[ad_1]

Rishi Sunak says no extra help for homeowners struggling with their mortgage

Prime minister Rishi Sunak has ruled out providing any extra help for households who are struggling with mortgage payments.

Speaking on ITV’s Good Morning Britain, the prime minister declined to back extra support for mortgage holders, despite concerns that millions of households facing a dramatic rise in borrowing costs as they remortgages their home loans in coming months.

Instead, he said the government needs to “stick to the plan”, and that his top priority remains bringing inflation down.

Sunak said:

“I know the anxiety people will have about the mortgage rates, that is why the first priority I set out at the beginning of the year was to halve inflation because that is the best and most important way that we can keep costs and interest rates down for people.

“We’ve got a clear plan to do that, it is delivering, we need to stick to the plan.

“But there is also support available for people. We have the mortgage guarantee scheme for first-time buyers and we have the support for mortgage interest scheme which is there to help people as well.

“But look, that is why my first priority is to halve inflation, one of my other priorities is to cut the waiting lists.”

On Friday, the Liberal Democrats called for a £3bn mortgage protection fund to be set up to offer help to families at risk of losing their homes, as fears of a jump in repossessions rose.

Mortgage experts fear the average rate on a two-year fixed-term mortgage could hit 6% today, having climbed to 5.98% at the end of last week.

But Sunak’s comments do square with the reports last night that Treasury insiders insisted that taxpayers will not bail out mortgage holders, as such state intervention would be the “most dangerous thing a government could do”.

Key events

Housing market analyst Neal Hudson of consultancy BuiltPlace shows in this tweet how mortgage holders in the South East are more vulnerable to rising mortgage rates:

It’s borrowers with higher loan-to-income ratios that will see their mortgage repayments rise most thanks to higher rates.

This map shows the proportion of mortgaged house purchases that were over 4x income in 2021 by postcode area: pic.twitter.com/IbdZ4Gn3zP— Neal Hudson (@resi_analyst) June 17, 2023

And here’s Jon Boys, economist at the CPID (Chartered Institute of Personnel and Development) on the generational impact:

I’ve been thinking about the housing crisis, rents rising and higher interest rates feeding into mortgages. Who will be hit? It’s the kids of course. 91% of under 16s live in mortgaged or rented accommodation compared to 27% of over 65s (72% of whom own outright). pic.twitter.com/vLCbvuUWUn

— jonathanboys (@JonathanBoys) June 16, 2023

Rishi Sunak says no extra help for homeowners struggling with their mortgage

Prime minister Rishi Sunak has ruled out providing any extra help for households who are struggling with mortgage payments.

Speaking on ITV’s Good Morning Britain, the prime minister declined to back extra support for mortgage holders, despite concerns that millions of households facing a dramatic rise in borrowing costs as they remortgages their home loans in coming months.

Instead, he said the government needs to “stick to the plan”, and that his top priority remains bringing inflation down.

Sunak said:

“I know the anxiety people will have about the mortgage rates, that is why the first priority I set out at the beginning of the year was to halve inflation because that is the best and most important way that we can keep costs and interest rates down for people.

“We’ve got a clear plan to do that, it is delivering, we need to stick to the plan.

“But there is also support available for people. We have the mortgage guarantee scheme for first-time buyers and we have the support for mortgage interest scheme which is there to help people as well.

“But look, that is why my first priority is to halve inflation, one of my other priorities is to cut the waiting lists.”

On Friday, the Liberal Democrats called for a £3bn mortgage protection fund to be set up to offer help to families at risk of losing their homes, as fears of a jump in repossessions rose.

Mortgage experts fear the average rate on a two-year fixed-term mortgage could hit 6% today, having climbed to 5.98% at the end of last week.

But Sunak’s comments do square with the reports last night that Treasury insiders insisted that taxpayers will not bail out mortgage holders, as such state intervention would be the “most dangerous thing a government could do”.

House prices: What the estate agents say

Rightmove’s survey covers asking prices, not the actual amount which buyers agree to pay for a home.

Jeremy Leaf, north London estate agent, reports that sale prices are ‘softening’, saying:

‘As expected, recent mortgage market turbulence is dampening the increase in prices and activity which we would usually see at this time of year.

‘However, these are, of course, only aspirational not achieved values. On the street, prices are softening as cash and equity-rich buyers in particular continue to hold sway over those relying on increasingly hard-to-obtain loans.

‘Negative publicity is helping lower expectations and encourage more seller realism.’

Tom Bill, head of UK residential research at Knight Frank, says sentiment has ‘taken a hit” in the past few weeks:

“Recent rate volatility hasn’t yet had a material impact on housing market activity because, if anything, those holding mortgage offers are keen to move sooner rather than later. That said, sentiment has taken a hit in recent weeks, which will keep a lid on trading volumes later this year.

Ironically, strong wage inflation rather than the mini-Budget is now the main brake on the housing market although the outlook will only become clearer this week. Those buying, selling or re-mortgaging will hope the Bank of England isn’t faced with a second ugly underlying inflation reading on Wednesday.”

