[ad_1]

Diego Thomazini

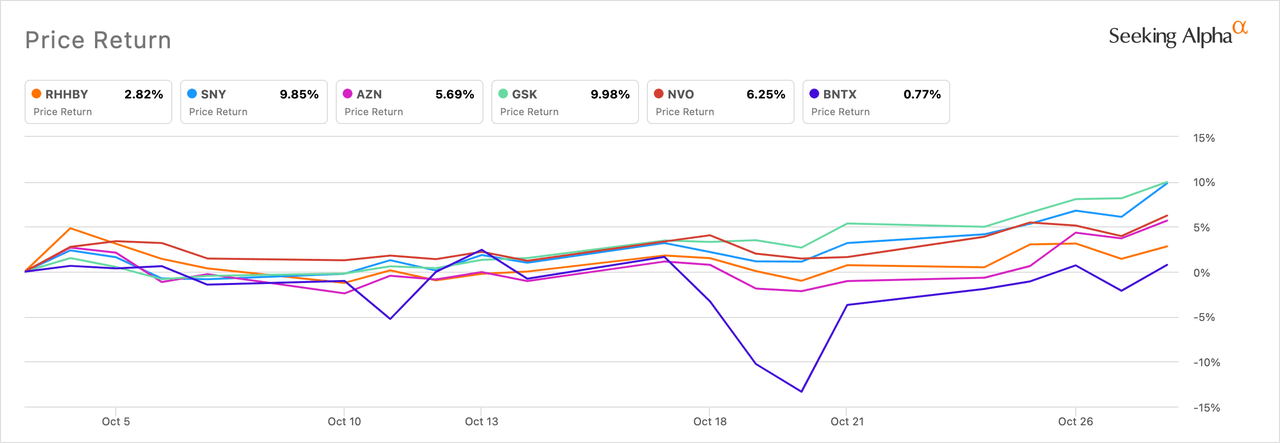

GlaxoSmithKline (NYSE:GSK) and Sanofi (NASDAQ:SNY) were the two best performing large cap European pharmaceutical companies in October as both returned ~10%.

GSK (GSK) was buoyed in the month by strong phase 3 efficacy results for its respiratory syncytial virus (RSV) vaccine candidate.

The European Medicines Agency and Japanese regulators accepted applications for the candidate later in the month. Additional global regulatory filings for the candidate are expected by the end of the year.

The British pharma was also helped by a US FDA advisory panel’s overwhelming vote in favor of aprodustat for anemia caused by chronic kidney disease.

Check out Seeking Alpha’s contributor John Kingham’s assessment of GSK (GSK) from a dividend investor’s perspective.

Sanofi’s (SNY) strong October showing was greatly impacted by its robust Q3 2022 financial results, which not only beat on the top and bottom lines, but also led to the company’s raising its full-year guidance.

In the month, Sanofi also released positive phase 3 data on Dupixent (dupilumab) for children with eosinophilic esophagitis.

Seeking Alpha’s Quant Rating views Sanofi (SNY) as a hold with high marks for profitability and revisions.

Novo Nordisk (NVO) was the third best performer of the month with a ~6.3% return.

The highlight for the company came early in the month with phase 3 data showing that its insulin icodec bested once-daily basal insulin in terms of lowering A1c. Novo (NVO) expects to apply for approval with regulators in the US, EU, and China in 1H 2023.

Read why Seeking Alpha contributor Daniel Schonberger says that Novo (NVO) is a hold because the stock is pricey.

AstraZeneca (NASDAQ:AZN) was the fourth best performer with a 5.7% return.

Perhaps the biggest development for the UK pharma in the month was the approval of Imjudo (tremelimumab) in combination with Imfinzi (durvalumab) to treat adult patients with unresectable hepatocellular carcinoma.

Later in the month, phase 2 data on camizestrant showed survival benefit compared to Faslodex (fulvestrant) in certain breast cancer patients.

Check out Seeking Alpha contributor’s Keith Williams’ deep dive on investing in AstraZeneca (AZN).

The worst performer of the month was BioNTech (NASDAQ:BNTX), which eked out a small gain of 0.8%.

BioNTech (BNTX) was hurt in the month by reports that uptake in the US of the update COVID-19 booster shots has been weak.

The German biotech will release Q3 2022 earnings on Monday before the closing bell, and the consensus EPS and revenue estimates reflect massive declines from the year-ago period.

Seeking Alpha’s Quant Rating views BioNTech (BNTX) as a hold with high marks for valuation, growth, and profitability.

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)