[ad_1]

Key events

Filters BETA

After a morning of gains, the FTSE 100 index is trading around 7981 points as the clocks chime noon in the City, up 0.45% or 34 points.

That leaves the index firmly on track for a new alltime closing high today, after it hit a new intraday high of 7996 points this morning.

Investors will be watching the latest US inflation report, in 90 minutes, to see if price pressures have eased. If so, shares could be lifted higher still, perhaps to the heights of 8,000 points for the first time….

The FTSE 100 is up 30 at 7977.

News editors everywhere are going, come on, just another 23, then we can run that 8000 headline thing…— SimonEnglish (@SimonEngStand) February 14, 2023

Rob Morgan, chief investment analyst at Charles Stanley points out that the FTSE 100 has underperformed other indices over the last 20 years, but it has a good track record of returning dividends to shareholders.

“Over the past two decades, the UK’s FTSE 100 index has been a poor performer compared with most other markets. The index, representing the 100 largest stock market-listed UK companies, is a mere 25% higher than at the turn of the millennium.

“Admittedly, this represents an unflattering starting point. The index was puffed up by unsustainable valuations of ‘TMT’ stocks during the dotcom bubble in the late 1990s. Yet it has been a clear laggard against the US or emerging markets where investors have comfortably trebled their money – in capital growth terms alone.

“Where the FTSE has stood out, and consequently generated respectable returns, is dividends – the profits declared by companies and paid to shareholders. Reinvesting these for growth has boosted returns substantially, and the old fashioned values of seeking out sustainable and growing pay outs from shares could finally nudge it over the line to its next milestone: 8,000 points.”

Britain welcomes Air India deal with Airbus and Rolls-Royce

The UK government has welcomed the news today that Air India has agreed to buy 250 jets from Airbus, including 210 narrowbody planes and 40 widebody aircraft

The deal is part of a huge order by Air India for 470 planes, which is expected to also include an order for 220 planes from Airbus rival Boeing, Reuters reports, as the airline heralds a decade-long expansion and reinvents itself under the new ownership of Tata.

N Chandrasekaran, chairman of Tata Group, said today:

“We on our part are going through a massive transformation because we are committed to building a world class airline. One of the most important thing is a modern fleet which is efficient and can perform for all routes.”

Prime minister Rishi Sunak says the deal will create jobs and boost exports from Britain, where the French planemaker designs and makes aircraft wings.

The deal should create 450 manufacturing jobs and bring more than £100m of investment to Wales, where Airbus manufactures wings, the British department for business and trade said.

The deal also includes 40 wide-body A350 aircraft powered by Rolls-Royce engines, which are assembled and tested in Derby in central England.

Holiday group TUI has given travel stocks a lift today, by telling shareholders it is seeing encouraging booking trends for summer and next winter.

TUI reported that it carried 3.3m customers in the final quarter of 2022 – an increase of one million versus the prior year, and 93% of the number just before the pandemic in October-December 2019.

Booking volumes overall in the last four weeks are now above pre-pandemic at higher prices, TUI said:

The start into the new year has seen significant booking momentum with record booking days online in both the UK and Germany.

Shares in TUI are up 1.7% this morning, on the FTSE 250 index of medium-sized companies. EasyJet have gained 4.4% and Wizz Air are up 2.1%.

Concerns among investors of a global recession have ‘melted away’, according to a survey of European fund managers.

Bank of America reports that a net 24% of those fund managers polled think the global economy will go into a recession over the next twelve months. That’s down from 51% last month and a peak of 77% in November.

This easing of recession worries has helped to push up stock markets this year.

BofA says:

Whereas 61% of investors still think European growth will slow in response to tightening credit conditions (down from 70% last month), a growing share of 33% expects growth to be resilient thanks to savings and order backlogs (up from 16%). 33% see resilient US growth in the near term before a slowdown due to monetary tightening (up from 25%).

FCA cracks down on illegal crypto ATMs

Britain’s financial watchdog has raided several sites in Leeds in a crackdown on illegally operated cryptocurrency ATMs.

