OPINION:

The Federal Reserve has dropped another anvil on the U.S. economy in its ongoing effort to tamp down the raging effects of inflation. Thanks to President Biden’s foolish, 2-year-long spending spree, financial equilibrium can only be restored by delivering a beatdown to hardworking Americans.

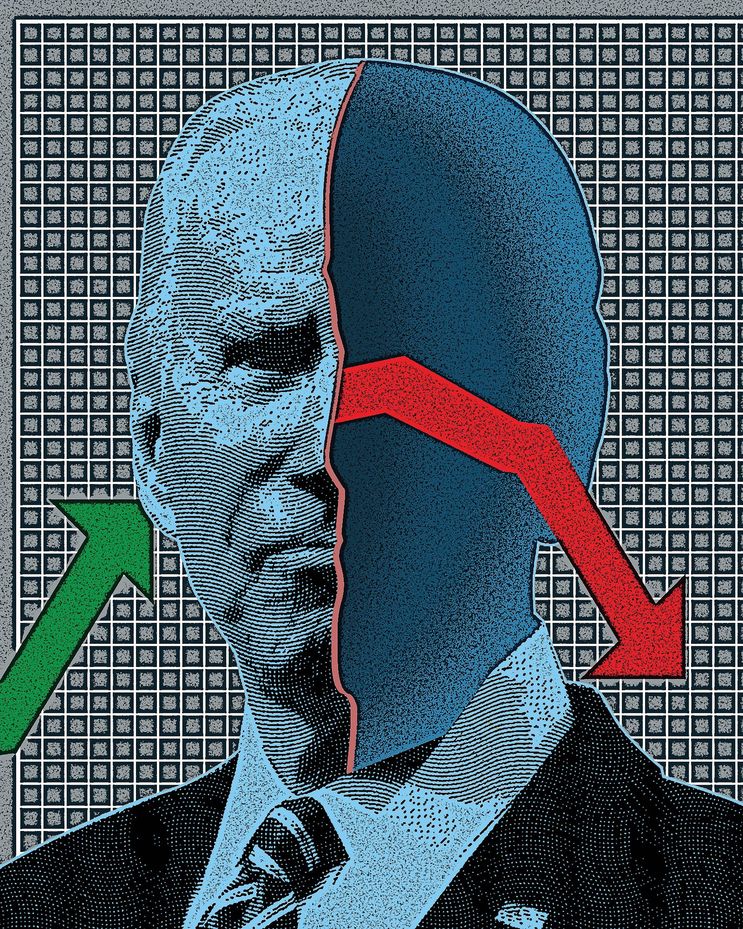

Federal Reserve Chairman Jerome Powell led Fed policymakers in unanimously opting for a widely anticipated three-quarter-point increase as their meeting concluded last week. The fourth consecutive such increase brings the central bank’s benchmark rate to a range of 3.75% to 4%.

Mr. Powell warned in a statement that future hikes are likely to reach the Fed’s target of 2% inflation, but he hinted that further increases could ease as a result of “the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” Americans can only hope his hunch proves on the money. Thus far, the steepest rate increases in four decades have done little to tame inflation, which eased only slightly from a high of 9.1% in June to 8.2% by September.

On top of year-over-year costs of necessities such as food, climbing 11%, and energy, up 20%, the relentless Fed rate increases have sent consumer borrowing costs spiraling upward. Mortgage rates that stood below 3% two years ago have surged above 7%, adding more than $600 to the monthly payment on an average home.

Given inflation’s stubborn persistence, the Fed’s painful battle is likely far from finished. Older Americans can only grimace when recalling a similar era when then-Fed chief Paul Volcker took the quick-and-dirty approach to crushing inflation in the early 1980s. After a peak of 14.8% in March 1980, Mr. Volcker hammered down inflation with successive rate hikes that crested at 20% in June 1981. The price of putting the U.S. economy back in order was putting Americans out of work, as unemployment reached 10%.

Senate Banking Committee Chairman Sherrod Brown, Ohio Democrat, pleaded with Mr. Powell by letter last week not to wield such extreme measures. “We must avoid having our short-term advances and strong labor market overwhelmed by the consequences of aggressive monetary actions to decrease inflation, especially when the Fed’s actions do not address its main drivers,” Mr. Brown wrote.

Mr. Biden and fellow Democrats have spent wildly on wealth distribution programs under the banner of coronavirus remediation — even as the pandemic ebbed. Yet they claim neither the Biden $4.8 trillion binge nor his war on fossil fuels that power the economy are the “main drivers” of inflation, but rather the global pandemic and Russia’s invasion of Ukraine. Baloney. When the world’s largest economy sneezes, the entire planet catches cold, not the other way around.

Only the cruel-hearted would welcome a victory over inflation wrought from deep recession and surging unemployment. Were the Federal Reserve to lose its nerve and suspend its rate-hike campaign, though, persistent inflation would eat away at Americans’ substance year after year.

As the Federal Reserve drops progressively heavier interest rates on inflation, Americans are paying dearly for Mr. Biden’s profligacy. On Election Day, voters left poorer have their chance to treat the president’s party to payback.

(This article is generated through the syndicated feeds, Financetin doesn’t own any part of this article)