[ad_1]

Eurozone falls into recession

Newsflash: the eurozone has fallen into recession, new data shows, as its economy contracted over the winter.

GDP across the euro area shrank by 0.1% in the first quarter of this year, downgraded from a previous estimate that the economy stagnated.

That follows a 0.1% contraction in GDP in the fourth quarter of last year, meaning the eurozone has shrunk for two quarters in a row – the standard definition of a recession.

It was dragged down by Ireland, where GDP fell by 4.6% in the first quarter of this year – although economists have questioned whether that really reflects the performance of the Irish economy.

Lithuania’s economy shrank by 2.1%, while the Netherlands contracted by 0.7%,

Germany, Europe’s largest economy, shrank by 0.3% and is also in recession.

Poland (+3.8%) recorded the highest increase of GDP compared to the previous quarter, followed by Luxembourg (+2.0%) and Portugal (+1.6%).

Europe’s economy has been hit by the economic disruption caused by the Ukraine war, which has pushed up energy and food prices.

That had prompted a series of interest rate rises, as the European Central Bank tried to battle higher inflation.

🇪🇺 BREAKING: the euro area enters a technical recession as Q1 GDP is revised lower to -0.1% QoQ.

NOT BREAKING: the euro area economy which remains resilient thanks to strong services and labour market.

— Frederik Ducrozet (@fwred) June 8, 2023

Key events

Eurozone GDP: the details

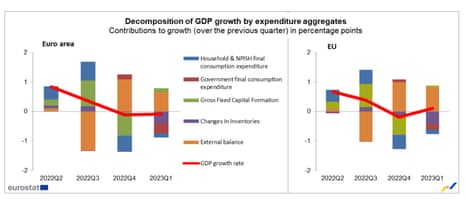

Falling household and government spending helped to push the eurozone into recession.

Household final consumption expenditure decreased by 0.3% in the euro area during the first three months of this year, following a 1% drop in the fourth quarter of 2022.

Government final consumption expenditure (which tracks government spending on goods and services) decreased by 1.6% in the euro area in January-March.

Gross fixed capital formation, which tracks investment, increased by 0.6% in Q1.

But trade deteriorated. Exports decreased by 0.1% in the euro area while imports dropped by 1.3%, showing that demand was hit by the cost of living squeeze.

The eurozone recession will come as a blow after politicians and European Central Bank officials said repeatedly that a downturn could be averted even as inflation rocketed to its highest level since the euro was introduced, Bloomberg says.

But… this is the smallest possible recession – just two quarters of a modest contraction in economic output.

Bloomberg adds:

But policymakers will take heart that their billions of euros in aid for households across the bloc meant that fears of much more severe economic damage in the wake of Russia’s invasion didn’t come to pass.

Eurozone recession: instant reaction

Despite falling into recession, the eurozone economy “remains resilient thanks to strong services and labour market”, says Pictet Wealth Management’s Fred Ducrozet:

🇪🇺 BREAKING: the euro area enters a technical recession as Q1 GDP is revised lower to -0.1% QoQ.

NOT BREAKING: the euro area economy which remains resilient thanks to strong services and labour market.

— Frederik Ducrozet (@fwred) June 8, 2023

But ING’s Carsten Brzeski warns that the eurozone faces stagnation.

And it’s a recession after all: #Eurozone GDP growth revised downwards to -0.1% QoQ for both Q4 22 and Q1 23. Here goes strong resilience and comes stagnation.

— Carsten Brzeski (@carstenbrzeski) June 8, 2023

Eurozone falls into recession

Newsflash: the eurozone has fallen into recession, new data shows, as its economy contracted over the winter.

GDP across the euro area shrank by 0.1% in the first quarter of this year, downgraded from a previous estimate that the economy stagnated.

That follows a 0.1% contraction in GDP in the fourth quarter of last year, meaning the eurozone has shrunk for two quarters in a row – the standard definition of a recession.

It was dragged down by Ireland, where GDP fell by 4.6% in the first quarter of this year – although economists have questioned whether that really reflects the performance of the Irish economy.

Lithuania’s economy shrank by 2.1%, while the Netherlands contracted by 0.7%,

Germany, Europe’s largest economy, shrank by 0.3% and is also in recession.

