Liquid loans is a system that enables you to use your Pulse (PLS), which will be the mother currency of Pulsechain, as collateral to mint a new more Stable coin that will also be native to that chain and called USDL.

During the process, you will bring your PLS coin to a front end DAPP where you will interact with a smart contract on the Pulsechain. This smart contract allows you to use the dollar value of your PLS as collateral to mint your own stable coin, which you remove from the table once the smart contract has been executed.

Then, with no interest to be paid, no deadline to repay, and most importantly, no third party involved, your PLS is locked into a smart contract and waiting for you to return to pay back what you received in USDL at any time in the future.

This indicates that you are not required to sell your PLS and risk losing it if you do so by driving the price down. Utilizing liquid loans allows you to keep the market price high, receive your dollar value in the stable coin USDL, and release your PLS once you have repaid your loan.

You can keep taking value out of your smart contract wallet, known as your “Vault,” in the form of more USDL if you do not want to buy out the PLS that you borrowed against and the collateral, your smart contract has increased in value since you opened it.

Now Uniswap has made it possible to use NFTs against liquid loans

What is a liquid loans sacrifice?

A liquid loans sacrifice is not similar to a stock IPO or a cryptocurrency ICO. Basically, it’s your opportunity to join the project early and for the cheapest possible entry fee. Depending on how much stable coin was sacrificed, the sacrificer will receive points. A higher point value will be awarded to earlier liquid loans sacrificers than to the later ones. Tokens will be distributed at launch according to the points acquired during the sacrifice phase. By delaying gratification for up to 24 months, you can receive up to 2.5 times more tokens than you would have received at otherwise at launch.

The following are the main advantages of Liquid loans:

- 0% interest rate;

- A minimum collateral ratio of just 110 percent;

- No maximum collateral ratio;

- Governance-free;

- Directly redeemable; USDL can always and at any time be redeemed at face value for the underlying collateral.

- Censorship-resistant — There is no owner and the contract is unchangeable.

The stability pool providers, another function of the protocol where providers of USDL into a pool to prop up the system have the option to manually liquidate any vault that has come up as eligible for liquidation after falling below the 110 percent ratio, will liquidate your vault if your vault falls below the minimum threshold collateralization level of 110 percent.

How is liquidation event caused in liquid loans sacrifice?

If your PLS has increased in value and as a result increased your collateralization level and overall value of your Vault, only the original amount of USDL you received is required to be returned in order to unlock that PLS (Note that The borrower has already extracted the dollar value in USDL in the beginning and has lost nothing).

You are also permitted to withdraw any additional funds over and above the original collateralisation as long as you maintain your original level of collateralization.

When will this protocol is expected to be launched?

It is anticipated to launch shortly after Pulsechain main net launch, but the Liquid Loans team advises that the precise launch will be decided upon and monitored as the opening price of PLS coin will have some market volatility and when it would have the potential to cause user liquidation events,

You can read more about liquid loans and liquid loans sacrifice in this white paper

FAQs:

Q: What makes it unique from other stable coin systems

A: Liquid Loans

- Has no counterparty. You are your counterparty.

- It has no admin keys – that means no one can alter how it works, no one can steal the funds, there are no back-doors…

- It’s completely decentralized, Liquid Loans lives on the blockchain, and no one can stop it. It’s always available.

- It has an incentive structure that encourages its users to provide stability (i.e., a virtuous cycle)

Q: What does the native token do?

A: LOAN is the native token of Liquid Loans protocol. The system generates LOAN tokens for incentivizing early adopters which captures the fee revenue generated by the system and distributes it to the stakes of LOAN tokens.

When staked, it earns USDL revenue from borrowers issued stablecoins and earns PLs for redemptions of USDL for PLS. It’s also a speculative instrument that can go up and down in value.

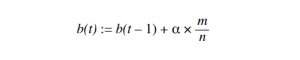

Upon every redemption, the base rate is increased by the proportion of

redeemed USDL and then applied to the current redemption as follows:

where b(t) is the base rate at time t, m the amount of redeemed USDL, n the

current supply of USDL and α constant parameter set to 0.5.

The base rate decays over time due to a decay factor that is applied with every

redemption and issuance of USDL prior to calculating the resulting fee.

Q: Is this a copy of AAVE?

A: This is not a fork of Aave. Aave uses flash loans, and this protocol does not.

