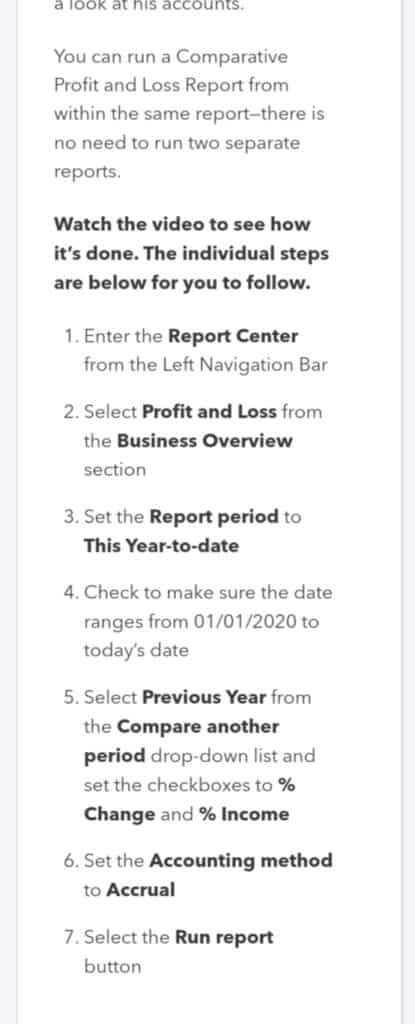

You can run a Comparative

Profit and Loss Report from

within the same report-there is

no need to run two separate

reports.

The individual steps

are below for you to follow.

- Enter the Report Center

from the Left Navigation Bar - Select Profit and Loss from

the Business Overview

section - Set the Report period to

This Year-to-date - Check to make sure the date

ranges from 01/01/2020 to

today’s date - Select Previous Year from

the Compare another

period drop-down list and

set the checkboxes to %

Change and % Income - Set the Accounting method

to Accrual - Select the Run report

button

As part of your analysis of the Profit and Loss Report, you will

want to run through some top-level questions with your client.

You’re looking for discrepancies or things that look out of place,

such as:

Income:

Does their total income look about right?

Which income streams brought in more revenue?

Is all their income categorized?

Expenses:

Are there any expense items in Ask My Accountant?

Point out expenses that were different from prior periods and

ask why

Review key areas like revenue, gross profit, and net profit

Let’s takea look at how the conversation between you and Dan

might go.

The key metrics to consider when analyzing the Profit and Loss

Report are:

.This year to date

.01/01/2020

To [date automatically sets as today]

Compare another period: Previous Year

Check % change

Check % of income

Accounting method: Accrual

You’ll see that some transactions will need reclassifying. We’ll

take a look at that in more detail in a future module.