[ad_1]

Key events

Filters BETA

Back in the markets…grain, wheat and soybean prices are falling on concerns that China’s Covid-19 outbreaks, and escalating protests, will hit its economic recovery.

Wheat is down 0.9% to its lowest level in around three months, while soybean prices are 0.4% lower, and corn is off 0.5%.

Matt Ammermann, StoneX commodity risk manage, explained:

“The news from China of more COVID cases and the unexpected protests against the government are weakening wheat, corn and soybeans today.

“There is concern in commodity markets both about the possible disruption in China from more anti-COVID measures and also the impact of protests.”

Strike news: Workers in seven train companies are to vote on whether they want to continue taking industrial action in a long-running dispute over jobs, pay and conditions.

The Transport Salaried Staffs’ Association (TSSA) is balloting more than 1,600 operational, station, control and management staff, for strike action and action short of strike.

Ballots will be held throughout December with results due just before Christmas.

The companies being re-balloted are Avanti West Coast, CrossCountry, East Midlands Railway, LNER, Northern, Southeastern and Transpennine Express (TPE).

National Grid could activate emergency winter plan to avoid blackouts

UK households might be paid to help Britain’s grid operator avoid a potential blackout on Tuesday evening, partly due to problems in the French energy grid and a drop in wind power.

National Grid’s electricity systems operator division said it is considering whether to activate a live run of its demand flexibility service for the first time on Tuesday.

The scheme, which launched at the start of this month, has already been tested twice in the last two weeks but has not yet been run for a live event.

National Grid said it would decide by around 2.30pm today whether to issue the notice to suppliers and households.

Electricity demand is rising as European temperatures fall, while weak wind speeds are hitting renewable energy supplies.

As I said earlier, while oil plunges, do keep an eye on European electricity markets (UK and France).

Despite seasonally mild weather, the lack of wind is forcing a high gas burn, sending day-ahead wholesale baseload prices pretty high, and peakload even higher | #EnergyCrisis pic.twitter.com/rd2wXlhzVu

— Javier Blas (@JavierBlas) November 28, 2022

UK wholesale power prices for tomorrow evening (5-6pm) will be very, very high at ~£1,100 per MWh. That’s the 15th highest ever price for an evening since 2010.

National Grid ESO is flagging it may activate for tomorrow its new Demand Flexibility Service to balance the market.

— Javier Blas (@JavierBlas) November 28, 2022

UK retail sales slide as pessimism mounts

Just in: UK retail sales weakened sharply this month as the economy weakened.

Retailers reported that demand fell this month, with stores bracing for a difficult December as consumers are hit by the cost-of-living crisis.

Expectations for sales in the coming month also weakened, to the weakest since March 2021, the CBI’s latest ‘distributive trades’ survey of UK retail shows.

Retailers are also cutting jobs – and expect to keep lowering their headcount next month.

That’s a sign of pessimism, as retailers fear that spending this Christmas will be weaker than last year.

Here are the key findings:

-

Retail sales declined in the year to November (-19% from +18% in October) with a broadly similar fall expected next month (-21%).

-

Sales volumes were seen as average for the time of year (+3% from +20% in October) and are expected to remain broadly in line with seasonal norms in December (-1%).

-

Online retail sales contracted in the year to November (-5% from -23% in October). Internet sales have now been flat or falling for 13 months, and an accelerated contraction (-26%) is expected next month.

-

Retailers remained notably pessimistic about the business situation over the next three months (-22%), to a similar extent to August (-22%).

-

Employment growth in retail slumped in the year to November (-17% from +13% in August) – the first decline in headcount since August 2021. A further fall (-12%) is anticipated next month.

-

Retailers expect to reduce investment in the next 12 months compared to the previous 12 (-38% from -31% in August), to the greatest extent since May 2020.

Martin Sartorius, principal economist at the CBI, says retailers are facing a tough time.

“It’s not surprising that retailers are feeling the chill as the UK continues to be buffeted by economic headwinds. Sales volumes fell at a firm pace in the year to November, and retailers remain notably downbeat about their future business prospects.

This pessimism is reflected in investment intentions worsening to the greatest extent since May 2020.

Barclays’ chief executive, CS Venkatakrishnan, has been diagnosed with non-Hodgkin lymphoma, the bank has announced.

Venkatakrishnan will be undergoing treatment for the next 12 to 16 weeks.

In a letter to staff, Venkatakrishnan explained that “the good news is that the matter has been detected early”, with scans and biopsies confirming it to be very localised.

Venkatakrishnan, who was described as unflappable and popular with staff when he was appointed as CEO a year ago, wrote:

The doctors have advised that my prognosis is excellent, and my condition is curable with their prescribed regimen.

During this period, the company will run normally, and I will continue to be actively engaged in managing it. However, I will have to work from home for some periods and not be able to travel. Fortunately, I have always exercised regularly and am strong and fit as I commence this treatment.

Barclays says its chief executive Coimbatore Sundarajan Venkatakrishnan, known as Venkat within the bank, is to receive treatment for cancer.

It revealed he would work from home for some periods while undergoing treatment for non-Hodgkin lymphoma in New York. pic.twitter.com/vDqLiUkC5E

— Capital Moments (@CapitalMoments) November 28, 2022

Very best wishes for a speedy recovery, Venkat.

