[ad_1]

UK house prices in biggest fall since 2009

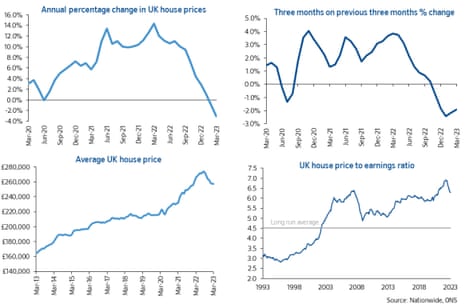

UK house prices are falling at the fastest annual rate since the aftermath of the financial crisis, new data from Nationwide shows.

Nationwide reports that UK house prices fell for the seventh month running in March, as the aftermath from the disastrous mini-budget continued to hammer the housing market.

This month, they fell by 3.1% compared to a year ago, which is the largest annual decline since July 2009, Nationwide Building Society said.

Across the UK, prices fell by 0.8% month on month, leaving the average UK house price at £257,122.

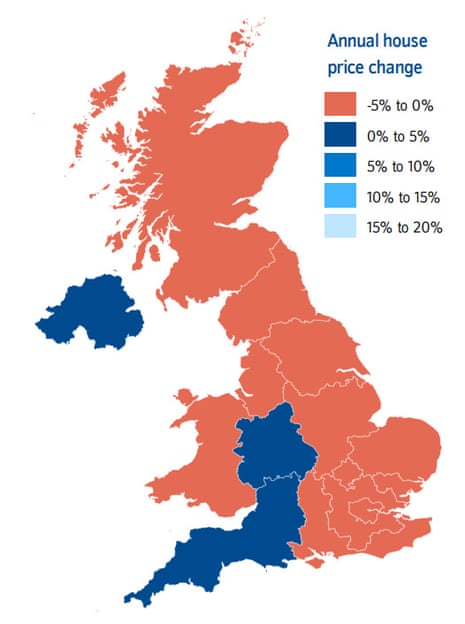

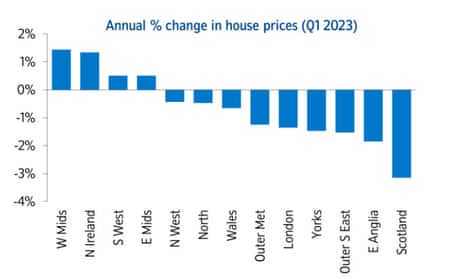

All regions of the UK saw a slowing in price growth in Q1, with most seeing small year-on-year falls. West Midlands was the strongest performing region, while Scotland remained the weakest.

Robert Gardner, Nationwide’s chief economist, explains:

“March saw a further decline in annual house price growth, with prices down 3.1% compared with the same month last year. March also saw a further monthly price fall (-0.8%) – the seventh in a row – which leaves prices 4.6% below their August peak (after taking account of seasonal effects).

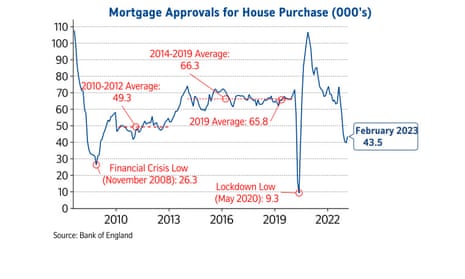

“The housing market reached a turning point last year as a result of the financial market turbulence which followed the mini-Budget. Since then, activity has remained subdued – the number of mortgages approved for house purchase remained weak at 43,500 cases in February, almost 40% below the level prevailing a year ago.

Key events

UK house prices fall at fastest annual rate since 2009

Kalyeena Makortoff

UK house prices have fallen at their fastest annual rate since the aftermath of the financial crisis in 2009, with experts at Nationwide warning that the squeeze on household budgets will make it hard to regain momentum soon.

The price of an average property dropped 3.1% to £257,122 over the year to March, according to Nationwide Building Society’s house price index. That is compared with a 1.1% annual decline in February, my colleague Kalyeena Makortoff reports.

