[ad_1]

Mortgage Q&A: “What is a lender credit?”

If you’ve been shopping mortgage rates, whether for a new home purchase or a refinance, you’ve likely come across the term “lender credit.”

These optional credits can be used to offset your closing costs. But they will bump up your interest rate in the process.

Let’s learn more about how they work and if it makes sense to take advantage of them.

Jump to lender credit topics:

– How a Lender Credit Works

– What Can a Lender Credit Be Used For?

– Lender Credit Limitations

– Borrower-Paid vs. Lender-Paid Compensation?

– Lender Credit Example

– A Lender Credit Will Raise Your Mortgage Rate

– Does a Lender Credit Need to Be Paid Back?

– How to See If You’re Getting a Lender Credit

– Is a Lender Credit a Good Deal?

– Lender Credit Pros and Cons

How a Lender Credit Works

- Mortgage lenders know you don’t want to pay any fees to get a home loan

- So they offer “credits” that offset the customary closing costs associated with a mortgage

- Credits can be applied to things like title insurance, appraisal fees, and so on

- You don’t pay those costs out-of-pocket, but wind up with a higher mortgage rate

Everyone wants something for free, whether it’s a sandwich or a mortgage.

Unfortunately, both cost money, and one way or another you’re going to have to pay the price as the consumer.

When you take out a mortgage, there are lots of costs involved. You have to pay for things like title insurance, escrow fees, appraisal fees, credit reports, taxes, insurance, and so on.

Lenders understand this, which is why they offer credits to cover many of these costs. This reduces your burden and makes their offer appear a lot more attractive.

However, when you select a mortgage that offers a credit, your interest rate will be higher to absorb those obligatory costs.

Simply put, you pay less money upfront to get your loan, but more over time via a higher rate/payment.

What Can a Lender Credit Be Used For?

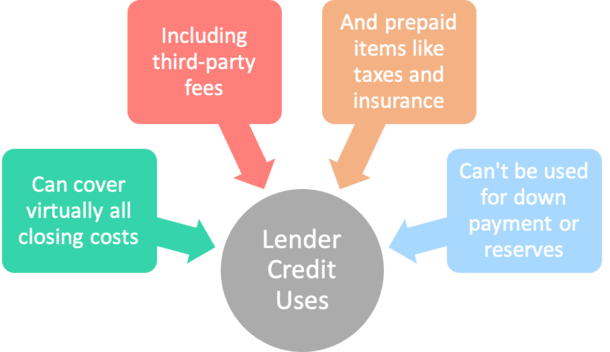

- You can use a lender credit to pay virtually all closing costs

- Including third-party fees such as title insurance and escrow fees

- Along with prepaid items like property taxes and homeowners insurance

- It may allow you to get a mortgage with no out-of-pocket expenses

When you purchase a home or refinance an existing mortgage, lots of hands touch your loan. As such, you’ll be hit with this fee and that fee.

You need to pay title insurance companies, escrow companies, couriers, notaries, appraisers, and on and on.

In fact, closing costs alone, not including down payment, could amount to tens of thousands of dollars or more.

To eliminate all or some of these fees, a lender credit can be used to cover common third-party fees such as a home appraisal and title insurance.

It can also be used to pay prepaid items including homeowner’s insurance and property taxes.

But remember, while you don’t have to pay these fees at closing, they are still paid by you. Just over time as opposed to at closing out-of-pocket.

Lender Credit Limitations

- A lender credit can’t be used toward down payment on a home purchase

- Nor can it be used for reserves or minimum borrower contribution

- But the credit may reduce the total cash to close

- Making it easier to come up with funds needed for down payment

While a lender credit can greatly reduce or eliminate all of your closing costs when refinancing, the same may not be true when it involves a home purchase.

Why? Because a lender credit can’t be used for the down payment. Nor can it be used for reserves or to satisfy minimum borrower contribution requirements.

So if you’re buying a home, you’ll still need to provide the down payment with your own funds or via gift funds if acceptable.

The good news is the lender credit should still reduce your total closing costs.

If you owed $10,000 in closing costs plus a $25,000 down payment, you’d maybe only need to come up with $25,000 total, as opposed to $35,000.

Indirectly, the lender credit can make it easier to come up with the down payment since it can cover all those third-party fees and prepaid items like taxes and insurance.

This frees up the cash for the down payment that might otherwise go elsewhere.

It can also make things a little more manageable if you have more money in your pocket as you juggle two housing payments, pay movers, buy furniture, and so on.

Lastly, note that if the lender credit exceeds closing costs. Any excess may be left on the table.

So choose an appropriate lender credit amount that doesn’t increase your interest rate unnecessarily.

If money is left over, it may be possible to use it to lower the outstanding loan balance via a principal curtailment.

Borrower-Paid vs. Lender-Paid Compensation?

