[ad_1]

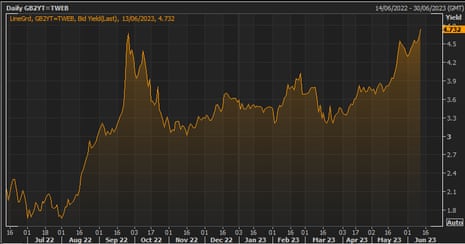

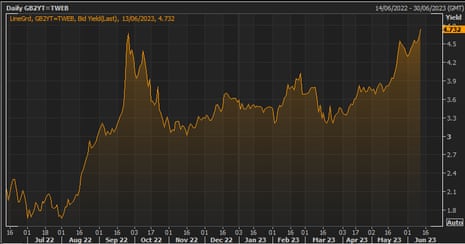

Newsflash: UK 2-year bond yields above Truss panic levels

Expectations that UK interest rates will keep rising are driving up the British government’s short-term borrowing costs ABOVE levels seen in Liz Truss’s brief premiership.

That’s bad news for people who looking to take out a mortgage, or remortage, soon.

The yield, or interest rate, on UK two-year government bonds has hit 4.73% this morning, up from 4.62% last night, after this morning’s jobs report showed regular pay growing at the fastest rate on record.

That is slightly higher than the peak seen in the turmoil after last autumn’s mini-budget, when chancellor Kwasi Kwarteng’s plan for unfunded tax cuts spooked the markets.

These two-year gilts are used to price fixed-term mortgages, and the recent increase in yields has already been forcing lenders to reprice deals, or pull them off the markets.

There could be more pain ahead too, as the money markets expect Bank of England base rate to hit 5.5% by the end of this year, up from 4.5% today.

Longer-dated government bond yields have also risen today, but are below their panic levels last autumn.

30 year yields still below the Trussonomics/LDI crisis level: 4.6% vs 5% then.

— Bond Vigilantes (@bondvigilantes) June 13, 2023

The surge in bond yields last autumn was partly driven by forced selling by pension funds who had followed Liability Driven Investment strategies, and by a lack of confidence in the Truss-Kwarteng plan.

Neil Wilson of Markets.com says the current situation is different, compared to last September when “the mini-Budget was doing its wrecking ball job”.

This time is different – LDI has unleveraged, and it’s not about the fiscal or political risk premium. It’s all about strong wage numbers driving expectations for the Bank of England to need to press hike button again and again.

We are now in wage-price spiral territory – private sector wage growth rose to 7.6% in the three months to April, whilst overall regular pay rose 7.2%. This only makes it harder for the BoE to cool inflation – a tougher stance is required but we know the dangers for the economy and notably the mortgage market if that happens.

Key events

Here’s Victoria Scholar, head of investment at Interactive Investor, on the jump in the 2-year UK gilt yield over its peak after last September’s mini-budget:

It comes after this morning’s UK labour market statistics which saw a rise in the number of people in employment to an all-time high and the fastest pace of growth since records began for basic pay (excluding the anomalous pandemic period).

These both underscore the tightness in the labour market, which could inhibit the decline of inflation, prompting the Bank of England to carry out further interest rate increases to cool price pressures.

Financial markets are pricing in further moves to tighten monetary policy from the current bank rate of 4.5% to 5.5% by year-end, which would add to pressure on consumers and businesses through higher borrowing rates.

Resolution Foundation have pulled together a handy thread on this morning’s UK labour market report -and are hopeful that the squeeze on real wages could be ending:

💸The UK’s real wage squeeze may be ending (for now).

📈But the rate rising cycle is likely to be extended.

A quick 🧵on today’s labour market stats…

— Resolution Foundation (@resfoundation) June 13, 2023

Good news: pay grew by 7.2% in the 3 months to April. If that is matched by a fall in inflation we could have already returned to real pay growth (given the data is lagged). pic.twitter.com/5lf4n5Cvna

— Resolution Foundation (@resfoundation) June 13, 2023

No so good news: both public and private sector pay are still falling in real terms – by 2.8% and 1.0% respectively. pic.twitter.com/YQ1iKQig4G

— Resolution Foundation (@resfoundation) June 13, 2023

Worth remembering that strong pay growth (while welcome news for workers) may well worry the Bank, and by extension anyone looking to remortgage, as it adds to the case for raising interest rates for longer.

— Resolution Foundation (@resfoundation) June 13, 2023

The labour market also continued to grow – with economic inactivity down and employment up.