Prices also fell on a month-on-month basis, dropping 0.8% since February. It marked the seventh monthly decline in a row and leaves prices 4.6% below their most recent peak in August, before the housing market was rocked by Liz Truss’s disastrous mini-budget.

“Since then, activity has remained subdued – the number of mortgages approved for house purchase remained weak at 43,500 cases in February, almost 40% below the level prevailing a year ago,” Robert Gardner, Nationwide’s chief economist, said.

He said it could take some time before prices rebound, as household finances come under pressure from rising bills and higher mortgage rates.

“It will be hard for the market to regain much momentum in the near term since consumer confidence remains weak and household budgets remain under pressure from high inflation,” Gardner said.

“Housing affordability also remains stretched, where mortgage rates remain well above the lows prevailing at this point last year.”

More here:

Full story: Failed IT systems at Capita fuel fears of cyber-attack on crucial NHS provider

Rob Davies

Computer systems have stopped working at outsourcing group Capita, triggering fears that a company that in charge of crucial operations for the NHS and the military could be under cyber-attack.

Staff are understood to have been unable to access IT systems at the outsourcing company since Friday morning, with an early investigation yet to establish the cause.

A spokesperson for Capita, who was unable to access their own email, said in a statement dictated over the phone:

“We are aware of a technical issue with our systems, which we are investigating.”

UK outsourcer Capita investigating IT issue

British outsourcing company Capita says it is investigating a technical issue with its systems, Reuters reports.

Among its clients, the company provides the UK government on a range of services including managing tax and I.T. services for local councils.

Katie Prescott of the Times has more details:

Capita staff have been unsuccessfully trying to access their systems since before 7am, I’m hearing. The UK’s biggest outsourcer – which handles major NHS contracts – is investigating an IT incident this morning.

— Katie Prescott (@kprescott) March 31, 2023

Capita staff have been advised that the company is “urgently investigating” and asked “not to attempt access via VPN or submit password recovery requests”

— Katie Prescott (@kprescott) March 31, 2023

UK energy firms lose high court challenge over handling of Bulb sale

Three major domestic energy suppliers have lost their high court challenge over the government’s handling of the sale of the collapsed energy firm Bulb.

Scottish Power, British Gas and E.ON claimed an “unfair sale process” led to decisions “to commit billions of pounds of taxpayer money to facilitate the acquisition of a failed business” by the rival firm Octopus Energy.

The three businesses brought legal action against the government, alleging its decision-making process was “flawed and unlawful”.

However, in a ruling on Friday, Lord Justice Singh and Mr Justice Foxton rejected the legal challenge.

At a hearing in London last month, the judges were told that the handling of the sale allegedly prevented British Gas making a “better” offer that could have saved money for taxpayers.

More here:

Octopus have welcomed the ruling, saying:

The High Court’s findings are clear: Octopus paid a fair price for Bulb in an open and competitive process.

The High Court was equally clear that there was no merit at all in the case brought by British Gas and the other legacy companies.

It’s clear that the case was a desperate attempt by those organisations to defend their waning market positions against a more efficient and customer-focused rival.

The Judge recognised the extensive level of information shared by Octopus, the Government and the administrators, which far exceeded what would be normal.

Our focus is now on delivering the best service possible to our new and existing customers.

And here’s John Leiper, chief investment officer at Titan Asset Management, on this month’s drop in eurozone inflation:

“Good to see a decline in euro area inflation although core inflation and the March number held relatively firm.

Bottom line, inflation remains sticky and the ECB will retain its hawkish bias despite the rising risk of recession later this year.”

While the large fall in headline eurozone inflation is welcome, the rise in the core rate is certainly not, says Diego Iscaro, head of European economics at S&P Global Market Intelligence:

But on balance, this morning’s figures still provide some reasons to be (relatively) upbeat, Iscaro adds:

We estimate that core inflation is close to its peak, and the pressure from food prices is also likely to ease during the second quarter. However, we expect core inflation to remain relatively sticky due to a combination of rising nominal wage growth and firms’ profit margins.