- First determine the type of compensation you’re paying the originator

- Which will be either borrower-paid (your own pocket) or lender-paid (higher mortgage rate)

- Then check your paperwork to see if a lender credit is being applied

- This can cover some or all of your mortgage closing costs

But wait, there’s more! Back before the mortgage crisis reared its ugly head, it was quite common for loan officers and mortgage brokers to get paid twice for originating a single home loan.

They could charge the borrower directly, via out-of-pocket mortgage points. And also receive compensation from the issuing mortgage lender via yield spread premium.

Clearly this didn’t sit well with financial regulators. So in light of this perceived injustice to borrowers, changes were made that limit a loan originator to just one form of compensation.

Nowadays, commissioned loan originators must choose either borrower or lender compensation (it cannot be split).

Many opt for lender compensation to keep a borrower’s out-of-pocket costs low.

Lender-Paid Compensation Will Also Increase Your Mortgage Rate

With lender-paid compensation, the bank essentially provides a loan originator with “X” percent of the loan amount as their commission.

This way they don’t have to charge the borrower directly, something that might turn off the customer, or simply be unaffordable.

So a loan officer or mortgage broker may receive 1.5% of the loan amount from the lender for originating the loan.

On a $500,000 loan, we’re talking $7,500 in commission, not too shabby, right? However, in doing so, they’re sticking the borrower with a higher mortgage rate.

While the commission isn’t paid directly by the borrower, it is absorbed monthly for the life of the loan via a higher mortgage payment.

Simply put, a mortgage with lender-paid compensation will come with a higher-than-market interest rate, all else being equal.

On top of this, the lender can also offer a credit for closing costs, which again, isn’t paid by the borrower out-of-pocket when the loan funds.

Unfortunately, it too will increase the interest rate the homeowner ultimately receives.

The good news is the borrower might not have to pay any settlement costs at closing, helpful if they happen to be cash poor.

This is the tradeoff of a lender credit. It’s not free money. In reality, it’s more of a save today, pay tomorrow situation.

An Example of a Lender Credit

Loan type: 30-year fixed

Par rate: 3.5% (where you pay all closing costs out of pocket)

Rate with lender-paid compensation: 3.75%

Rate with lender-paid compensation and a lender credit: 4%

Let’s pretend the loan amount is $500,000 and the par rate is 3.5% with $11,500 in closing costs.

You don’t want to pay all that money at closing, who does? Fortunately, you’re presented with two other options, including a rate of 3.75% and a rate of 4%.

The monthly principal and interest payment (and closing costs) look like the following based on the various interest rates presented:

- $2,245.22 at 3.5% ($11,500 in closing costs)

- $2,315.58 at 3.75% ($4,000 in closing costs)

- $2,387.08 at 4% ($0 in closing costs)

As you can see, by electing to pay nothing at closing, you’ll pay more each month you hold the loan because your mortgage rate will be higher.

A borrower who selects the 4% interest rate with the lender credit will pay $2,387.08 per month and pay no closing costs.

That’s about $72 more per month than the borrower with the 3.75% rate who pays $4,000 in closing costs.

And roughly $142 more than the borrower who takes the 3.5% rate and pays $11,500 at closing.

So the longer you keep the loan, the more you pay with the higher rate. Over time, you could wind up paying more than you would have had you just paid these costs upfront.

But if you only keep the loan for a short period of time, it could actually be advantageous to take the higher interest rate and lender credit.

Alternatively, you could shop around until you find the best of both worlds, a low interest rate and limited/no fees.

A Lender Credit Will Raise Your Mortgage Rate

- While a lender credit can be helpful if you’re cash poor

- By reducing or eliminating all out-of-pocket closing costs

- It will increase your mortgage interest rate as a result

- You still pay those costs, just indirectly over the life of the loan as opposed to upfront

In the scenario above, the borrower qualifies for a par mortgage rate of 3.5%.

However, they are offered a rate of 4%, which allows the loan originator to get paid for their work on the loan. It also provides the borrower with a credit toward their closing costs.

The loan originator’s lender-paid compensation may have pushed the interest rate up to 3.75%, but there are still closing costs to consider.

If the borrower elects to use a lender credit to cover those costs, it may bump the interest rate up another quarter percent to 4%. But this allows them to refinance for “free.” It’s known as a no closing cost loan.

In other words, the lender increases the interest rate twice. Once to pay out a commission, and a second time to cover closing costs.

While the interest rate is higher, the borrower doesn’t have to worry about paying the lender for taking out the loan. Nor do they need to part with any money for things like the appraisal, title insurance, and so on.

Does a Lender Credit Need to Be Paid Back?

- The simple answer is no, it doesn’t need to be paid back

- Because it’s not free to begin with (it raises your mortgage rate!)

- Your lender isn’t giving anything away, they’re simply saving you money upfront on closing costs

- But that translates into a higher monthly payment for as long as you hold the loan

No. As the name implies, it’s a credit that you’re given in exchange for a slightly higher mortgage rate.

So to that end, it’s not actually free to begin with and you don’t owe the lender anything. You do in fact pay for it, just over time as opposed to upfront.