Two key milestones have been passed in recent months, with employment levels and working hours both back above pre-pandemic levels. pic.twitter.com/Llcsqdyf37

— Resolution Foundation (@resfoundation) June 13, 2023

Lastly, it’s worth noting how the number of people out of work due to long-term sickness continues to rise, reaching a fresh record high of 2.55 million.

Tackling this issue will hold the key to further boosting the size of Britain’s workforce. pic.twitter.com/dk3hw8oQGD

— Resolution Foundation (@resfoundation) June 13, 2023

Bank’s new policymaker: lowering inflation to 2% will be hard

The newest Bank of England interest rate setter has warned that it will be tough to return inflation to the UK’s 2% target.

Megan Greene was speaking to the Treasury Committee this morning, as short-term bond yields continue to climb.

Greene, an economist who is joining the Bank’s MPC from consultancy group Kroll in July, told MPs that the BoE should act against signs of persistence in inflation.

She told the committee that halving inflation from its peak last winter will be easier than bringing it down to target, saying:

“I think that there is some underlying persistence and so getting from 10% to 5% … is probably easier than getting from 5% to 2%.”

Greene also says getting inflation from 5% to 2% is likely to be harder than from 10% to 5%. BoE will need to lean against inflation pressures.

— David Milliken (@david_milliken) June 13, 2023

Significantly, Greene then warns about the risks of relaxing monetary policy too soon.

She says:

“If you engage in stop-start monetary policy, you may end up having to tighten even more and generating an even worse recession on the other side.

“And also that inflation expectations can’t be allowed to become de-anchored or you end up in that situation.”

Looking at the inflation lessons of the 1970s, incoming Bank of England policymaker Megan Greene says it’s important to avoid stop-start policy or letting inflation expectations get de-anchored. (Lessons she thinks the BoE has absorbed.)

— David Milliken (@david_milliken) June 13, 2023

UK short-term borrowing costs have continued to soar above their mini-budget peak last autumn.

The yield on two-year gilts now trading at 4.83%, the highest since the 2008 financial crisis, up from 4.62% last night.

Newton-Smith doesn’t rule out CBI name change

Q: Is the CBI planning to change its name, Ian Lavery MP asks…

Rain Newton-Smith says the CBI’s name isn’t the most important issue, but doesn’t deny that a rebrand is an option.

She says the CBI’s listening exercise with business leaders found they believe the UK need a strong collective voice on business, and want the CBI to focus on issues such as sustainable growth, and improving employment and skills.

The CBI’s director-general tells MPs:

At some stage, if we change our name, would we move away from being the Confederation of British Industry? Again, it’s really one for our members.

In April, the Financial Times reported that “the crisis-stricken CBI will be renamed as part of efforts to demonstrate that it has reformed its toxic workplace culture”.

Ian Lavery MP asks whether the CBI is now unnecessary, as other business groups have “stepped up to the plate” since it was forced to pause its work.

[for example, the British Chambers of Commerce has launched a new Business Council to bring business leaders together]

Rain Newton-Smith says the CBI has been, and can be a really important voice on key issues – such as high inflation and the cost of living crisis, and weak growth.

She cites this Spring’s budget, which took on the CBI’s work on childcare reform, and work helping firms to decarbonise.

CBI won’t say how many members it has lost

The Business and Trade committee then ask Rain Newton-Smith how many members the CBI actually has left, following the crisis that engulfed the lobby group.

Director-general Rain Newton-Smith says the CBI has 1,200 direct members, which represents 2.5m private sector employees, plus 120 trade associations (which include 160,000 business organisations).

In contrast, Germany’s BDI has 39 sector association members, representing 100,000 businesses, she adds.

Q: The Labour party, HMRC…are advocating no direct senior-level connection with the CBI. How many members have you lost?

Newton-Smith says the CBI has lost ‘some members’, but won’t give a total.

[Back in April, more than 20 businesses cut ties with the CBI after the Guardian reported a second woman had alleged that she was raped by two male colleagues when she worked at the group.

That included Accenture, Arup, Aviva, BMW, Fidelity International, Jaguar Land Rover, Kingfisher, Phoenix Group, Sage and Virgin Media O2, with other companies pausing work with the CBI.]

Newton-Smith says the 1,200 members it represents now is a “really strong mandate” – and one that policymakers on both sides of the House of Commons should be listening too.

Q: But it’s very hard to tell if you still have the confidence of the industry as a whole, without knowing how many members you have lost… How will you regain trust with government departments?