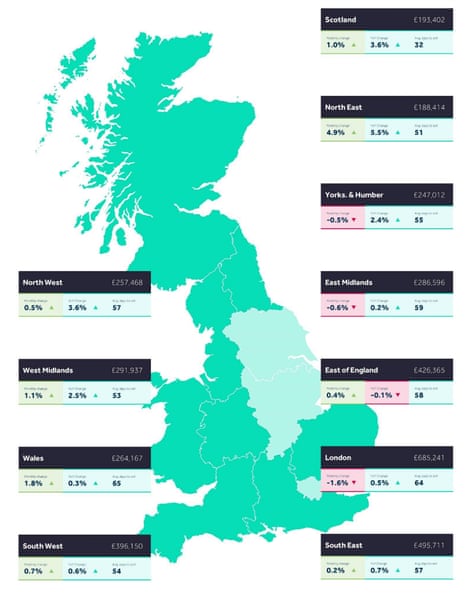

Rightmove’s monthly house price report also shows regional differences in the markets

In London, average asking prices fell by 1.6% in the month, while they dropped 0.6% in the East Midlands and by 0.5% in Yorkshire and the Humber region.

But average asking prices rose 4.9% in the North East, followed by a 1.8% gain in Wales.

Victoria Scholar, head of investment at interactive investor, says:

“Rightmove’s UK asking prices dropped for the first time since 2017 but only by £82 on average. Versus last year, house prices in June rose by 1.1% to an average of £372,812. There are significant regional differences; the North East saw average property prices increase by 4.9% to £188,414 whereas London prices fell by 1.6% to £685,241.

The housing market tends to get a seasonal boost around this time of year, and consumer confidence has been picking up. However the market is still grappling with rising interest rates, falling real wages, sluggish economic growth and volatility in the mortgage market.

This week the Bank of England is expected to raise interest rates again by 25 basis points while the latest UK inflation figures [on Wednesday] are expected to point to price pressures which are easing but remain sharply above target.

Introduction: Surging mortgage rates bring early summer slowdown

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Rising mortgage rates are cooling the UK housing market, bringing forward the usual summer slowdown in the housing market.

Asking prices for British homes fell in June for the first time in six years, property website Rightmove reports this morning.

Rightmove’s latest data shows that average new asking prices dipped, slightly, this month for the first time this year. It suggests that some sellers are pricing their properties a little more competitively, as higher borrowing costs dampen the market.

Average new seller asking prices slipped by £82 this month to £372,812. This is the first monthly drop in new asking prices this year, and the first at this time of year since 2017, Rightmove reports.

The number of sales being agreed has dropped marginally, and in the last two weeks is 6% behind the same period in 2019; twice as fast as the 3% drop recorded in May.

Stubborn inflation & rate rises cause summer mkt slowdown to come early.

In June 23 AVG ASKING prices dropped by £82 to £372,812. The first of many potential falls this year. Despite this activity is 6% higher than in a 2019 mkt but sales lag 6% behind @rightmove pic.twitter.com/oxPBHuCdzj— Emma Fildes (@emmafildes) June 19, 2023

On average, over the previous ten years prices have risen by 0.6% at this time of year. Rightmove suggests that constraints on buyer affordability due to higher borrowing costs, and “more pricing realism from new sellers” have brought forward the usual summer slowdown.

Tim Bannister of Rightmove explains:

Average new seller asking prices, the first and leading indicator of new trends in the market, have dropped slightly this month, signalling that the belated spring price bounce has quickly turned into an earlier than usual summer slowdown.

We expect asking prices to edge down during the second half of the year which is the normal seasonal pattern, and while we sometimes re-forecast our expectations for annual price changes at this time, current trends suggest that our original forecast of a 2% annual drop in asking prices at the end of 2023 is still valid.

The squeeze on borrowers is expected to worsen this week, with the Bank of England expected to raise interest rates on Thursday from 4.5% to 4.75%.

One Conservative MP warned last weekend that Britain is heading for a “mortgage catastrophe”, due to the surge in borrowing costs this year.

Lucy Allan, the Tory MP for Telford, said:

“I don’t think we have quite understood the interest rate catastrophe.

People [are] telling me their monthly mortgage payment is exceeding their salary. That is unsustainable.

“Constituents do ask about ‘support for unaffordable mortgages’. I say ‘talk to your lender,’ but the reality is they need to sell sooner rather than later and that’s a hard message to hear.”

Allies of chancellor Jeremy Hunt have ruled out giving any direct fiscal support to households struggling with soaring mortgage costs.

Hunt, according to Treasury sources, has concluded that such an intervention would drive up government borrowing and fuel inflationary pressure, leading to even higher interest rates.

More than a quarter of UK homeowners on a fixed-rate mortgage are heading for sharp increase in monthly payments before the next election.

Figures shared with the Guardian by UK Finance, the banking industry trade body, show more than 2.4m fixed-rate homeowner deals will expire between now and the end of 2024.

According to the Resolution Foundation, total annual mortgage repayments are now on course to rise by £15.8 billion by 2026, as households move onto new, higher fixed-rate deals.

That means an extra £2,900 cost for the average household re-mortgaging next year.

The agenda

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)