The Financial Conduct Authority says it entered several sites around the City, in a joint operation with West Yorkshire Police’s Digital Intelligence and Investigation Unit.

This is thought to be the first action of its type in the UK.

Crypto ATMs allow customers to buy or convert funds into cryptoassets. But there are no crypto ATM operators with FCA registration, which they need to do to comply with UK Money Laundering Regulations.

Mark Steward, executive director of enforcement and market oversight at the FCA, said:

Unregistered Crypto ATMs operating in the UK are doing so illegally.

We will continue to identify and disrupt unregistered crypto businesses operating in the UK.

Crypto businesses operating in the UK need to be registered with the FCA for anti-money laundering purposes. However, crypto products themselves are currently unregulated and high-risk, and you should be prepared to lose all your money if you invest in them.

Sushil Kuner, at the law firm Gowling WLG, says the regulator taking a more interventionist approach:

This is a prime example of the FCA being more interventionist in what is one of its highest priority risk areas.

Crypto ATM operators are generally considered to be cryptoasset exchanges under the UK Money Laundering Regulations and anyone operating as such without first being registered with the FCA for AML [anti moneylaundering] purposes risks being found guilty of a criminal offence.

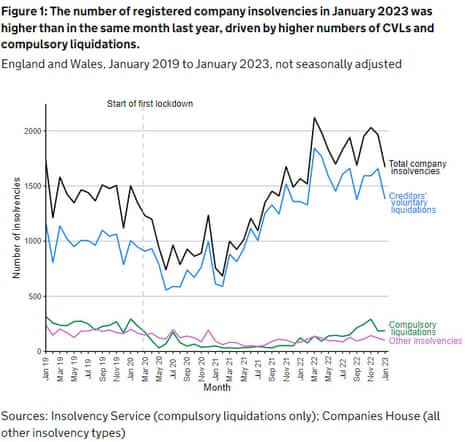

There were 1,671 company insolvencies across England and Wales last month, new figures from the Insolvency Service show.

That’s a 7% increase year-on-year, and 11% more than in January 2020 – just before the pandemic hit.

But it’s a decline on December, when 1,964 firms collapsed.

There were 189 compulsory liquidations in January 2023, which is 52% more than in January 2022.

Compulsory liquidations have increased from historical lows seen during the coronavirus (COVID-19) pandemic, partly as a result of an increase in winding-up petitions presented by HMRC, the Insolvency Service says.

There were also 1,382 Creditors’ Voluntary Liquidations, in which a company which can’t pay its debts decides to put itself into liquidation.

Business insolvencies rose through 2022 as costs soared, the economy stumbled, and pandemic-related government support ended.

Ed Macnamara, head of restructuring at PwC’s Restructuring and Forensics practice, warns of a ‘domino effect’ as companies struggle to pay their bills:

While the number of company insolvencies in January is down on the month before, any respite is likely to be short-lived. The data, which shows a 7% rise on the year before, serves as a reminder that we are still in the midst of a difficult trading environment with rising interest rates and high inflation which, when combined, generally results in more company failures.

We’re also seeing an uptick in both late payments and the number of requests to extend credit terms. In the construction sector for example, clients have flagged a significant increase in new customer accounts being opened as companies try to spread their credit risk across the market. In addition, many subcontractors are reporting that they’re unable to pay for products because they haven’t been paid either. This domino effect is likely to increase the squeeze on businesses already struggling with their debts and might mean that some are forced into insolvency.

The GMB union has spotted that the number of UK workers on zero hours contracts has hit a record high.

Today’s labour market report shows there were 1,133,441 people employed on a zero hours contract in October to December 2022. That’s up from 1.034m in the final quarter of 2021, and the highest on record.

The GMB says Rishi Sunak is presiding over a ‘tidal wave’ of insecure work.

Younger people (those 16-24), and those in the hospitality industry, are more likely than other workers to be on zero-hours contracts.