Newton-Smith insists that the “vast majority” of members have stayed with the CBI.

The CBI has been “very open about its programme of change”, showing how seriously it takes its reforms, she adds.

It is also showing it has strong businesses behind it, she insists, and bats the question back to MPs, saying:

I would ask, what else do we need to do? I think we have a mandate that any politician or policymaker would respect.

We are putting ourselves in front of scrutiny, in front of parliament today.

We have the trust of our membership.

CBI chief: very confident that we can recover from the crisis

The new head of the CBI has declared she is very confident that it can recover from the crisis that has gripped the business lobby group this year.

Rain Newton-Smith, the CBI’s new director-general, is appearing before parliament’s business and trade committee now.

Committee chair Darren Jones MP starts by asking about the reputational damage caused by recent allegations (of multiple examples of sexual misconduct by senior figures at the CBI, reported by the Guardian).

Q: Are you and your members confident that you can recover from this period of reputational damage?

Newton-Smith, who returned to the CBI in April, says:

Yes, we are very confident that we can recover from the crisis that our organisation has gone through.

It has been a difficult time for us as an organisation, but we really responded to it and set out a programme of change.

Newton-Smith tells MPs that 93% of members voted in support of that programme last week, backing its plans around people and culture, and how its members want it to be a very strong voice for business.

Q: The victims involved in these cases want to see that you’ve understood the root causes that led to those situations arising. What have you found from the work have you done?

Newton-Smith says the CBI has looked into its organisation, and used independent experts such as law firm Fox Williams to investigate the allegations reported in the Guardian.

Consultancy firm Principia Advisory have surveyed over 90% staff, and ran 110 interviews to understand their experiences with the CBI

Q: So what were the root causes of the problems that occured?

Newton-Smith says the CBI has no information on the two alleged rapes, so it hasn’t been able to investigate those allegations.

But it has looked into the issue of whether women always felt supported when they raised concerns, and whether the CBI had the right processes and support processes.

The CBI wants to be very best organisation at supporting individuals as and when they they raise grievances, she says.

Q: So the governance at the CBI wasn’t right before because there wasn’t a channel to raise concerns?

Newton-Smith says governance was weaker than it should have been.

Although there was a whistle-blowing line, she says some staff didn’t feel confident in using it, or able to use it.

TUC: “Family budgets can’t take any more”

The TUC have warned that family budgets can’t take any more pressure, after wages continued to lag inflation in the last quarter.

That’s because basic pay growth, at 7.2%, was well behind April’s inflation reading of 8.7%, meaning real wages are still falling.

TUC General Secretary Paul Nowak says “working people have had enough”.

Nowak is urging the government to resolve the current public sector pay disputes, and lift the minumum wage to help low earners through the cost of living squeeze.

“It’s no wonder workers are reluctantly taking strike action to defend their living standards. They’ve been backed into a corner and pushed to breaking point.

“Ministers need to get round the table and resolve all of the current pay disputes.

“People need money in their pockets now.

“The government must give public sector workers a real pay rise, boost the minimum wage to £15 per hour, and end their draconian attack on the right to strike in the Strikes Bill.”

Today’s wage growth data (see opening post) highlight the risk of a wage-price spiral to inflation, says Josie Anderson, managing economist at the CEBR.

With regular pay growing at 7.2% per year, the highest on record (outside of Covid-19) times, the Bank of England is more likely to raise interest rates.

Anderson explains:

With inflation and wage growth both at very high levels, and unemployment remaining at just 3.8% in the three months to April, employees have been able to bargain for higher wages to cover their rising living costs.

As the volatile components of inflation, such as energy, bring down the headline rate of CPI, stickier components, such as consumer services, may cause inflation to persist. This will particularly be the case if wage growth stays high, as this will encourage businesses to raise prices in order to maintain their margins.

This morning’s wage growth data have, therefore, increased the likelihood of an interest rate rise from the Bank of England later this month. Cebr expects a 25 basis point hike, taking the base rate to 4.75%.”

Mortgage broker: Monday was horrendous

This morning’s surge in UK short-term borrowing costs comes amid turmoil in the mortgage market.

Yesterday, NatWest told mortgage brokers it was raising prices on some new and existing mortgages from today, including a 1.57% percentage point increase on some buy-to-led loans.

Santander paused new applications for certain products last night, ahead of launching a new range tomorrow.

That followed HSBC temporarily removing its “new business” residential and buy-to-let products last week, and Nationwide lifting its rates.