The ECB is unlikely to take the view that its fight against inflation is over, following today’s figures. Stress in the financial sector means that there is a higher than normal uncertainty about the ECB’s next move, but we still believe that a further rise in rates in May is certainly on the cards.

..but core inflation rises

Although headline inflation in the eurozone fell this month, underlying inflation has risen.

The eurozone consumer prices index, excluding energy, food, alcohol & tobacco, rose by 5.7% over the last year, up from 5.6% in February.

This means that the fight against inflation is not over, reports Bert Colijn, ING’s senior economist for the eurozone.

Colijn predict the European Central Bank will raise eurozone interest rates by two more quarter-point increases, before rates peak.

Colijn writes:

While March has seen a large drop in inflation, core inflation remains a concern for the ECB.

The potential for core inflation to remain stickier than hoped will be the main reason for the ECB to continue to hike in the near term.

We expect another 25bp hike in May and another in June. As the inflation outlook is starting to look more benign, and recent banking turmoil serves as an illustration that aggressive hikes are not without cost, we expect a peak to be reached thereafter.

Eurozone inflation falls to 6.9% as energy prices drop

Newsflash: Inflation across the eurozone has fallen, as households benefit from falling energy prices.

Euro area annual inflation is expected to be 6.9% in March, down from 8.5% in February according to a flash estimate from Eurostat which suggests Europe’s cost of living squeeze is easing.

Prices of food, alcohol & tobacco accelerated this month – up by 15.4% year-on-year, from 15.0% in February.

Non-energy industrial goods prices jumped by 6.6%, down from 6.8% in February, while services inflation rose to 5.0%, from 4.8%.

But energy prices were cheaper than a year ago – with prices falling by 0.9%, compared with a 13.7% rise in February.

Russia’s invasion of Ukraine in February 2022 caused energy prices to surge a year ago.

This creates a base effect, pulling eurozone inflation lower this month in comparison. European wholesale gas prices, for example, are below their levels on the day of the invasion, as we showed at the end of last year:

Security staff have begun a strike at Heathrow today, leading to British Airways cancelling some flights.

The Unite union says 1,400 security officers are striking from today, in a pay dispute after last-ditch talks broke down yesterday when Heathrow Airport Limited “failed to substantially improve its pay offer”.

The strike involves security staff at Terminal Five, which is used exclusively by British Airways, and Campus security guards, who are responsible for checking all cargo that enters the airport.

BA flights to Athens, Amsterdam, Malaga, Vienna, Jersey, Nice, Los Angeles and Seattle have been cancelled so far today, although other flights are leaving from T5 as planned.

Travel journalist Simon Calder reports that the flagship carrier has cancelled over 70 flights altogether.

British Airways’ 70-plus cancellations today to/from Heathrow affecting an estimated 10,000 passengers. Many flights to destinations including Athens, Los Angeles and Palma de Mallorca were grounded overnight at very short notice. Other airlines unaffected https://t.co/r38Erwxcab

— Simon Calder (@SimonCalder) March 31, 2023

Heathrow says the airport is operating as usual, and that security is free flowing, with its contingency plans working well.

The airport’s chief executive John Holland-Kaye told Sky News that passengers shouldn’t arrive earlier than usual for their flights:

“I’m here in Terminal Five which is the only terminal that voted for strike action and you’ll see it’s operating as normal.

“We have a lot of colleagues who have come to help us out today – both security officers and managers who are helping out in their purple shirts like me.

“But we also have some other agency, third party, workers who have come in to help us who are very experienced in this kind of security environment, and they’re keeping the airport running smoothly.

“So, Heathrow is operating as normal. If you’re travelling over the Easter period, don’t worry, you’ll have a good journey.

“Please don’t come too early. Three hours is plenty for a long-haul flight, two hours for a short-haul flight, and we will get you to your destination on time.”

In Germany, unemployment has unexpectedly ticked up.