Remember, you’ll wind up with a larger mortgage payment that must be paid each month you hold your loan.

As shown in the example above, the credit allows a borrower to save on closing costs today, but their monthly payment is higher as a result.

This is how it’s paid back, though if you don’t hold your loan for very long, perhaps due to a quick refinance or sale, you won’t pay back much of the credit via the higher interest expense.

Conversely, someone who takes a credit and keeps their mortgage for a decade or longer may pay more than what they initially saved at the closing table.

Either way, you indirectly pay for any credit taken because your mortgage rate will be higher. This means the lender isn’t really doing you any favors, or providing a free lunch.

They’re simply structuring the loan where more is paid over time as opposed to at closing, which can be advantageous, especially for a cash-strapped borrower.

Check Your Loan Estimate Form for a Lender Credit

- Analyze your LE form when shopping your home loan

- Take note of the total closing costs involved

- Ask if a lender credit is being applied to your loan

- If so, determine how much it reduces your out-of-pocket expenses to see if it’s worth it

On the Loan Estimate (LE), you should see a line detailing the lender credit that says, “this credit reduces your settlement charges.”

It’s a shame it doesn’t also say that it “increases your rate.” But what can you do…

Check the dollar amount of the credit to determine how much it’s doing to offset your loan costs.

You can ask your loan officer or broker what the mortgage rate would look like without the credit in place to compare. Or compare various different credit amounts.

As noted, the clear benefit is to avoid out-of-pocket expenses. This is important if a borrower doesn’t have a lot of extra cash on hand, or simply doesn’t want to spend it on refinancing their mortgage.

It also makes sense if the interest rate is pretty similar to one where the borrower must pay both the closing costs and commission.

For instance, there may be a situation where the mortgage rate is 3.5% with the borrower paying all closing costs and commission. And 3.75% with all fees paid thanks to the lender credit.

That’s a relatively small difference in rate. And the upfront closing costs for taking on the slightly lower rate likely wouldn’t be recouped for many years.

The Larger the Loan Amount, the Larger the Credit

It should be noted that the larger the loan amount, the larger the credit. And vice versa, seeing that it’s represented as a percentage of the loan amount.

So borrowers with small loans might find that a credit doesn’t go very far. Or that it takes quite a large credit to offset closing costs.

Meanwhile, someone with a large loan might be able to eliminate all closing costs with a relatively small credit (percentage-wise).

In the case of borrower-paid compensation, the borrower pays the loan originator’s commission instead of the lender.

The benefit here is that the borrower can secure the lowest possible interest rate, but it means they pay out-of-pocket to obtain it.

They can still offset some (or all) of their closing costs with a lender credit, but that too will come with a higher interest rate. However, the credit can’t be used to cover loan originator compensation.

If you go with borrower-paid compensation and don’t want to pay for it out-of-pocket, there are options.

You can use seller contributions to cover their commission (since it’s your money) and a lender credit for other closing costs.

[Are mortgage rates negotiable?]

Which Is the Better Deal? Lender Credit or Lower Rate?

- Compare paying closing costs out-of-pocket with a lower interest rate

- Versus paying less upfront but getting saddled with a higher interest rate

- If you take the time to shop around with different lenders

- You might be able to get a low interest rate with a lender credit!

There are a lot of possibilities, so take the time to see if borrower-paid compensation will save you some money over lender-paid compensation, with various credits factored in.

Generally, if you plan to stay in the home (and with the mortgage) for a long period of time, it’s okay to pay for your closing costs out-of-pocket. And even pay for a lower rate via discount points.

You could save a ton in interest long-term by going with a lower rate if you hold onto your mortgage for decades.

But if you plan to move/sell or refinance in a relatively short period of time, a loan with a lender credit may be the best deal.

For instance, if you take out an adjustable-rate mortgage and doubt you’ll keep it past its first adjustment date, a credit for closing costs might be an obvious winner.

You won’t have to pay much (if anything) for taking out the loan. And you’ll only be stuck with a slightly higher interest rate and mortgage payment temporarily.

As a rule of thumb, those looking to aggressively pay down their mortgage will not want to use a lender credit, while those who want to keep more cash on hand should consider one.

There will be cases when a loan with the credit is the better deal, and vice versa. But if you take the time to shop around, you should be able to find a competitive rate with a lender credit!

Lender Credit Pros and Cons

Now let’s briefly sum up the benefits and downsides of a lender credit.

Benefits

- Can avoid paying closing costs (both lender fees and third-party fees)

- Less cash to close needed (frees up cash for other expenses)

- May only increase your mortgage rate slightly

- Can save money if you don’t keep your mortgage very long

Downsides

- A lender credit will increase your mortgage rate

- You’ll have a higher monthly mortgage payment

- Could pay a lot more for the lack of closing costs over time (via more interest)

- Loan may be less affordable/more difficult to qualify for at higher interest rate

Read more: What mortgage rate should I expect?

[ad_2]

Source link