[ad_1]

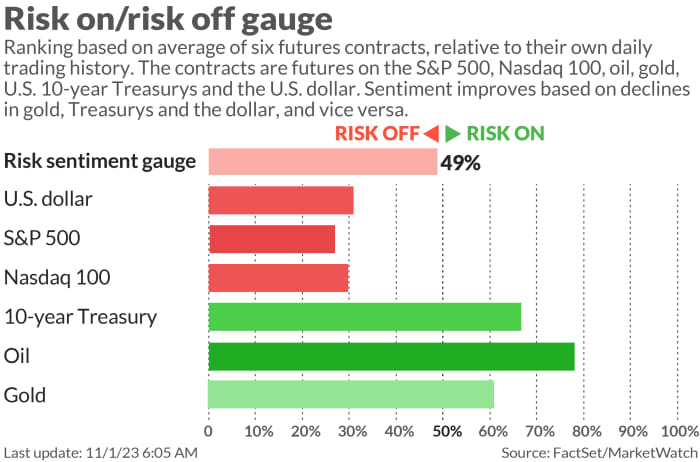

Welcome to the historically decent stock month of November, which follows the longest monthly losing streak (three months) for the three major indexes. It kicks off with a Fed meeting and perhaps more important, the Treasurys breakdown of debt issuance.

Our call of the day switches gears to discuss investing in potentially lucrative megatrends in an interview with Aspen Funds’ co-founder and chief financial officer Bob Fraser. The 10-year old firm with $300 million in assets under management, operates like a hedge fund, doing private investments for high net worth individuals.

Fraser has been pounding the table since June 2022 about over-hyped recession fears, a call that has thus far proved right, and inflation that would be higher for longer. The first megatrend zeroes in on playing the no-recession megatrend.

“The number one way to play no recession is to get your cash to work,” he said. And he suggests investors look at inflation beaters, via “stocks with the ability to pass price increases on the consumer and with fixed costs,” Fraser told MarketWatch in an interview.

“Or even better is real estate because real estate is priced on net operating income and thus goes up with inflation,” he said. Investors could buy a home for Airbnb use, or just buy that house they’ve been holding off on, put money in a real-estate investment trust (REIT), or participate in a private fund like Aspen’s.

Onto the next megatrend — neighborhood strip malls. That focuses on a big demographic shift from cities to suburbs as more people work from home and shop nearby at those strip centers.

“In good locations there are almost no vacancies, rents have been increasing and they haven’t built any new ones in about 15 years,” he said. “They’re full and we’re paying half of the replacement cost which is a recipe for making money over time…Add in some expenses and leverage with a little debt, and investors can get 14-18% total returns with 9-11% of that as cash flow.”

How to invest? Aspen packages strip centers into an LLC, giving investors ownership and tax benefits, but REITs like Kimco Realty

KIM,

or Regency Centers

REG,

to name a few also offer exposure. SITE Centers

SITC,

earlier this week announced plans to spin off all of its strip malls into a publicly traded company.

The next megatrend is industrial real estate, which Fraser says ties into the some $1 trillion or more U.S. companies spent last year relocating back home.

“It’s actually cheaper to build in the U.S…if you count robotics, you count shipping costs and tariffs and especially if you count energy, because America has the cheapest energy around. So what’s happening is massive. There’s not enough real estate…so one of the best places you know is large, big box industrial real estate,” he said, adding that Prologis

PLD,

is one listed company that’s doing just that.

“That’s a huge, huge trend and it’s not going to stop for the next 20 years. The world is over globalized and now it’s deglobalizing majorly,” he said.

The last two megatrends are energy and the coming bubble in multifamily housing. As for the first, Fraser said they are buying up oil fields due to the false belief out there that “the world is post fossil fuels,” and with oil underdeveloped for the last seven years.

“And so we’re about to have an energy crisis and it’s going to unfold over the next three to five years… The only thing that’s going to slow it is a recession, but even if we do have a recession, we still have this declining supply curve. At some point it’s going to hit it, and we still have a problem,” he said.

That will include oil prices above $100 a barrel, he said, and for average investors oil futures and major oil companies would offer exposure.

One final megatrend from Fraser is more looming — the “multifamily meltdown,” as he cites a stat from real estate analytics firm, Newmark, pointing to nearly $200 billion worth of troubled multifamily loans due in the next three years.

“During COVID, we saw a huge amount of liquidity flood the market and a lot of syndicators invested into multifamily, and multifamily has been kind of a gold standard for real-estate investors, because ‘people always need a place to live’ and there’s a well-known housing shortage in America. So what happened is they started bidding up the prices way too much,” he said.

Investors ended up overpaying and using variable rate financing and their 3% to 4% loans are starting to mature and they now face 8% to 9% rates. “They can’t refinance them and what’s worse, the property values have come down, so the banks won’t lend enough money on it,” he said.