Poland (+3.8%) recorded the highest increase of GDP compared to the previous quarter, followed by Luxembourg (+2.0%) and Portugal (+1.6%).

Europe’s economy has been hit by the economic disruption caused by the Ukraine war, which has pushed up energy and food prices.

That had prompted a series of interest rate rises, as the European Central Bank tried to battle higher inflation.

🇪🇺 BREAKING: the euro area enters a technical recession as Q1 GDP is revised lower to -0.1% QoQ.

NOT BREAKING: the euro area economy which remains resilient thanks to strong services and labour market.

— Frederik Ducrozet (@fwred) June 8, 2023

In the City, shares in Vodafone have dropped 4.5% to the bottom of the FTSE 100 leaderboard, amid expectations that a merger with CK Hutchison could be announced imminently.

Vodafone and CK Hutchison, which owns Three, are reportedly in the final stage of agreeing to merge their British operations. An announcement could come as soon as Friday or early next week.

Reuters has reported that Vodafone will own 51% and Hutchison 49% of the combined group, which could be worth around £15bn including debt.

The two companies have been talking for months, with Hutchison’s chief financial officer Frank John Sixt saying last month that it was proving “extremely difficult” to get it over the line.

UK business conditions remain “challenging”, according to the latest realtime data from across the economy.

But there are some small signs of improvement last month, the Office for National Statistics reports. Fewer companies voiced concerns about their prospects, and around two-thirds were able to get the materials, goods and services they need from within the UK.

Latest results from our Business Insights and Conditions Survey (live from 15 to 28 May 2023) suggest business conditions continue to remain challenging, but estimates show small signs of positive improvement for some measures.

➡️ https://t.co/lCsyFTOOD4 pic.twitter.com/gFu3xpSmwz

— Office for National Statistics (ONS) (@ONS) June 8, 2023

65% of trading businesses said they were able to get the materials, goods or services they needed from within the UK in April 2023 🧱 🚚 🏦

This is unchanged from March 2023.

— Office for National Statistics (ONS) (@ONS) June 8, 2023

When asked in May 2023, 68% of businesses reported they had some form of concern for June 2023 🙍

This is:

▪️ down from the 71% reporting concerns the previous month for May 2023

▪️ the lowest percentage reported this year— Office for National Statistics (ONS) (@ONS) June 8, 2023

23% of businesses said their employees’ hourly wages had increased in April 2023 compared with March 2023 (14%) 💷

For businesses with over 10 employees this was 48% in April 2023 compared with March 2023 (23%) 💰

— Office for National Statistics (ONS) (@ONS) June 8, 2023

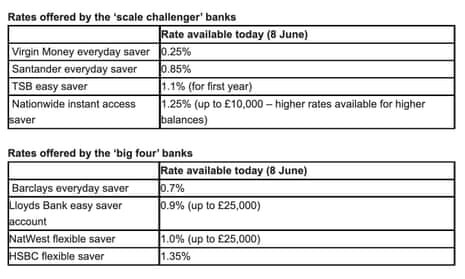

MPs: Banks must ‘up their game’ and pass on interest rate rises to savers

Parliament’s Treasury Committee are urging UK banks to pass on higher interest rates to savers.

The Treasury Committee has been investigating retail banks since February, when UK interest rates were 4%. At that stage, the big four banks offered between 0.5% and 0.65% on their easy access savings accounts.

Today, they’re offering between 0.7% and 1.35%, while Bank Rate has been raised to 4.5%.

Harriett Baldwin MP, chair of the Treasury Committee, said:

“With the Bank of England confirming the pass through of base rate increases to easy access savings accounts has been unusually weak, it’s clearer than ever that the nation’s biggest banks need to up their game and encourage saving. While other products are available to those who shop around, the measly easy access rates on offer lead us to conclude that loyal customers are being squeezed to bolster bank profit margins.

“We remain concerned that the loyalty penalty is especially prominent for elderly and vulnerable customers who may still rely on high street bank branches.”

It would be a mistake for the government to heed calls from housebuilders to restart the Help To Buy scheme, argues Graham Cox, founder of the Bristol-based broker, SelfEmployedMortgageHub.com.