Labour Office figures show a rise in joblessness this month, suggesting that economic headwinds undemined the usual seasonal pick-up in hiring in th spring.

The Federal Labour Office said the number of people out of work increased by 16,000 in seasonally adjusted terms to 2.54 million. Analysts polled by Reuters had expected that figure to remain unchanged.

⚠️ BREAKING: GERMAN UNEMPLOYMENT CHANGE SA ACTUAL 16K (FORECAST 1K, PREVIOUS 2K) $MACRO

— Breaking Market News (@financialjuice) March 31, 2023

This has pushed up Germany’s seasonally adjusted unemployment rate by 0.1 percentage points, from 5.5% to 5.6%.

Labour Office head Andrea Nahles says:

“The labour market remained robust overall in March. However, the weak economy is leaving its mark.”

Handelsbanken: House price correction ‘has some way to go’

The UK house price correction still has some way to go, predicts Daniel Mahoney, UK Economist at Handelsbanken, after prices fell again in March.

As he points out, UK mortgage approvals in February were much lower than a year earlier.

And with financial conditions tightening (UK interest rates have been hiked 11 times in a row), prices may keep falling, Mahoney explains:

The Halifax House Price Index had shown an unexpected jump in February m-o-m, but this latest March reading from Nationwide appears to confirm that this was a blip.

Indeed, latest mortgage approval data from the Bank of England, which is a forward-looking indicator, would suggest that the correction in UK-wide house prices has got some way to go. While mortgage approvals ticked up in February, they only registered at 43,500 which is roughly down by about 40% on the year. Furthermore, the tightening in financial conditions following recent market turbulence is likely to reinforce the current downward trend in prices. The peak to trough fall in UK house prices could end up being in the region of 10%.

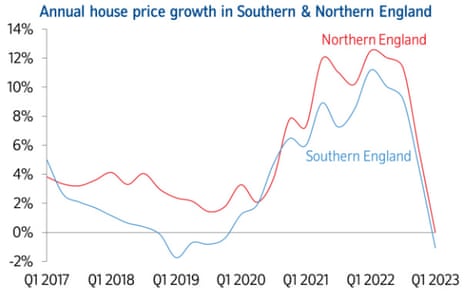

UK house price falls: map and charts

This map shows how house prices have cooled in much of the country, compared to a year ago:

While these charts illustrate how prices have dropped from their peak last summer:

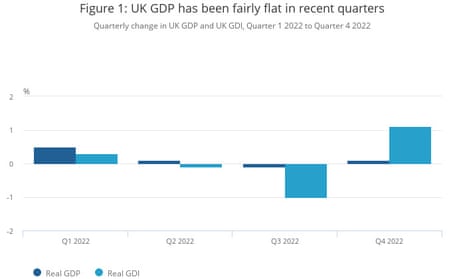

Although the UK happily avoided falling into recession this morning, growth has been rather lacklustre.

The upwardly-revised 0.1% increase in GDP in the final quarter of last year leaves the economy only 0.6% larger than a year earlier.

Higher inflation and a tightening in financial conditions have weighed on the UK economy in recent quarters, points out the ONS.

There’s little meaningful difference between an economy that is stagnating and one that is growing slightly, points out Martin Beck, chief economic advisor to the EY ITEM Club, says:

The revelation from Q4 2022’s national accounts that the economy grew 0.1% quarter-on-quarter, rather than flatlining as in the preliminary estimate, therefore doesn’t carry much significance.

That said, alongside Q3’s contraction in GDP being revised smaller, it represents the latest in a run of upside surprises and suggests the economy has displayed a welcome degree of resilience, despite pressure from high inflation and expensive energy.

Jeremy Leaf, north London estate agent, reports that house buyers and sellers are negotiating hard, resulting in prices ‘softening’:

‘Although these figures show house price growth is still slowing, we have seen signs of improvement over the last few months at the sharp end.

