[ad_1]

The S&P 500 (SP500) on Friday slumped to its worst weekly performance since late September, slipping 3.37% to end at 3,934.38 points. The benchmark index posted losses in four out of five sessions.

In a week in which the Federal Reserve was in a quiet period ahead of its policy meeting, market participants focused on mixed economic data which sparked concerns that the central bank would have to stick with tighter policy for longer. Gloomy economic outlooks from major banks and research firms along with recession forecasts from top CEOs also weighed on sentiment.

Investors are now looking ahead to a hotly anticipated meeting of the Fed’s monetary policy committee – its last one of this year – which is set to kick off on Tuesday. Chief Jerome Powell’s comments might or might not spur a year-end rally, or what many are calling a “Santa rally”.

“At the conclusion of next week’s FOMC meeting we and the consensus expect that the Committee will raise the target range for the funds rate by 50bp to 4.25-4.5%,” JPMorgan’s Michael Feroli said in a preview note.

“The phrase ‘ongoing increases’ in the interest rate guidance may need to be adjusted, but we expect this will be done with offsetting hawkish revisions. Given Chair Powell’s preference for well-orchestrated meetings we don’t think these expectations are too contingent on next Tuesday’s November CPI report,” Feroli added.

According to the CME FedWatch tool, markets are pricing in a 77% probability of a 50 basis point rate hike next week.

On the economic front, the November ISM services PMI index, a key gauge of strength in the services sector, ticked unexpectedly higher. October factory orders also climbed past estimates, while labor productivity rose more-than-expected. The positive data was seen to potentially encourage the Fed to keep rates elevated. Moreover, inflation remained stubbornly high, with headline and core producer price inflation coming in hotter-than-expected.

In contrast, the labor market seemed to show some hints of cooling, with continuing jobless claims surging past the consensus. The University of Michigan’s reading on consumer sentiment was better-than-anticipated, while short-term inflation expectations improved.

The SPDR S&P 500 Trust ETF (NYSEARCA:SPY) on Friday retreated 3.35% for the week alongside the benchmark index. The ETF is -17.20% YTD.

For the week, the S&P 500’s (SP500) constituent sectors were a sea of red, with all 11 ending in negative territory. Energy was the top loser, as oil (CL1:COM) slumped on supply concerns after an outage at a key North American pipeline. Defensive sectors Utilities, Health Care and Consumer Staples fell the least. See below a breakdown of the weekly performance of the sectors as well as the performance of their accompanying SPDR Select Sector ETFs from Dec. 2 close to Dec. 9 close:

#1: Utilities -0.32%, and the Utilities Select Sector SPDR ETF (XLU) -0.28%.

#2: Health Care -1.29%, and the Health Care Select Sector SPDR ETF (XLV) -1.29%.

#3: Consumer Staples -1.83%, and the Consumer Staples Select Sector SPDR ETF (XLP) -1.68%.

#4: Real Estate -1.85%, and the Real Estate Select Sector SPDR ETF (XLRE) -1.72%.

#5: Industrials -3.20%, and the Industrial Select Sector SPDR ETF (XLI) -3.19%.

#6: Materials -3.33%, and the Materials Select Sector SPDR ETF (XLB) -3.32%.

#7: Information Technology -3.34%, and the Technology Select Sector SPDR ETF (XLK) -3.29%.

#8: Financials -3.90%, and the Financial Select Sector SPDR ETF (XLF) -3.90%.

#9: Consumer Discretionary -4.48%, and the Consumer Discretionary Select Sector SPDR ETF (XLY) -4.47%.

#10: Communication Services -5.39%, and the Communication Services Select Sector SPDR Fund (XLC) -4.81%.

#11: Energy -8.40%, and the Energy Select Sector SPDR ETF (XLE) -8.45%.

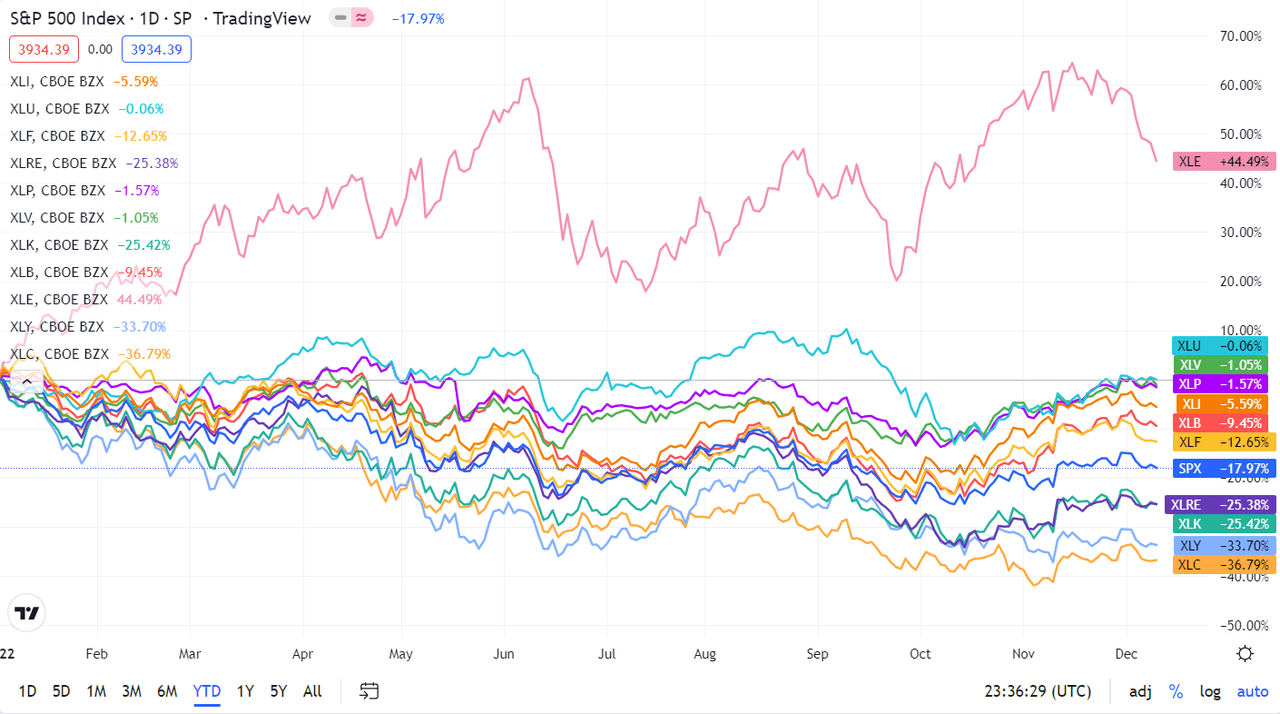

Below is a chart of the 11 sectors’ YTD performance and how they fared against the S&P 500. For investors looking into the future of what’s happening, take a look at the Seeking Alpha Catalyst Watch to see next week’s breakdown of actionable events that stand out.

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)