[ad_1]

Joules is “latest victim of UK’s retail crisis”

Here’s Victoria Scholar, head of investment at Interactive Investor, on Joules’s plan to appoint administrators and suspend its shares.

It comes after various discussions with investors about an equity raise including Cornerstone Investment and the retailer Next appear to have fallen through.

Last week Joules reported revenue figures for the 11 weeks to 30th October which fell short of analysts’ expectations driven by softer online sales. The fashion brand’s cash crunch is putting around 1,700 jobs at risk with shares now suspended on AIM this morning, pending clarification of the company’s financial position.

Joules appears to be the latest victim of the UK’s retail crisis with the demise of the high street and the cost-of-living crisis. Just last week Made.com entered into administration after the interior design and DIY pandemic boom faded along with its furniture sales.

Joules has been struggling with the squeeze on household budgets after the post-pandemic and war-driven inflation supercharged the cost-of-living, leaving far less money left over for retail spending. Outdoor goods vendor, the Garden Trading Company which is owned by the same parent company is also on the brink of collapse.

The latest UK retail sales figures underscore the difficulty facing shops across Britain, with a 6.9% slump year-on-year in October as retail sales still languish below their pre-covid February 2020 levels.

Key events

Filters BETA

UK house prices fall as mini-budget spooks first-time buyers

Another economic warning light is flashing – in the housing market.

Asking prices for British residential properties are dropping, and first-time buyers are pulling back as the turmoil following the “mini-budget” slows the property market.

Figures from the property platform Rightmove show buyer demand fell 20% in October compared with a year ago, as house-hunters put their property searches on hold in response to soaring borrowing costs and rising economic uncertainty.

Zoe Wood

Older people face a bigger income hit from surging energy costs this winter but younger households are more at risk of being unable to pay their bill or getting into debt amid the cost of living crisis.

As households across Britain turn their heating on, the research by the Resolution Foundation thinktank found that older generations, in particular the over-75s, will spend a bigger share of their income, up from 5% to 8%, on their energy bills.

For those under 50 the proportion is 5%.

From our new report – young people have less of a ‘savings buffer’ to cover unexpected or higher costs, such as higher energy bills this winter. Over two thirds of 20-29-year-olds had savings of less than one month’s income. https://t.co/sB8XrqLjLz pic.twitter.com/E9SPTgkQUw

— Resolution Foundation (@resfoundation) November 14, 2022

But while older households face a bigger increase, it is younger generations, who have endured years of stalled pay growth and high rents, who will struggle most to cope, according to the report.

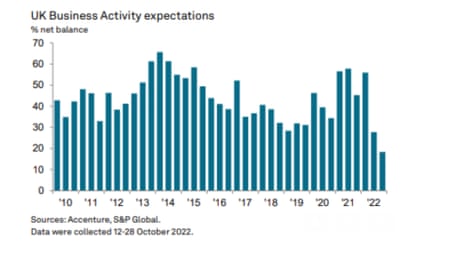

How business confidence has hit 13-year low

Here’s a chart showing how business confidence has sunk to a 13-year low, as firms brace for a lengthy recession.

As flagged in the intro, bosses haven’t been this gloomy since the aftermath of the financial crisis.

The proportion of manufacturing and service sector firms expecting activity to increase over the next 12 months was the lowest since 2009.

Firms expect inflation to remain elevated, while pessimism about profits will lead to cuts in both capital expenditure (capex) and research & development (R&D) spending.

European bosses are even gloomier, according to the latest Accenture / S&P Global UK Business Outlook.

Here’s the key findings from the report:

-

UK headline index has fallen to its lowest of +18% since 2009, but remains stronger than European peers.

-

Employment still expected to rise, though firms lack confidence in finding skilled staff

-

Companies still expect a considerable rise in costs, with 80% of UK businesses forecasting higher wages

-

UK firms project falls in both capex and R&D over the coming 12 months

Advice for Joules consumers

Lisa Webb, consumer rights expert at Which?, has advice for customers of Joules, and its subsidiary The Garden Trading Company:

“The news that Joules is entering administration will be devastating for its employees, as well as a real concern for customers with orders placed – as exercising your rights is not always straightforward in these circumstances.

“When a company is in administration, it may not accept the return of items.

“Many customers may find themselves in a situation where items have not been delivered. It is always worth trying to claim for a refund in these situations, but customers should know it is not guaranteed. The cost of repairs for faulty items could still be claimed if they came with a warranty.

“If you’ve bought something on your credit card costing more than £100, the card provider is jointly responsible for any breaches of contract.

“You can claim under Section 75 of the Consumer Credit Act if the item is faulty or not delivered.

“If you paid for goods that cost less than £100 on a credit or debit card, you may be able to claim under chargeback.”

Elsewhere in UK retail, Frasers Group is reportedly in late-stage talks to seal a deal for Savile Row tailor Gieves & Hawkes.

Sky News has reported that Mike Ashley’s empire is close to sealing the purchase of the 251-year-old Savile Row business after its Hong Kong-based owner fell into administration

The value of the deal is uncertain but will not be material for Frasers, which rejoined the FTSE 100 index this year.

Gieves & Hawkes have been royal tailors since 1809. The Gieves and Hawkes tailoring labels can trace their histories back to 1785 and 1771 respectively, with Giever supplying the British Royal Navy and Hawkes the British Army.

Gieves acquired Hawkes in 1974.

Sky’s Mark Kleinman explains:

Based at 1 Savile Row, the brand has been part of Trinity Group – which is in turn owned by the collapsed Shandong Ruyi Technology Group – since 2012.

Sarah Riding, retail partner at the law firm Gowling WLG, predicts another retailer will move to rescue Joules – but there could still be job losses.

