Different companies use different alternatives to meet their financial needs. There are many funding options available to businesses including non-banks, traditional banks, government agencies, equity and debt funding, Micro factoring and even crowdfunding.

Applying for a business loan is a standard way to deal with volatilities in cash flow, and many people often prefer short-term loans over traditional financing.

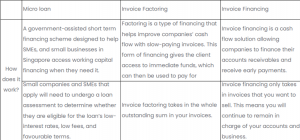

Microloans also called micro factoring, invoice factoring loans and invoice financing are types of short-term loans that businesses can apply for to help maintain and improve their liquidity. But how do you choose the right loan for your business and which is the best option for you?

Following table can help you understand the options and decide.

But Micro factoring and Micro financing sound the same; how are they different from each other?

Many people seem to confuse micro factoring (invoice factoring) and micro financing (invoice financing), as the two terms are often used interchangeably. In fact, micro-factoring is a form of micro- financing. However, when most people use the term “invoice or micro financing,” they are referring to accounts receivable financing. Micro financing or invoice financing is actually very similar to invoice factoring. However, with these types of loans, your unpaid bills will serve as collateral to secure the credit limit. The size of your credit limit depends on the amount of your bill.

With invoice factoring, you receive a lump sum payment from the factor based on the total value of the invoice. In short, the factoring company buys your invoice rather than taking a portion of it. Factoring companies are therefore responsible for collecting payments from your customers.

But with invoice financing, the invoice still belongs to you and is only used as collateral. This means that it is your responsibility to collect money from your customers.

In summary, with Micro-financing you can choose which invoices to finance when you need it. With invoice factoring, on the other hand, you might expect less flexibility, as the invoice amount is usually pushed into the order received.

For short-term loans, many aspects will help you decide which type of loan is best for your existing and future business. Some elements are loan amount, interest rate, eligibility requirements, loan payment and repayment period.

In conclusion, if you need quick cash flow to boost your business, or if unpaid bills are holding back your business, it’s time to consider a short-term loan to keep you running and increasing your profits. With microloans, invoice financing and micro factoring, you can get the money you need even if you don’t qualify for a traditional loan. Consider what type of financing is best for your business, find the most affordable rates, and choose a lender based on your business’s financial needs to keep it running like a well-oiled machine.

Micro-factoring provides the following benefits:

- Improve cash flow

- unlimited funds

- Eliminate bad debts

- Reduce operating expenses

- Expand working capital financing

- Improve management information

- Factoring is quick and easy

- No bank loan or SBA loan required

- Free yourself from time-consuming activities such as credit checks, bookkeeping and debt collection

Micro factoring is the same as standard accounts receivable factoring, but it applies to the following types of business:

- Start-ups

- has just entered the wholesale market

- Having few customers according to payment terms

- hand made or homemade products

- Discard the shipped items

- Service companies with one or more employees

- Not eligible for a bank loan

You can read more about what is micro factoring, how is factoring done, what are the challenges involved in this PDF. Download the PDF here.