‘Clearly the rise in mortgage rates and cost of living continues to weigh heavily. However, buyers have been tempted back by more choice and less competition compared with much of 2021 and 2022 as the balance between supply and demand improves.

‘If anything, the passage of time has made the reasons for moving more compelling but buyers and sellers want to ensure they are not caught out financially so are trying to negotiate best possible terms, which has led to some price softening.’

Why house prices are falling at fastest rate since 2009

Many analysts are blaming the chaos caused by the Truss-Kwarteng mini-budget for the slide in house prices.

UK borrowing costs surged following the announcement of large unfunded tax cuts, which drove up mortgage rates. They have fallen back since, though, as Jeremy Hunt unwound much of the mini-budget measures.

Tom Bill, head of UK residential research at Knight Frank, warns that the reverberations from the mini-budget “won’t disappear overnight”.

After effectively shutting down for Christmas in September, the property market turned back on in January as stability returned to Westminster and the mortgage market.

Activity has been solid this year as buyers accept the new normal for mortgage rates. For anyone with memories that stretch further back than 2008, it looks very much like the old normal. That said, more financial pain will enter the system as owners move onto higher fixed-rate deals and combined with an increase in supply from the lows of the pandemic, we expect UK prices to fall by a few percent this year.”

Victoria Scholar, head of investment at interactive investor, says some potential buyers are holding off, in the hope that prices will continue to fall:

The UK housing market has been in disarray since the fiscal fiasco around the mini-budget last September which sent mortgage rates sharply higher while many mortgage deals were pulled from the market.

Since then, although mortgage rates have been normalising, house prices have been hurt by rising interest rates from the Bank of England, sluggish economic growth, falling real wages and soft consumer confidence. Many would be buyers are holding off in anticipation that inflation, house prices and mortgage rates will cool further this year, helping the market to become more affordable and enticing buyers back.”

Jason Tebb, chief executive officer of property search website OnTheMarket.com, reports that the market is continuing to rebalance, as higher mortgage rates and inflation mean purchasers have less buying power.

“With March seeing a further decline in annual house price growth, the adjusting and rebalancing of the market continues.

Rising interest rates, combined with a higher cost of living have contributed to a slowdown in activity, inevitably impacting the confidence of the average property-seeking consumer in the short term. Pressure on household budgets has been considerable and is not yet easing, although many believe inflation and interest rates are close to their peak.

Prices falling faster in the South

There’s a North-South divide in UK house prices.

Across northern England overall (the North, North West, Yorkshire & The Humber, East Midlands and West Midlands), prices were flat year-on-year in the last quarter.

But in southern England (the South West, Outer South East, Outer Metropolitan, London and East Anglia), they fell 1.1% compared with Q1 2022.

Northern Ireland saw “a noticeable slowing in annual house price growth”, although prices were still up 1.3% year-on-year, Nationwide reports.

In Wales, annual house price growth turned negative – down from +4.5% to -0.7%.

Depending on where you are in the country the severity in prices changes differs significantly, with Scotland in particular feeling the cold pic.twitter.com/NenOhH7G6p

— Emma Fildes (@emmafildes) March 31, 2023

For the 7th month in a row house prices fall. In March house prices dropped to £257,122. This is a -3.1% year-on-year drop and a -0.8% monthly fall which leaves prices 4.6% below their Aug peak (after taking account of seasonal effects) @AskNationwide pic.twitter.com/c2goQ1uM6x

— Emma Fildes (@emmafildes) March 31, 2023

Most regions see small year-on-year house price falls

House prices in nine out of 13 British regions recorded annual house price declines in the first quarter of this year, Nationwide reports.

Chief economist Robert Gardner says:

Scotland remained the weakest performing region with prices down 3.1% compared with a year ago, a sharp slowing from the 3.3% year-on-year increase the previous quarter.

East Anglia, which was the strongest performing region last quarter, saw a significant slowdown, with prices falling 1.8% year-on-year, making it the weakest performing English region. The neighbouring Outer South East saw a 1.5% yearon-year decline, while London saw a 1.4% fall.

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)