Consistent with weaker demand – or at least with higher uncertainty – is that the number of workers on zero hours contracts has risen, to a new record of 1.13 million in the three months to December. The increase has been concentrated among the young, and in hospitality. pic.twitter.com/OfKXGvQktt

— Nye Cominetti (@nyecominetti) February 14, 2023

Gary Smith, GMB general secretary, said:

This government is making history for all the wrong reasons.

Rishi Sunak is presiding over a tidal wave of insecure work and exploitative zero-hours employment is higher than ever.

The economy is stalling and his answer is to launch a bonfire of workers’ rights while other countries get with ending these contracts for good.

Zero-hours contracts are a key part of a broken employment model in sectors from social care to retail. It’s time for a government that will fight for workers’ rights.

The pound has rallied this morning, after this morning’s labour market statistics showed a rise in wages in the last quarter.

Sterling has gained half a cent against the US dollar to $1.219.

The 6.7% rise in regular pay (excluding bonuses) over the last year could potentially spur the Bank of England to raise interest rate again, perhaps from 4% to 4.25% at its next meeting, in March.

“It might be stretching things to say love is in the air when it comes to the stock market, but the FTSE 100 is mounting a Valentine’s Day push toward the 8,000 level,” says AJ Bell investment director Russ Mould.

All eyes will be fixed on Washington later as the US Bureau of Labor Statistics posts inflation numbers for January.

The expectation is for another modest easing of inflationary pressures and anything more than this could provide a real boost to sentiment – though conversely a renewed move higher in the inflation rate could prompt heavy selling.

In the UK record wage growth raised concerns the UK’s own inflation problems might prove stickier than feared ahead of the UK posting its own CPI numbers on Wednesday.

However, the Bank of England will likely be hoping the lagged impact of a series of rate increases is yet to fully come through amid growing expectations a rate hike in March will be the last.

FTSE 100’s strength doesn’t reflect UK economy’s performance

The tailwinds from another decent market performance in the US overnight have given the FTSE 100 another boost this morning, Richard Hunter, head of markets at Interactive Investor, tells us.

He also points out that the FTSE 100 is not a gauge of the UK economy …

The index continues to attract investment interest with its exposure to banks and energy companies still seeing the benefits of rising interest rates and a recovering Chinese economy respectively. At the same time, its proliferation of defensive, and in some cases somewhat inflation-proof stocks, along with an average dividend yield of 3.5% all add to its attractions as a potential investment destination of choice.

Perhaps most importantly, the index is not an accurate barometer of the UK economy. An estimated 75% of company earnings come from overseas which, coupled with the more recent weakness in sterling, means that these earnings become more valuable on repatriation.

These combined factors resulted in a strong outperformance compared to many other global indices last year. In 2022, for example, the main indices in the US plummeted – the Dow Jones was down by 8.8%, the S&P500 by 19.5% and the technology-heavy Nasdaq by 33.1%. The FTSE 100 eked out a gain of 0.9% (excluding dividends) and is now ahead by over 7% in the year to date.

Last week we learned that the UK economy stagnated at the end of 2022, with no growth in the October-December quarter.

The market is not the economy, rather it is a discounting mechanism which aims to anticipate future events, both economic and corporate, Hunter explains:

If inflation and interest rates are peaking, and if company earnings continue to show resilience in the face of the economic challenges to come, the relatively cheap valuation of the index compared to many of its global peers could leave this rally with further to run.

The strength of the FTSE 100 is therefore positive news for investors as well as its constituents, which happened to be based in the UK, as opposed to the performance of the UK economy itself.”

The FTSE 100 is closing in on the 8,000-point mark for the first time.

The index has just climbed to 7,996, an all-time high.

It’s all about today’s inflation data from the US [at 1.30pm UK time], says Neil Wilson of Markets.com.

Core inflation is expected to decline to 5.4% from 5.7%, up +0.4% month on month, with the headline print down to +6.2%. For all the talk of disinflation, price growth remains way too high.

