[ad_1]

Key events

Filters BETA

The Bank of England has only seen muted demand for its first sale of medium-dated UK government bonds bought through its quantitative easing stimulus programme.

The Bank successfully sold 750m of gilts with a maturity of 7-20 years on Monday, havingy received orders for £1bn.

That’s less interest than it saw last week, when it received almost £2.5bn of bids for the £750m of short-dated British government bonds on offer.

The BoE received only £1bn of bids for £0.75bn on offer, not brilliant and perhaps illustrating the difficulties in offering bonds days before the DMO follows up with £6.25bn’s worth of auctions

2/

— Antoine Bouvet (@AntoineBouvet2) November 7, 2022

Understandably, gilts are selling off the result (6bp, and counting) but the good news is the 2s10s curve is actually flattening (~3bp) as a result which is slightly surprising as the long-end has proved a persistent weak spot in recent sessions

— Antoine Bouvet (@AntoineBouvet2) November 7, 2022

The Bank hopes to sell £80bn of its stock of £835bn of UK government bonds by the end of next year.

US second-hand car prices have continued to slide, in a timely sign that the inflation surge could be fading.

Wholese sale prices for used autos fell by 2.2% in October, according to auction company Manheim, and were 10.6% lower than a year ago.

Manheim Used Car Index is out.

Actual prices are -10.6% Oct Y/Y

Holding October static (not likely)

November would be -14% y/y and December -15% y/y pic.twitter.com/acjWrn9GhL

— Sean D. Emory (@_SeanDavid) November 7, 2022

Used car prices jumped dramatically once the pandemic disrupted global supply chains, hurting production of new cars. There was also rising demand as some people steered away from public transport for fear of catching Covid-19.

But now, semiconductor bottlenecks have eased – helping car factories to produce more models, while the jump in US interest rates is deterring some buyers.

A majority of workers at packaging giant DS Smith have voted in favour of taking strike action in a dispute over pay, the GMB union reports.

GMB, which represents 1,000 workers at the London-listed company, said 93% of the workers had voted for strikes. The industrial action could take place as soon as the end of this month, it said.

DS Smith makes packaging for companies including Amazon, whiskey producer Chivas, craft beer firm Brewdog, drinks giant PepsiCo and KP snacks.

GMB says DS Smith is offering staff a 3% pay rise plus a payment of £760 for 2022-23 – a ‘massive real terms pay cut’ when the retail price index measure of inflation is 12.3%.

Eamon O’Hearn, GMB National Secretary, says staff deserve more:

“DS Smith members worked through the pandemic, helping keep the company afloat through troubled times.

“It turns out that the company was hugely profitable during the pandemic, now they need to company to step up and help them through the cost of living crisis.

“A strike at DS Smith could have serious implications across a range of household names – not least Amazon which gets packaging from the company.

Incidentally, DS Smith’s CEO, Miles Roberts, received a 2% pay increase this year, taking his total pay to £2.58m. But his total remuneration had jumped by 78% the previous year, as DS Smith saw strong trading during the pandemic home-shopping boom.

Many young UK adults are priced out of the housing market even if prices fall by a sixth, the Resolution Foundation warns:

Falling house prices could help young people get onto the housing ladder. But even if house prices fell by 18%, nearly three-quarters of 25-to-34-year-old non-home-owning families would have neither the savings nor the earnings to be able to buy a house. https://t.co/gCWGHKMcYg pic.twitter.com/P0jF77MHim

— Resolution Foundation (@resfoundation) November 7, 2022

Global inflation may be near its peak, says IMF’s Georgieva

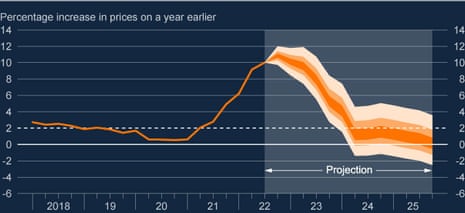

Global inflation may be peaking, according to the head of the International Monetary Fund.

Kristalina Georgieva has said that the global surge in consumer prices may be close to the high point of the current cycle, as central banks continue to drive up interest rates to fight inflationary pressures.