XM: Market nervous about protests

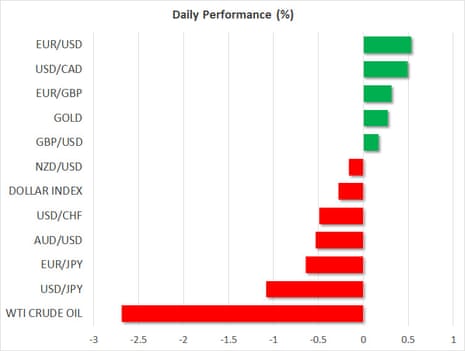

The outlook for oil has worsened today, sending crude down around 3%.

Investors are worried that authorities will clamp down hard against the protesters in China, and tighten restrictions even more, with daily infections at daily highs.

Raffi Boyadjian, lead investment analyst at XM, explains:

Risk assets took a knock at the start of the week as worries about instability in China and how the country’s unyielding zero-Covid policy might further blight the outlook led investors to search for safety. Anti-lockdown protests started spreading after a deadly fire in Xinjiang last Thursday where residents were reportedly unable to escape the residential complex due to the harsh Covid restrictions.

But the protests erupted further over the weekend, turning into nationwide demonstrations against the government’s handling of the pandemic as anger boiled over. It is yet unclear how authorities plan to quell the ever-growing unrest given their unprecedented scale, or just how much more widespread these protests will become.

But this is uncharted territory for President Xi Jinping and the Communist Party, and it is making the markets nervous.

The US stock market is on track to open lower.

The tech-focused Nasdaq futures contract is down 1.1%, while the S&P 500 futures is off 0.9%.

The analyst team at Saxo Bank say the unrest in China has rattled markets:

Dramatic scenes of widespread protests in China against Covid policies there have pulled sentiment lower, with US yields dipping to new local lows and crude oil prices pushing on cycle lows even after Friday’s drop.

The US dollar has firmed against most currencies, but the Japanese yen is stronger still as the fall in yields and energy prices support the currency. This is a sudden powerful new distraction for markets when this week was supposed to be about incoming US data.

Worst day in a month for China stocks

China’s stock market posted its worst one-day fall in a month today, as investors worried about the protests against Covid-19 restrictions.

The CSI 300 shed 42 points to finish at 3,733 points, a two-week low.

The selloff was led by ‘academic and educational services’, property companies, financial companies and miners.

A U.S. crackdown on Chinese tech giants citing national security concerns also weighed on shares of technology firms, Reuters points out.

Gary Ng, economist at Natixis, says:

“The market does not like uncertainties that are difficult to price and the China protests clearly fall into this category. It means investors will become more risk-averse.”

The CSI 300 is down 25% this year, caught up in the global selloff

The gold price has nudged higher, up around $5 to $1,761 per ounce.

Rupert Rowling, market analyst at Kinesis Money, says bullion is popular as a safe-haven today:

Gold has been lifted by market jitters as a result of the protests in China about continuing lockdown restrictions.

With equities down, gold has climbed back to around $1,760 an ounce as investors seek out the precious metal as a haven.

The cost of insuring China’s debt against default has risen a little today.

China five-year credit default swaps have risen by 6 basis points to 79bps, according to S&P Global Markets intelligence. That’s still low (showing the debt is seen as safe), but it shows rising edginess in the markets.

Europe’s oil and gas share index is down almost 2%, on worries that demand from China could weaken.

AJ Bell investment director Russ Mould explains:

“China is a rapacious consumer of global commodities and signs economic activity is being disrupted by the mounting dissent in the country will be seen as negative for demand. It’s worth noting that unrest is already affecting business in China including Apple which has seen violent clashes at one of its facilities in Zhengzhou.

“In the medium term the protests could be positive for growth if they persuade Beijing to adopt a looser approach to Covid but given how strident Xi Jinping has been in pursuing the hard-line policy, it’s difficult to see it being surrendered easily.

“Part of the problem for China is vaccination levels are behind those seen in other parts of the world and this means a ‘living with the virus’ strategy comes with substantial risks attached.”

Apple “to lose 6 million iPhone Pros” from China tumult

Photograph: AP

Bloomberg are reporting that the turmoil at Apple’s key manufacturing hub of Zhengzhou could create a production shortfall of close to 6 million iPhone Pro units this year

They say:

The situation remains fluid at the plant and the estimate of lost production could change, the person said, asking not to be named discussing private information.

Much will depend on how quickly Foxconn Technology Group, the Taiwanese company that operates the facility, can get people back to assembly lines after violent protests against Covid restrictions. If lockdowns continue in the weeks ahead, production could be set further back.

The Zhengzhou campus has been wracked by lockdowns and worker unrest for weeks after Covid infections left Foxconn and the local government struggling to contain the outbreak. Thousands of staff fled in October after chronic food shortages, only to be replaced by new employees who rebelled against pay and quarantine practices.

Videos fro Zhengzhou have shown police in China beating workers who protesting over working conditions and pay at the iPhone factory. More here:

Shares in Apple are down around 1.4% in premarket.

Martin Petch, vice president at Moody’s Investors Service, has said the ratings agency expected the protests in China “to dissipate relatively quickly and without resulting in serious political violence”.

But he cautioned:

“However, they have the potential to be credit negative if they are sustained and produce a more forceful response by the authorities.”

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)