[ad_1]

NFT and crypto trading analytics site DappRadar made a stunning announcement yesterday. During a bear market, traders poured over $311m of sales volume into virtual worlds in Q1 2023. What helped cause this surge in buying virtual world NFT projects?

Image Credit: DappRadar

What caused $311m in sales volume for virtual worlds in Q1?

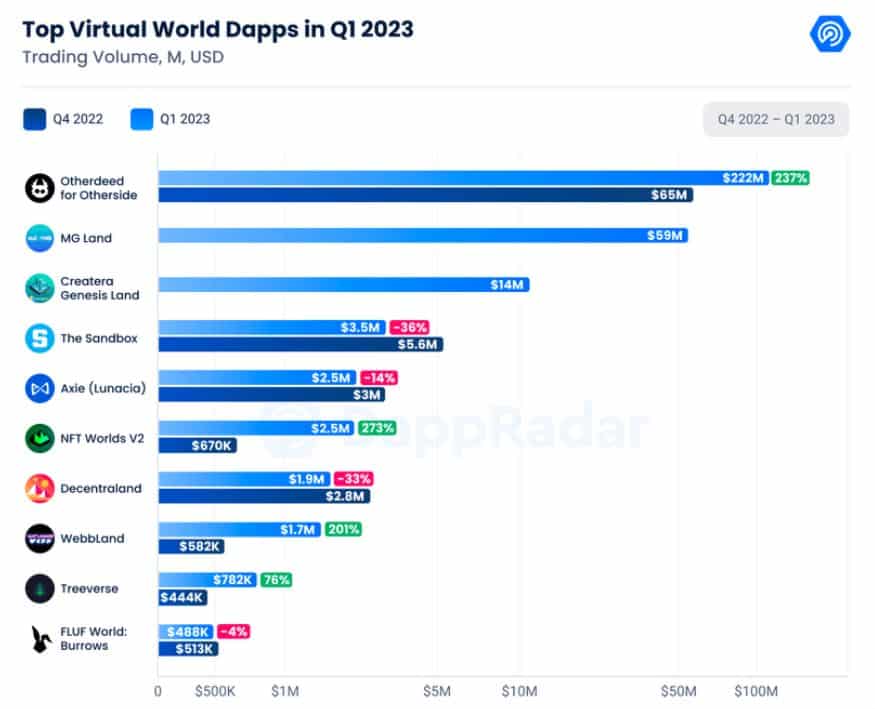

DappRadar attributes the majority of the record-breaking sales volume to Yuga Lab’s Otherside. The metaverse NFT project saw $222m of trading volume, good for an increase of 237% in trading volume over the previous quarter.

This market frenzy came after Yuga Lab’s announced a date for its “Second Trip” into the Otherside. The NFT community will get a new look at their upcoming metaverse on March 25. The previous sneak peek was a success, and many traders are betting that Yuga will also impress with tomorrow’s second glimpse into the Otherside.

NFT trading on Blur is also responsible for the high trading volume, DappRadar reports. The disruptive NFT platform injected hundreds of millions of dollars into the NFT ecosystem with its last airdrop, and the window to qualify for their next round of airdrops is running now. To qualify, traders must bid on collections and list NFTs close to project floors. Free money is always a compelling proposition. Not surprisingly, traders are buying in by flooding Blur’s order books with market activity.

Airdrop farmers targeted one project in particular, for example. MG Land, a metaverse project that allows users to meet friends and play games in their virtual world, registered over $60m of trading volume in Q1. This $60m volume was higher than the volumes of well-known virtual land projects Axie Infinity, Sandbox, and Decentraland.

NFT traders used Blur’s zero royalty platform to wash trade MG Lands assets back and forth. Many critics pointed to MG Land’s trading activity as an example of artificial market dynamics created by Blur’s airdrop campaign, complaining that the buyers and sellers had no interest in the actual project itself.

These claims do seem correct. Blur turned off the ability for traders to earn points by buying and selling MG Land, and the project’s floor immediately crashed to .03 eth after reaching a high of .15 eth in early March.

What does the future hold for NFT trading in virtual worlds?

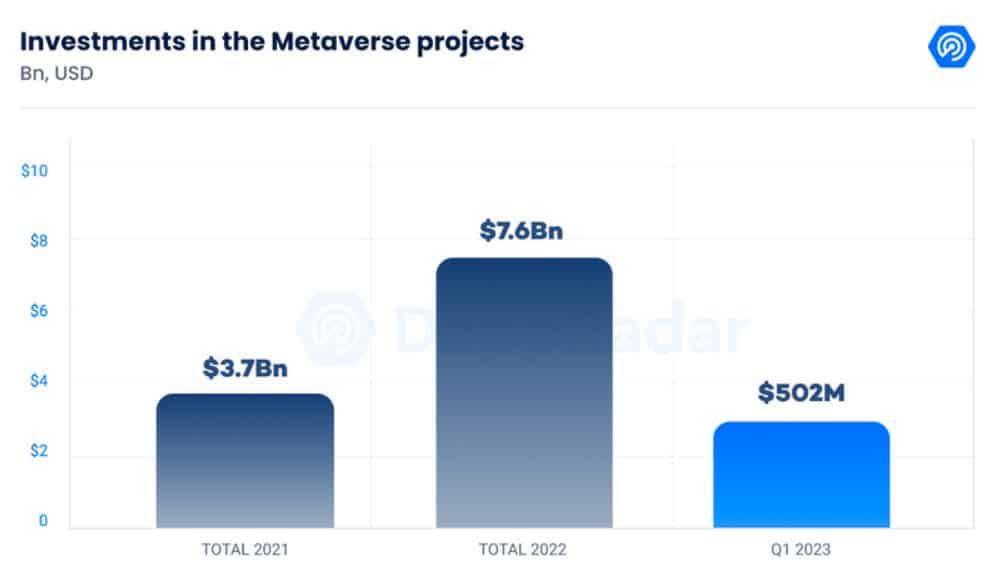

The trading volume for virtual worlds does not seem like an isolated phenomenon. In 2021, investors put $3.7b of funds into metaverse and blockchain gaming projects. That number nearly doubled to $7.6b in 2022. This year has been rough for markets. Many economists are predicting worldwide recessions as central banks struggle to reduce inflation amidst meltdowns in the banking industry. With over $500m invested in Q1 2023, however, there seems to be plenty of appetite for exposure to the growing sectors of metaverse projects and blockchain gaming.

Image Credit: Dappradar

Humanity seems destined to become more digitally native over time as a species. It seems inevitable, therefore, that we’ll be spending more and more time in virtual worlds. As we do so, we’ll also continue to place an increasing amount of emphasis on owning digital assets in our metaverses. For these reasons and as data from DappRadar indicates, it’s clear that trading NFTs in virtual worlds projects will continue to be a huge business.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.

[ad_2]

Source link