Speaking at the Cop27 climate change summit in the Egyptian resort of Sharm el-Sheikh, the IMF managing director told Bloomberg TV that:

“I’m not going to jump ahead of data, but it is very possible that we are peaking”

Failure to cool inflation would hurt economic growth prospects, she added:

“We now see central banks very united on fighting inflation as a top priority and rightly so.

If we don’t succeed, it would de-anchor and then the foundation for growth which is price stability is dented.”

Energy prices have fallen from their highs this summer, while falling demand (illustrated by the surprise contraction in China’s trade last month) could also ease inflation.

US inflation data, due on Thursday, is expected to show that price increases slowed, to 8% per year in October from 8.2% in September.

In the UK, inflation is a 40-year high of 10.1%, but is expected to fall back next year.

However, bringing inflation back down to target might take time, Georgieva added.

“Inflation is going to be harder to bring down to the desirable level of around 2%.

“If we are going to see diversification of supply chains, that inevitably is going to put some upward pressure on prices.”

PwC, who conducted the pay survey, reports that 56% of FTSE 100 CEOs received a percentage salary increase for 2022 in line with, or below, the workforce level.

The big change, which drove pay back to pre-pandemic levels, was bonuses.

Only 5% of FTSE 100 CEOs received no bonus for 2021/22, down from 22% in 2020/21.

And the average annual bonuses for 2021/22 increased to 86% of the maximum opportunity, which is above historical pre-covid levels.

‘Tin-eared’ CEOs criticised for huge bonuses

Investment management firm EdenTree has criticised ‘tin-eared’ CEOs whose pay is soaring as workers face real terms pay cuts and falling house prices.

We flagged earlier (see post) that the average FTSE 100 CEO got a 23% pay boost this year, to £3.9m, mainly due to a jump in bonuses.

Neville White, Head of RI Policy & Research at EdenTree, says the return of big bonuses is largely ‘unjustifiable’ in the current economic climate:

“2022 has seen a strong bounce back in bonus culture after overall remuneration quantum stalled in 2020-21, much of which we find unjustifiable in the midst of an economic downturn.

For the first year since we began consistent voting on executive pay, EdenTree has been unable to support any FTSE100 remuneration policies or reports, opposing all those that have come before us.

White also criticices the “disagreeable trend” towards Restrictive Share Plans – which hand out shares to employees without any performance targets.

And he adds that some bonus schemes are being manipulated to pay out cash to executvies, even if targets were missed:

Unfortunately we have also seen individual examples of Remuneration Committee discretion being applied to change or manipulate performance metrics in order to pay out.

At a time of increasing economic hardship, this somewhat ‘tin-eared’ response by executives to their own rewards sets a particularly poor example.”

Here’s a timely example of how rising interest rates has hit mortgage affordability:

The Bank of England just updated October mortgage rates , the 2Y fixed rate went to 6.01% from 4.17%.

Applying this rate to the nation-wide average house price, and assuming a 15% down payment, your monthly payment would be £1,369 up from £764 at the start of the year: {ECAN} pic.twitter.com/keReqLDb24— Michael McDonough (@M_McDonough) November 7, 2022

Here is much home you can afford in the UK with a £800/month mortgage payment using the 2Y fixed rate mortgage rate and a 15% down payment: {ECAN} pic.twitter.com/C4XHL6GFau

— Michael McDonough (@M_McDonough) November 7, 2022

BOE calls for tougher global regulation after UK pensions crisis

As well as driving up mortgage costs, the plunge in UK government bonds after the mini-budget created turmoil in the pensions industry.

Pension funds with leverage driven investment strategies were forced into a wave of fire sales – as UK bond prices fell, funds had to put up more collateral, forcing them to sell bonds which drove price lower.

And now, a Bank of England senior policymaker has warned that tighter global regulation may be needed to prevent dangerous levels of debt building up, as well as more transparency about risks.

Sarah Breeden, executive director for financial stability strategy and risk, warned the international community hasn’t made enough progress tackling the risks of leverage outside the banking sector (now more closely regulated following the financial crisis).

In a speech today, Breeden said that the root cause of the pension crisis was “poorly managed leverage” – which led the Bank to pledge to buy up to £65bn of gilts to stabilise the markets.

She said:

“Beyond improving transparency, regulators will need to consider how best to ensure leverage is well managed.

She added that “market regulations to ensure excessive leverage is better controlled by market pricing and margins” could help build resiliency.