Q: When will this protocol launch?

A: It is expected to be ready to launch in production along with the official PulseChain Launch but may hold off for some time to ensure we launch in a stable environment.

Borrowing

Q: How much can I borrow?

A: Your loan must be a minimum of 110% collateralized. That means: If you have $10,000 worth of PLS, you can borrow 10,000/1.10 = 9090.90 USDL or ~90.9% of the PLS value.

Q: Is there a minimum borrowed amount of USDL?

A: Yes, the minimum loan amount is $2000 USDL. No maximum.

Q: Can I take Pulse out from my Vault at any time?

A: Yes, you may remove PLS up to a collateralization ratio of 110%. You may remove any amount of PLS but must remain above 110% collateralization. If you would like to remove all PLS, repayment of the loan in USDL must be made.

Q: I’m using this as a stop loss and using the Stability Pool as a hedge, right?

A: Not exactly. You’re using your loan as your stop loss. I.e., you borrow against your PLS; if the value drops sufficiently, you lose your PLS, but you keep your USDL. So it’s effectively a stop loss. The stability pool is a mechanism, separate from your loan, that helps ensure USDL remains pegged to $1.

Q: Why would I ever pay back the loan if my collateral continues to appreciate?

A: I suppose you wouldn’t, but psychologically some people don’t like to have debt. Some people may just want their PLS back to give as a gift…

Q: Will there be tools to monitor my position?

A: Yes, in fact, you can use the same Dapp where you created your loan to monitor your loan.

Q: Do flash loans pose a problem?

A: Just guessing at the timeframe of your “flash loan,” but I suppose you could program a bot to interact directly with the Liquid Loans Contract, but the system is designed to be accessed by a human through the User Interface.

Q: Can I borrow against HEX?

A: This has been explored but will not be at this time. There is more economic study required to determine if it would benefit the community as a whole.

Q: Will there be a credit/debit card?

A: Similar to the answer above, for HEX. It’s something that’s been explored and not out of the question, but the focus is on the launch of the first product.

Stability Providing

Q: Which token is in the Stability Pool?

A: USDL

Q: Can stability pool depositors withdraw their USDL at any time? Any restrictions on this?

A: The USDL depositors can withdraw their USDL at any point, with one exception: If there is a loan that is under collateralized and needs to be liquidated, the loan must be liquidated first (i.e., someone must run a function to liquidate the Vault). This is a good thing. In essence, it forces the USDL Stability Pool depositor to make money from the liquidation prior to removing their USDL. This is to ensure the system stays in a healthy state.

Q: When I provide Stability, what do I earn?

A: You receive PLS and earn LOAN tokens

- PLS if a loan gets liquidated in return for your USDL

- LOAN tokens for being part of the Stability Pool

The protocol continuously issues LOAN to users who have deposited USDL to the Stability Pool. The system issues LOAN according to a release schedule. The release schedule halves the number of tokens distributed each year, favoring early adopters.

Staking

Q: Will this protocol have a native token?

A: Yes, its native token is the “LOAN” token.

Q: How does this compare to delegating to Pulse validator?

A: In several ways:

- In PulseChain DPOS, you deposit PLS. With our system, you deposit LOAN tokens

- In PulseChain, you earn a portion of transaction fees based on the Validator’s terms and the network load. Within the Liquid Loans system, you stake LOAN tokens and receive USDL and PLS as borrowers take out loans and redemptions occur.

Q: When I Stake LOAN, what do I earn?

A: Within the Liquid Loans system, you stake LOAN tokens and receive USDL and PLS as borrowers take out loans and redemptions occur.

Q: Does the LOAN token have any Pumpamentals?

A: It’s designed to be staked and earn revenues from the protocol. It’s a utility token with utility, so it should go up in value the more successful the LL protocol becomes.

Q: Is there Metamask browser support?

A: Yes and most likely web3 as well.

Q: Farming?

A: You can farm in multiple ways:

- You can deposit USDL into a stability pool and earn a fee

- You can stake LOAN tokens and earn

- You can provide liquidity for USDL or LOAN in a DEX liquidity pool

Difference between other lending protocols

A: How is this trustless? Not your keys, not your coins. It’s just you and the smart contract. You deposit PLS and mint USDL. You pay off your loan and receive your PLS.