[ad_1]

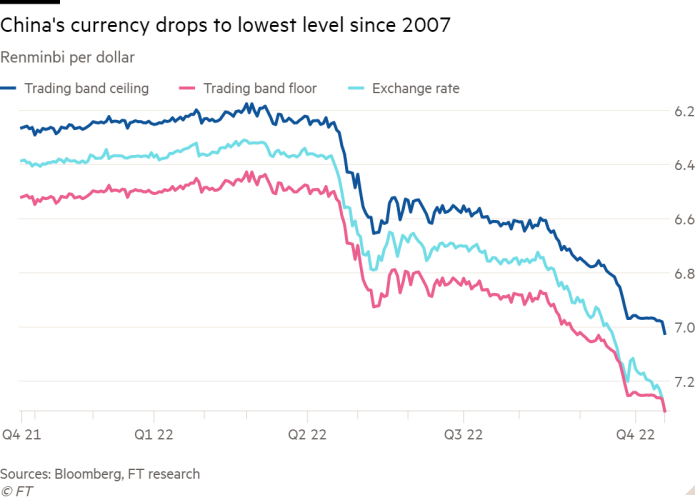

China’s renminbi has hit its weakest level against the dollar since 2007 as concerns over President Xi Jinping’s appointment of a harder line leadership team and a struggling economy spread from equities to currency markets.

The renminbi, already hit this year by a widening interest rate differential with the US, fell as much as 0.6 per cent on Tuesday to Rmb7.3084 per dollar. The fall came after the People’s Bank of China moved the midpoint of the currency’s trading band to the lowest level since the global financial crisis.

China’s currency has lost 13 per cent of its value in the year to date. Tuesday’s decline followed a global sell-off of Chinese equities this week, with the Hang Seng China Enterprises index losing more than 7 per cent on Monday and the Nasdaq Golden Dragons index of large technology stocks trading in New York dropping more than 14 per cent.

The sell-off follows the Chinese Communist party congress in Beijing last week in which Xi unsettled global investors by stacking the ranks of China’s senior leadership with loyalists focused more on national security and strict zero-Covid-19 policies than on economic growth or supporting markets.

“Something had to give,” said Sean Callow, senior currency strategist at Westpac, of the central bank’s decision to set the trading band markedly lower on Tuesday after keeping it steady during the party congress.

“The PBoC had been defying reality for about three weeks in terms of the trading band’s midpoint,” Callow said.

He added that the renminbi exchange rate was touching the weak end of the trading band by the close of trading on Monday, meaning that unless the central bank was willing to intervene in markets directly, “the best option they had was to set a more realistic midpoint”.

Markets in mainland China also face sustained selling pressure from foreign financial institutions, which have reversed almost all of their net purchases of Shanghai- and Shenzhen-listed stocks this year.

Financial Times calculations show that offshore investors using Hong Kong’s Stock Connect program have sold more than Rmb52bn ($7.1bn) worth of mainland stocks this month, leaving just Rmb1.6bn in net purchases for 2022.

Shares in Hong Kong pared losses slightly on Tuesday, with the Hang Seng China Enterprises index up about 1 per cent. However, a trader with one Chinese brokerage in the city said trading volumes were far lower compared with the sell-off on Monday and that buy orders were “devoid of global long-only investors”.

China’s benchmark CSI 300 index of Shanghai- and Shenzhen-listed stocks edged down another 0.1 per cent on Tuesday, taking losses to 3 per cent for the week.

Separately on Tuesday, the PBoC and China’s foreign exchange regulator raised the upper limit on cross-border financing for Chinese companies, encouraging corporates to borrow more offshore in a move that could boost foreign capital inflows and take pressure off the renminbi.

However, analysts said it was unclear how much the change to China’s so-called macroprudential adjustment parameter would affect the renminbi’s exchange rate.

Wang Zhiyi, an analyst at the Shanghai-based Cross-border Finance Research Institute, said markets would have to “wait and see for the real impact of the adjustment”.

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)