And she concludes by warning that lessons must be learned from the risis:

Events of recent weeks, months and years have once again reminded us of the systemic risks posed by poorly-managed leverage in the non-bank financial system.

All too often excessive risk taking alongside improper liquidity risk management has threatened conditions in the real economy – an issue that feels especially pertinent in the current environment of high volatility and tightening financial conditions.

Sarah Breeden explains how leverage in non-banks can pose risks to financial stability and to the economy as a whole 👇https://t.co/02xgjleG4B

— Bank of England Press Office (@BoE_PressOffice) November 7, 2022

Full story: UK house prices fall after ‘significant shock’ of mini-budget

Jasper Jolly

UK house prices fell by 0.4% in October after Liz Truss’s mini-budget drove a sudden rise in mortgage rates, the lender Halifax said.

The decline in the average price to £292,598 was the third in the past four months and the steepest since February 2021. The annual rate of growth in house prices slowed to 8.3% in October from 9.8% in September.

The mini-budget on 23 September, under the previous prime minister, Liz Truss, and her chancellor, Kwasi Kwarteng, caused financial market turmoil that pushed up borrowing costs and eventually resulted in Truss’s replacement by Rishi Sunak.

Sunak and his chancellor, Jeremy Hunt, responded to the chaos by signalling tax rises and government spending cuts are likely, which could add to the downward pressure on house prices, Halifax said.

Kim Kinnaird, the director of Halifax Mortgages, said the mini-budget had added to other trends that could push prices down, including the rising cost of living and the high level of house prices compared with earnings

Higher unemployment during an expected long recession would also add to downward pressure on prices.

“While a post-pandemic slowdown was expected, there’s no doubt the housing market received a significant shock as a result of the mini-budget which saw a sudden acceleration in mortgage rate increases,” she said.

“While it is likely that those rates have peaked for now – following the reversal of previously announced fiscal measures – it appears that recent events have encouraged those with existing mortgages to look at their options, and some would-be homebuyers to take a pause.”

Young homeowners at risk of negative equity as house prices fall

Rising interest rates and falling house prices could drive newer housebuyers into negative equity – which scarred the UK economy in the early 1990s.

The Resolution Foundation has warned that higher interest rates will affect over five million households with mortgages by the end of 2024.

New analysis: Higher monthly mortgage costs over the coming years are set to more than double the lifetime interest costs incurred when buying a first-time property – from £74,000 to £153,000. They also bring the overall lifetime cost of a FTB property to a record £326,000. pic.twitter.com/De4xnTBD8T

— Resolution Foundation (@resfoundation) November 6, 2022

However, younger homeowners will be particularly hard hit, as they tend to be earlier in their mortgage terms – when interest forms the largest share of mortgage payments. They will also have bought when house prices were at record levels, meaning they are more highly leveraged than previous generations of first-time buyers.

Sophie Hale, Principal Economist at the Resolution Foundation, said:

Alongside higher mortgage costs, young homeowners are also in particular danger of low or negative equity as a result of falling house prices.

“The flip side is that falling house prices and higher returns on savings could lower barriers to home ownership for the next generation of first-time buyers, by making it easier for them to come up with a deposit on their first home.”

Sharp rise in unemployment would push house prices down

The outlook for the UK housing market could depend on how sharply unemployment rises (as well as interest rates) as the economy teeters on the brink of recession.

Kim Kinnaird, Director at Halifax Mortgages, says history shows that rising joblessness hits house prices.

“Currently joblessness remains historically low, but with growing expectations of the UK entering a recession, unemployment is expected to rise.

Whilst it may not spike to the same extent as seen in previous downturns, history tells us that how this picture develops in the coming months will be a key determinant of house price performance into next year and beyond.”

Mike Scott, chief enalyst at national estate agency Yopa, agrees, adding:

A sharp rise in unemployment, particularly long-term unemployment, would both reduce the demand for buying a home and increase the supply due to forced sales from homeowners who could no longer afford their mortgage repayments. However, in other recent economic downturns the UK labour market has proved surprisingly resilient, so we do not expect such large increases in unemployment levels.

We would also anticipate some kind of government action to assist homeowners who couldn’t keep up with their mortgage repayments. We therefore do not expect significant house price falls next year.

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)