December 26 — down from the mid-November high of 95.6 per cent, according to industry body Gas Infrastructure Europe.

The Dutch TTF gas future for the coming month, the benchmark European contract, dropped as much as 7.4 per cent on Wednesday to €76.78 per megawatt hour — its lowest level in 10 months. What a change from the

€300+ /MWH back in August.

Prices are now back at pre-war levels. pic.twitter.com/PmZKBEyCnE— Jumana Saleheen (@JumanaSaleheen) December 28, 2022

US natural gas futures have also dropped this week.

They hit a nine-month low on Wednesday, amid forecasts of milder weather forecasts over the next two weeks that could hit heating demand.

Weaker demand from Europe is also a factor, as US exports of liquefied natural gas to Europe hit record levels this year, to make up for sharply lower pipelined natural gas supplies from Russia.

Another reason that US #natgas prices have been pressured lower is that European gas demand has been extremely weak. The continent is seeing highs 10F-25F warmer-than-normal, driving single digit daily storage draws & pushing the surplus vs 2021 to a massive +1149 BCF or +55%. pic.twitter.com/s5jBPUiljd

— Celsius Energy (@CelsiusEnergyFM) December 28, 2022

Milder winter weather has helped Europe preserve its gas storage reserves, which has pushed down prices.

Ole Hansen, head of commodity strategy at Saxo Bank, has tweeted the details:

TTF #gas trades near €80/MWh, a six-month low as mild winter weather lifts the YoY storage surplus to 325 TWh, some 25 TWh above what was withdrawn during Q1-2021. pic.twitter.com/iLngzrqAe2

— Ole S Hansen (@Ole_S_Hansen) December 27, 2022

Introduction: European natural gas prices drop back to pre-Ukraine war level

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

European gas prices have dropped back to levels seen before the Ukraine war began in February, as fears of a gas crisis this winter ease.

The month-ahead European gas future contract dropped as low as €76.78 per megawatt hour yesterday — its lowest level in 10 months, data from Refinitiv shows.

As this chart shows, gas prices have fallen back from their surge in March, and again in the summer as European countries scrambled to fill their gas storage tanks.

Prices have dropped thanks to warmer-than-normal temperatures this winter, which have limited demand for gas, after the European Union successfully filled reserves to a peak of almost 96% in November.

Consumption reduction targets have also helped to limit demand, with the EU aiming to cut its gas consumption by 15%.

Earlier this week, 83.2% of EU gas storage was filled, data from industry body Gas Infrastructure Europe shows, still above the target of 80% set for the start of November.

European natural gas prices have fallen to levels last recorded before war started in Ukraine in February, as warmer weather helps the continent to preserve its reserves. pic.twitter.com/ZZpeJTJX7t

— Business – Finance – Markets @equityin ⚡ (@equityin) December 29, 2022

Traders are confident that inventories will end winter at a very comfortable level with a very low risk of falling to critically low levels, says John Kemp, energy market analyst at Reuters.

UK gas prices have also dropped back from their highs earlier this year. The day-ahead gas price closed at 155p per therm yesterday, compared with 200p/therm at the start of 2022, and over 500p/therm in August.

Also coming up today

The new head of the Trades Union Congress has warned the UK government that further strikes lie ahead next year, unless it enters negotiations over pay rises.

TUC incoming general secretary Paul Nowak says “we must end Britain’s living standards nightmare” – which has been fuelled by higher energy costs – and is also accusing ministers of “sabotaging efforts to reach settlements”.

Speaking to the Guardian, Nowak also warned that the Labour party will not be able “turn the taps on from day one” on public spending if it wins the next election.

He said:

“Who knows what economic mess Labour is going to inherit. It’s not going to be able to turn the taps on from day one. It’s not going to be able to fix our public services.

“What you can’t fix is 12 or 13 years of neglect on day one but you can set a very clear direction of travel. No one believes that you can fix our NHS, fix our schools, fix our civil service on day one of a Labour government because you’re undoing years of neglect … But you can certainly begin to do things that would give confidence.”

Nowak also says prime minister Rishi Sunak needs to find an “exit strategy” from the ongoing industrial disputes to avoid them escalating in the months ahead after overestimating public support for his “1980s playbook” approach to widespread strikes,

Industrial action is continuing today, with Border Staff workers who are members of the PCS union continuing to strike at six airports.

PCS staff at the Driver and Vehicle Standards Agency in the West Midlands, eastern region and East Midlands are also on strike today.

There is disruption on the railways too, with TSSA union members at Great Western Railways and West Midlands Trains concluding a one-day strike at noon today.

The agenda

-

8am GMT: Spanish retail sales data for November

-

1.30pm GMT: US weekly jobless data

-

4pm GMT: EIA weekly crude oil stock data

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)