Lenders are struggling to keep their prices in line with interest rate expectations, since UK inflation fell much less than expected in April, to 8.7%. Once one pulls its business, potential customers flood to the next.

Today’s increase in two-year UK government bond yields will put more pressure on lenders to reprice mortgages higher.

Steven Morris, advising director at Advantage Financial Solutions LTD, says yesterday was “quite simply horrendous”.

Morris explains:

We had rate withdrawals and rate increases across the board. Some increases with high street lenders were as high as 1.57%. Some lenders paused lending altogether for a period. Withdrawal deadlines of just a few hours were given. My advice to customers right now is don’t even bother getting mortgage advice unless you are prepared to apply within a couple of hours.

Send your broker documents ASAP and up-front if possible or you don’t even stand a chance of getting a deal before it’s withdrawn.

He also urges borrowers to “be kind to your broker”:

They have a zillion other clients in the same position as you and with lenders giving just a few hours’ notice of products being withdrawn, are left having to choose which client to ‘save’.

Being a mortgage broker right now is like trying to stop the tide from coming in armed with a mop. Pointless.

Here’s our news story on this morning’s wage growth data, which is piling pressure on the Bank of England to raise interest rates even higher.

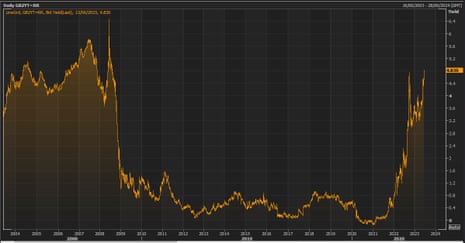

UK short-term borrowing costs highest since financial crisis

UK two-year borrowing costs are now at their highest level since the financial crisis, points out Bloomberg’s Kristine Aquino, following their jump today (see here).

And there we have it — two-year gilt yields have surged past the peak of the Truss turmoil and have hit 4.73%, the highest level since 2008.

While that’s quite the milestone, it’s well below the 5.75% level that traders currently expect for BOE borrowing costs. In that case, there may be more pain to come for gilts as markets come to grips with the prospect of even higher rates.

Here’s M&G’s Bond Vigilantes team on the jump in UK borrowing costs:

Newsflash: UK 2-year bond yields above Truss panic levels

Expectations that UK interest rates will keep rising are driving up the British government’s short-term borrowing costs ABOVE levels seen in Liz Truss’s brief premiership.

That’s bad news for people who looking to take out a mortgage, or remortage, soon.

The yield, or interest rate, on UK two-year government bonds has hit 4.73% this morning, up from 4.62% last night, after this morning’s jobs report showed regular pay growing at the fastest rate on record.

That is slightly higher than the peak seen in the turmoil after last autumn’s mini-budget, when chancellor Kwasi Kwarteng’s plan for unfunded tax cuts spooked the markets.

These two-year gilts are used to price fixed-term mortgages, and the recent increase in yields has already been forcing lenders to reprice deals, or pull them off the markets.

There could be more pain ahead too, as the money markets expect Bank of England base rate to hit 5.5% by the end of this year, up from 4.5% today.

Longer-dated government bond yields have also risen today, but are below their panic levels last autumn.

30 year yields still below the Trussonomics/LDI crisis level: 4.6% vs 5% then.

— Bond Vigilantes (@bondvigilantes) June 13, 2023

The surge in bond yields last autumn was partly driven by forced selling by pension funds who had followed Liability Driven Investment strategies, and by a lack of confidence in the Truss-Kwarteng plan.

Neil Wilson of Markets.com says the current situation is different, compared to last September when “the mini-Budget was doing its wrecking ball job”.

This time is different – LDI has unleveraged, and it’s not about the fiscal or political risk premium. It’s all about strong wage numbers driving expectations for the Bank of England to need to press hike button again and again.

We are now in wage-price spiral territory – private sector wage growth rose to 7.6% in the three months to April, whilst overall regular pay rose 7.2%. This only makes it harder for the BoE to cool inflation – a tougher stance is required but we know the dangers for the economy and notably the mortgage market if that happens.

On today’s jobs data, Minister for Employment Guy Opperman MP says:

“Our drive to get more people into work and grow the economy has seen inactivity fall for the fifth month in a row. Vacancies continue to drop, employment is up and the numbers on company payrolls are also up.

“We’re investing £3.5 billion to remove barriers to work – with extra support for people with health conditions, an expansion of free childcare and arming jobseekers with the skills they need through tailored training and extra work coach time.”

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)