Help To Buy, introduced in 2013, provided government-backed loans to purchase a new-build home, and shut at the end of March.

Homebuilders benefitted from the pick-up in sales, so it’s not surprising that Crest Nicholson is today urging ministers to provide some form of assistance.

Cox says:

“Desperation emanates from every word of Crest Nicholson’s trading statement, as they implore the government to do something, anything, to stem the tide. No doubt they would love Help to Buy to make a comeback, as they’ve made huge profits off the back of it over the past decade.

It would, however, be a huge mistake, which is not to say the government won’t make it, particularly with the Tories languishing in the polls. What really helps people buy is cheaper house prices. Help to Buy only increases them.”

Former chancellor George Osborne has claimed that Help to Buy “helped hundreds of thousands of families buy their own home and supported thousands of construction jobs”.

Housing experts, though, warn that it inflated the housing market and swelled housebuilders’ profits.

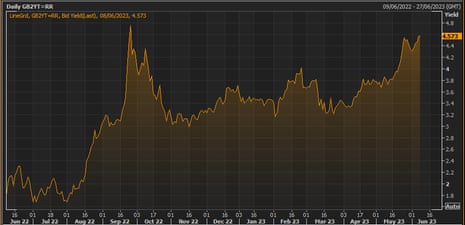

There are jitters in the bond markets this week, as traders recognise that global central banks are far from finished fighting inflation.

Bond prices have fallen, driving up the yield (or interest rate) on government borrowing, which is a sign that investors expect interest rates to keep rising.

Already this week, two central banks – in Australia and Canada – have surprised the markets by raising borrowing costs, when they were expected to hold them steady.

This morning, UK short-term borrowing costs have hit the highest level since the mini-budget turmoil last autumn. The yield (or interest rate) on UK two-year gilt yields has hit its highest level since late last September, at 4.6%.

Those gilts are used by banks and building societies when pricing mortgages, so rising yields will feed through to higher borrowing costs.

Shares in housebuilder Crest Nicholson have dropped almost 4% in early trading, after it flagged slowdown worries.

Investors are reacting to its 60% drop in profits and warned that rising interest rates would cool the markets (see early post).

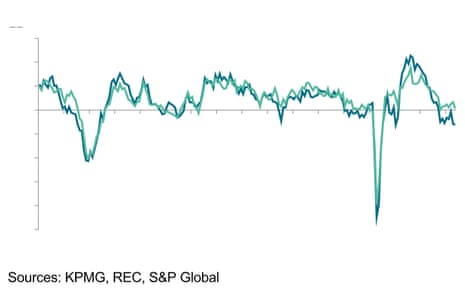

UK jobs market shows signs of cooling

Britain’s labour market cooled last month, with the starting salaries paid to permanent staff rising at the weakest pace in over two years.

The latest Jobs Survey from KPMG and REC has found that economic uncertainty continued to dampen hiring activity in May.

Hiring in hospitality, healthcare and engineering remained strong, but demand is weakening in construction, IT and retail.

Permanent staff appointments fell for the eighth month in a row, as companies cut back on hiring, with vacancies expanding at the second-softest rate since early 2021.

Caution around the outlook and delayed decision-making led to a further marked fall in permanent staff appointments, while temp billings rose only slightly, recruitment consultants reported.

Neil Carberry, REC chief executive, said:

“Despite the overall temporary work market continuing to grow – and permanent hiring declining from the sugar rush of 2022 – the story can vary widely across different businesses as their economic outlook remains unclear.”

In the travel sector, budget airline Wizz Air is hopeful of returning to profit this year.

Wizz almost doubled its passenger numbers in the last financial year, to 31 March, carrying 51m (a company record), up from 27m the previous year when pandemic disruption hit demand.

That helped narow its losses by 16% in the last financial year, to €535m.

And it hopes to make a net profit this financial year of €350m-€450m, helped by increased demand. However, “adverse exogenous events” such as an incremental impact from the war in Ukraine or delays to deliveries of new planes could disrupt that.

Housebuilder Crest Nicholson warns higher interest rates will hit demand

One of the UK’s building firms is warning of a further slowdown in the housing market this morning too, and urging more action from the government.

