[ad_1]

One of the fantastic things about free market capitalism and financial markets is how they keep adapting, changing and reinventing things as the world and its needs change. One such innovation is the introduction of ‘actively managed certificates’ (AMC) notes to our local JSE.

About two weeks ago, I was privileged to attend a JSE listing event where a number of new AMCs were listed, including two with portfolios managed by us [Integral Asset Management] – a local small/mid-cap portfolio and a global small/mid-cap portfolio).

ADVERTISEMENT

CONTINUE READING BELOW

A range of other AMCs were listed that day; since finalising the rules earlier this year, the JSE now has over 32 AMCs listed, which collectively have raised nearly R10 billion (see here)!

But what are AMCs, and why is there a need for them?

The above-linked JSE article does articulate what AMCs are, but there is a lot of jargon and complexity in understanding this. I am going to try and break it down simplistically.

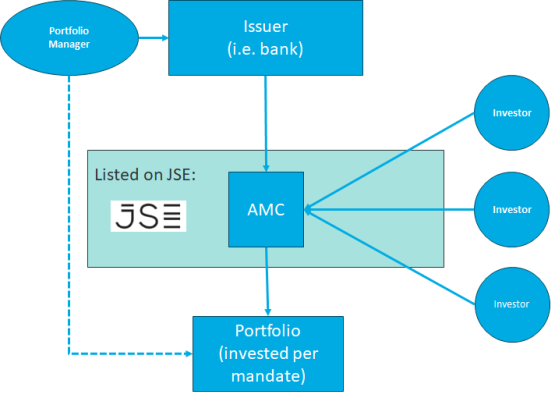

Basically, an AMC is the following setup with individual participants in bold:

- An issuer (normally a big bank) issues a note that it lists on the JSE;

- The value of the note attaches to an underlying portfolio – i.e. NAV (net asset value) that is managed by a portfolio manager per a predefined mandate; and

- Investors can buy and sell this note on the JSE, which shows up in the note as inflows or outflows of capital.

A visual representation of this structure and its relationships:

Source: Integral Asset Management

Put differently, an AMC is a ‘structure’ to house a portfolio for an investor to have a single entry point to invest (or disinvest) and for a portfolio manager to have a single place to manage multiple investors’ capital in a single pool. The issuer (the bank) serves as the neutral third-party administrator of this structure, and the JSE offers a central distribution platform for all the parties and their capital to meet.

If lots of this sounds similar to either an exchange-traded fund (ETF) or a unit trust, then you are correct.

Some differences are that ETFs are passive and merely track mechanical indices (AMCs are actively managed), and unit trusts are not listed on the JSE and cannot be bought in your brokerage account (but AMCs are listed and can be).

ADVERTISEMENT

CONTINUE READING BELOW

Some of these differences offer clues as to the problems AMCs are trying to solve: actively managed and listed are key here, while the speed and flexibility of these structures is an added bonus to investors and investees.

Particularly, unit trusts are encumbered with onerous legislation and rules that, while aiming to protect unitholders, at worst force many fund managers to fight with one arm tied behind their backs, or, at best, just result in more costs in running these vehicles. Likewise, an ETF is only as good as its index and is inflexible in design.

Hence, the wonderful evolution of our market where we now have AMCs to buy and sell on the JSE.

Locally, investors now have another investment product to choose from. More options are always better than fewer – thus, I applaud the regulators, JSE and banks for bringing AMCs to South Africa.

Keith McLachlan is chief investment officer at Integral Asset Management.

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)