The market is going to realise that a peak inflation is leading to more of a plateau not a sharp march down.

The FTSE 100 pushed up to a fresh record high, nudging closer to the magic 8,000 level, as risk remained bid following a positive start to the week ahead of today’s all-important US inflation data.

European equity markets were broadly higher after Wall Street closed up more than 1% and stocks in Asia were mainly higher.

Ford announces job cuts

Car giant Ford has said it is cutting around 3,800 jobs across Europe, including 1,300 in the UK, over the next three years.

That’s a fifth of its total workforce in the UK, the BBC reports.

The reduction in product development and administration jobs is as part of an overhaul as Ford battles rising costs and pivots its production towards electric vehicles.

Around 2,300 jobs will be cut in Germany, and 200 in the rest of Europe, the company said, adding it intends to achieve the reductions through voluntary separation programmes.

The American carmaker will retain around 3,400 engineers in Europe who will build on core technology provided by their U.S. counterparts and adapt it to European customers, European passenger electric vehicle (EV) chief and head of Ford Germany Martin Sander said on a press call.

Sander added:

There is significantly less work to be done on drivetrains moving out of combustion engines. We are moving into a world with less global platforms where less engineering work is necessary.

This is why we have to make the adjustments.

🚨NEW: Ford to cut 3,800 jobs in Europe🚨

🔧2,800 in engineering

🔧1,000 in admin/back officeCountry split:

🇬🇧1,300

🇩🇪2,300

🇪🇺200Driven by simpler EVs & smaller Ford line-up.

Full story: https://t.co/f7VnTpmauR

— Peter Campbell (@Petercampbell1) February 14, 2023

FTSE 100 hits record high, with 8,000 points in view

In the City, the UK’s blue-chip share index has hit a new record high, as it continues to rally in 2023.

The FTSE 100 index has jumped by 36 points, or 0.45%, to 7986 points – its highest point on record.

The FTSE has now gained 7% so far this year, as markets have been lifted by hope that inflation may have peaked, meaning central banks may slow their interest rate increases.

The index hit its first record high since 2018 at the start of this month.

Traders are hopeful that US inflation fell last month – we get January’s CPI report at 1.30pm UK time.

Mobile operator Vodafone is among the top FTSE 100 risers, up 1.8%. Yesterday, US telecoms group Liberty Global announced it had taken a 5% stake in Vodafone in a bet on the UK company’s revival – but has ruled out making a takeover bid.

The FTSE 100 has started the week on a very positive note, says Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown:

There is a great deal of attention going on US and UK inflation data this week, with hopes that the Federal Reserve is going to stick to the hymn sheet when it comes to the expected 25 basis point increase in interest rates expected in March.

She warns, though, that the UK’s market mood can change “on a dime”:

Although the economy’s holding up well for now, there are still question marks hanging over corporate margins and consumer spending power, which the forward-looking FTSE may not have correctly priced in.

UK real wages should start rising in the second half of this year, predicts Simon French, chief economist at Panmure Gordon, as inflation falls.

Tentative signs that the trend of early retirement – through ill health or choice – may be on the turn in the UK labour market. Those aged 50-64 declaring themselves inactive showing signs of having peaked (albeit still +8.5% from Q1 2020) pic.twitter.com/YenNf3rpMh

— Simon French (@shjfrench) February 14, 2023

Also employment amongst those aged 50+, which hit a clear structural break during the pandemic, also now showing signs of ticking higher. Albeit latent capacity is still v considerable with employment in this age group around 900,000 lower than the pre-CV19 trend pic.twitter.com/ymtRJthWGW

— Simon French (@shjfrench) February 14, 2023

Overall a reasonable UK jobs report with payrolls up 102,000 in January (which tallies neatly with US NFP at 500,000 – given UK labour market about one fifth the size). Real pay declines should give way to real pay growth by H2 as headline inflation falls away fast from July.

— Simon French (@shjfrench) February 14, 2023

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)