“While the potential job losses are regrettable, it seems that Joules has taken the precautionary steps needed to limit further fallout in terms of further job losses and an erosion in their brand equity.

“Given the surprising acquisitions and strategic partnerships that have been made in the retail space recently, there should be at least some optimism that another industry player will come to the rescue of a brand that still holds resonance with consumers.

While the brand may need to identify supply chain contingencies that deliver more value for money for consumers with lighter pockets, the potential is there for a partner to emerge and help facilitate this.”

Joules is “latest victim of UK’s retail crisis”

Here’s Victoria Scholar, head of investment at Interactive Investor, on Joules’s plan to appoint administrators and suspend its shares.

It comes after various discussions with investors about an equity raise including Cornerstone Investment and the retailer Next appear to have fallen through.

Last week Joules reported revenue figures for the 11 weeks to 30th October which fell short of analysts’ expectations driven by softer online sales. The fashion brand’s cash crunch is putting around 1,700 jobs at risk with shares now suspended on AIM this morning, pending clarification of the company’s financial position.

Joules appears to be the latest victim of the UK’s retail crisis with the demise of the high street and the cost-of-living crisis. Just last week Made.com entered into administration after the interior design and DIY pandemic boom faded along with its furniture sales.

Joules has been struggling with the squeeze on household budgets after the post-pandemic and war-driven inflation supercharged the cost-of-living, leaving far less money left over for retail spending. Outdoor goods vendor, the Garden Trading Company which is owned by the same parent company is also on the brink of collapse.

The latest UK retail sales figures underscore the difficulty facing shops across Britain, with a 6.9% slump year-on-year in October as retail sales still languish below their pre-covid February 2020 levels.

Crumbs – another one bites the dust.

Joules files notice to appoint administrators after financing talks break down.

These are names that you wouldn’t have put on the hit list a few years ago..So who will get it? – Next, Frasers or M&S. Boohoo has its own problems

— Ashley Armstrong (@AArmstrong_says) November 14, 2022

Joules operates about 130 shops, so its collapse would be a blow to UK high streets as well as extremely worrying news for its staff.

Retail analyst Nick Bubb says:

Well, at Friday’s close of c9p, Joules was capitalised at just £10m, so its fall from grace has been alarming (the IPO price in May 2016 was 160p and it peaked at over 300p), but no doubt Next will be poised to pick up the pieces…

Joules had hoped that Next, one of Britain’s biggest clothes retailers, would invest in the company to help with its turnaround. However, a deal could not be reached.

Once Joules has appointed administrators, as it intends to, some of its assets could be bought up by a larger rival.

If Joules goes into administration wouldn’t surprise me if Frasers group swoop in and go online only.

They also have physical presence to maybe make the concession model work.

I feel sorry for the employees and the creditors.

— ThinkInvestGrow📈 (@ThinkInvestGrow) November 14, 2022

Joules shares suspended

Trading in Joules shares have been suspended at the company’s request, ‘pending further clarification of the Company’s financial position’, says the London Stock Exchange.

Joules shares have fallen 93% this year, from around 140p in January to 9p at the end of last week.

Jobs at risk

Over 1,000 jobs are at risk at Joules and the Garden Trading Company, as it prepares to appoint administrators.

The company is also asking for its shares to be suspended.

Sky News reports:

Joules Group, which has around 1,700 staff, revealed it was to file a notice of intention to appoint administrators and had requested the suspension of trading in the company’s shares.

Introduction: Joules intends to appoint administrators after rescue talks fail

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Struggling high street retailer Joules has decided to call in the administrators, becoming the latest UK company to be hit by the cost of living crisis.

The coats and wellies retailer is on the brink of collapse after failing to raise new funding.

Joules told the City this morning that it will file a notice of intention to appoint Interpath Advisory Limited as administrators to the Company, “as soon as reasonably practicable.”

It explains:

“The board is taking this action to protect the interests of its creditors”

Garden Trading, Joules’ furniture and accessories business, will also file for administration.

Joules has suffered from the milder weather this year, as well as the cost of living crisis, whic both hit sales in recent month.

In August it issued a profits warning, blaming the summer heatwave for plunging sales of clothing such as jackets, knitwear and wellington boots.

Last week, Joules revealed it was in talks with its founder, Tom Joule, over a possible cash injection following those poor sales. It had also hoped to agree a bridging loan, to help it keep operating while refinancing talks took place.

But today, it says:

….discussions with various parties have not been successful and have now terminated.

The crisis at Joules follows the collapse of online furniture retailer Made.com last week, which led to 320 redundancies and left customers worried about their orders.

Online mattress retailer Eve Sleep also filed for administration, before being rescued by rival Bensons for Beds.

And there are more warning signs across the economy today, with UK business confidence falling to its lowest level in 13 years, according to data from Accenture and S&P Global.

Firms are cutting back on capital investment plans, while rising inflation is creating tough economic conditions.

Simon Eaves, Market Unit Lead for Accenture in the UK & Ireland, said:

“As we head towards what is likely to be a tough winter for the UK economy, business confidence has understandably been shaken. However, many British companies continue to demonstrate resilience in the face of economic difficulties.

Hiring plans remain positive and overall optimism, whilst muted, is higher than many of our European counterparts.

The agenda

-

10am GMT: Eurozone industrial production for September

-

10am GMT: ECB board member Fabio Panetta speech at a conference on output gap measurement in the Euro area

-

Noon GMT: India’s inflation rate for October

-

3.15pm GMT: Treasury committee hearing into the crypto-asset industry

-

4pm GMT: US consumer inflation expectations for October

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)