Crest Nicholson has reported a fall in revenues in the six months to 30 April to £282.7m, down from £364m a year before. Adjusted pre-tax profits more than halved to £20.9m, from £52.5m.

Peter Truscott, chief executive, says the period began amid “the worst of the economic uncertainty arising from the September 2022 mini-budget”.

Rapidly falling consumer confidence and rising interest rates immediately led to softer demand in the housing market, Truscott explains. And although confidence has returned, Crest Nicholson fears that rising interest rates will cool demand further.

Truscott says:

The economic case for buying a home therefore remains compelling, but for many first time buyers the higher cost of borrowing and the cessation of Help to Buy are prohibitive to realising this ambition.

If interest rates continue to rise, and remain elevated for a sustained period of time, this will undoubtedly exacerbate this issue even further and start to impact demand and confidence again. We continue to call on Government to recognise this challenge and provide further support to these potential homeowners.

Mortgage rates in the UK have been rising in recent weeks, and some lenders have also pulled deals from the market.

It emerged last month that Rishi Sunak was drawing up plans to boost support for first-time home buyers, as part of the next general election campaign.

Officials in Downing Street and the Treasury are looking at proposals to help thousands of renters who have been unable to get on the housing ladder in the face of high prices and rising interest rates, The Times reported at the start of May.

Introduction: ‘Storm clouds are gathering’ for the property market, warn surveyors

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Storm clouds are gathering over the UK property market, according to the country’s surveyors.

The Royal Institution of Chartered Surveyors (RICS) is warning this morning that expectations of further interest rate rises from the Bank of England may put renewed downward pressure on the market in the months ahead.

RICS’s monthly healthcheck on the property sector has found some improvement in market conditions during May, with the first rise in new instructions since early 2022. House prices continue to fall in much of England, although Scotland and Northern Ireland have witnessed an uplift.

RICS Senior Economist, Tarrant Parsons, says there was a modest recovery in the sales market activity during May, with generally less negativity compared to the end of 2022.

But he warns that expectations of further interest rate hikes will hit demand and affordability.

“However, it seems storm clouds are gathered, with the UK’s stubbornly high inflation likely undermining the recent improvement in activity by prompting the Bank of England to take further action through interest rate rises, leading to higher mortgage rates and ultimately reducing affordability and buyer demand.

The banking sector appears to expect this with many banks and building societies already introducing products with higher interest rates.

MKT condition metrics look sunnier in May but recent inflation blow could see storm clouds closing in.

-New buyer enquiries inc from -34% in April to -18%.

-New instructions inc +14%

-Surveyors cite further falls in national prices of -30% (least neg fig in 3mths) @RICSnews pic.twitter.com/hgGey1dTXD— Emma Fildes (@emmafildes) June 8, 2023

Yesterday morning, Halifax reported that house prices experienced their first annual fall in more than a decade last month.

The Bank of England has already raised interest rates 12 times in a row, and the City currently expects another rise this month, from 4.5% to 4.75%. They could hit 5.5% by the end of the year, the money markets indicate.

Interest rate rises are also impacting the rental sector, encouraging landlords to leave the sector and sell up property, Parsons adds.

Also coming up today

The UK’s financial regulator has unveiled a major shake-up of the rules around marketing of cryptoassets.

The crackdown from the Financial Conduct Authority will include banning the so-called “refer a friend” bonuses that are popular in the industry. Promoters must also ensure adverts are clear, fair and not misleading, and ensure people have the appropriate knowledge and experience to invest in crypto.

Sheldon Mills, executive director at Consumers and Competition, said:

“It is up to people to decide whether they buy crypto. But research shows many regret making a hasty decision. Our rules give people the time and the right risk warnings to make an informed choice.

“Consumers should still be aware that crypto remains largely unregulated and high risk. Those who invest should be prepared to lose all their money.

“The crypto industry needs to prepare now for this significant change. We are working on additional guidance to help them meet our expectations.”

The agenda

-

9.30am BST: Latest UK economic activity and business insight data

-

10am BST: Eurozone growth figures for Q1 2023 (third estimate)

-

1.30pm BST: US weekly jobless data

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin neither support nor own any part of this article)