“So I would say late 2024 or 2025 is probably a good time probably to buy apartment REITs. For us, we’re doing a distressed debt fund, so we basically will come in with debt or preferred equity and we basically go down the capital stack in these deals where we can get equity-like returns with debt-like risk. So it’s a great opportunity,” he said.

You can read more about the Aspen’s big megatrends — seven in total — here.

The markets

Stock futures

YM00,

ES00,

NQ00,

are dropping ahead of the Fed decision later, with Treasury yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

steady. Gold

GC00,

is under some pressure, along with silver

SI00,

while oil

CL.1,

is rising. The dollar has hit a 33-year high versus the yen

USDJPY,

with Japan intervention talk in the air.

Read: Time to put money in international equities as they stealth pass U.S. stocks?

The buzz

A Fed decision is expected at 2 p.m., followed by a press conference with Chairman Jerome Powell. No rate hike is expected, with all eyes on its forward guidance. The Treasury’s quarterly refunding statement is due ahead at 8:30 a.m.

Also, the ADP employment report is coming at 8:15 a.m., with job openings and the Institute for Supply Management’s manufacturing survey at 10 a.m.

DuPont

DD,

is down on a sales miss and weak guidance and Kraft

KHC,

is up on a profit beat and improved outlook, and CVS

CVS,

is up on an earnings beat, though lower guidance. Estee Lauder

EL,

is headed for a six-year low after a downbeat outlook.

Qualcomm

QCOM,

Etsy

ETSY,

Clorox

CLX,

and a few more results are in the after-hours lineup.

WeWork

WE,

is down 42% after a report that the co-working space group plans to file for bankruptcy protection as soon as next week.

Advanced Micro Devices

AMD,

is dropping after a weak revenue forecast spooked investors.

Opinion: AMD’s bold predictions for its chips are not so far-fetched

Earnings and guidance disappointment also hit shares of Match Group

MTCH,

Paycom

PAYC,

and Yum China Holdings

YUM,

A gloomy forecast is dinging shares of Big 5 Sporting Goods

BGFV,

as well

Best of the web

In the Northeast, a wet autumn has become an ‘apple-picking apocalypse’

Red Bull’s 31-year old heir’s first payment was a $615 million dividend.

Waystar, one of the last big IPOs of 2023, is now delayes.

The chart

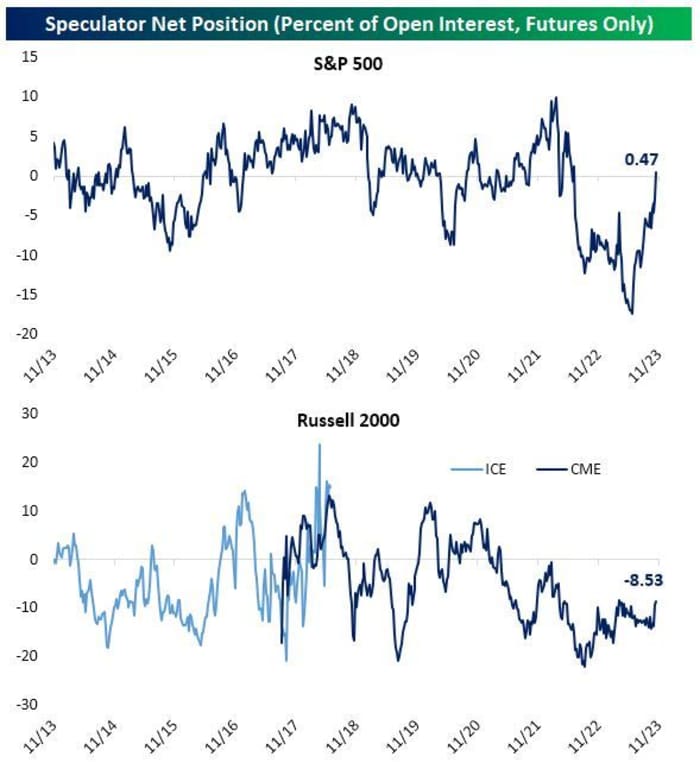

One possible indicator of optimistic investors? They have been slowly unwinding their bearish bets on S&P 500 futures since a big short position this summer, as noted by Bespoke.

Bespoke

“The S&P 500 is back to net long for the first time in well over a year. In fact, the streak of net short readings concluded at 70 straight weeks. That is now the longest such streak in the record of the data dating back to the late 1990,” said Bespoke. It’s less bullish for the Russell 2000

RUT,

which “remains in deep net short territory,” they note.

The tickers

These were the top-searched tickers as of 6 a.m.:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

AMD, |

Advanced Micro Devices |

|

GME, |

GameStop |

|

MULN, |

Mullen Automotive |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

AMZN, |

Amazon.com |

|

PLTR, |

Palantir |

|

NVDA, |

Nvidia |

Random reads

Dutch government puts ‘wild parking’ bikers on alert.

World’s greatest sandwich? He’s on the case.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)