[ad_1]

The Federal Reserve on Wednesday opted for a dovish hike over a hawkish pause with the banking system still seemingly on fire, or as Elon Musk just tweeted, “melting.”

But whether it was the right move or not, the central bank acknowledges it might be close to the end of the rate-hike cycle, as it downgraded its views of further increases to “some additional policy firming” from “ongoing increases in the target range.”

And if the Fed is near the end of the rate-hike cycle, it also follows that the days of peak inversion have probably come and gone. The market sure seems to think so — the gap between the 2-year

TMUBMUSD02Y,

and the 10-year

TMUBMUSD10Y,

yield reached as much as 1.08 percentage points on March 8, but as of Wednesday stood at just 49 basis points, after SVB Financial, Silvergate and Signature Bank relocated to the big bank regulator in the sky. Deutsche Bank is now recommending a trade betting on the curve steepening for the first time in more than three years (more on that later).

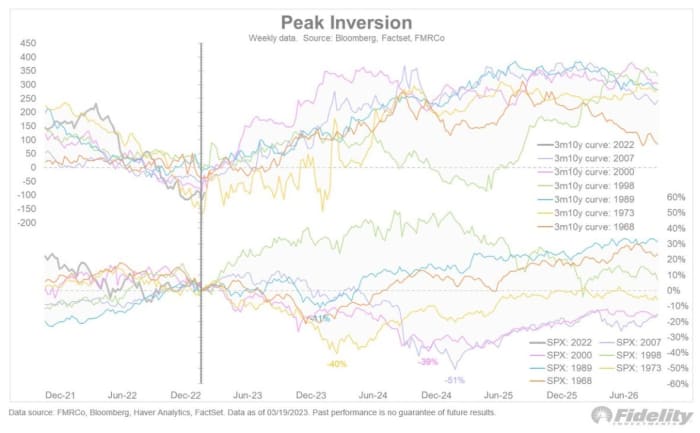

Jurrien Timmer, director of global macro at Fidelity Investments, looked at the intersection of yield-curve inversions and the stock market. He acknowledges the signals are “frustratingly disparate” in terms of lead time and magnitude, but what typically happens is the market holds up for a bit, and then there are big drawdowns in the months that follow. He studied the 3-month

TMUBMUSD03M,

versus 10-year inversion for his analysis.

Fidelity/Bloomberg/Haver

The worst performance was after the inversion in 2007, when the S&P 500

SPX,

drawdown reached as much as 51%. Of course, that was after the global financial crisis. But other drawdowns were pretty steep too, including 40% after the 1973 inversion (oil crisis) and 39% after 2000 (dot-com bust).

Fidelity/Bloomberg/Haver

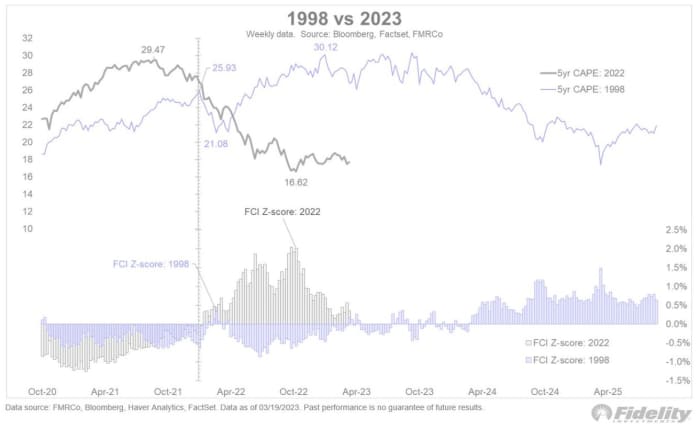

Timmer posted another chart, showing both five-year cyclically adjusted price-to-earnings ratios and financial conditions indexes. Long-Term Capital Management collapsed in 1998, the Fed pivoted, and the dot-com bubble swelled in size. “I don’t see a repeat of this outcome, since we already had a similar bubble, but it’s an analog to keep in mind,” he said.

“Be careful what you wish for when it comes to Fed pivots,” he says.

The markets

Stock futures

ES00,

NQ00,

were moving higher after the big drop on Wednesday, which was tied to Treasury Secretary Janet Yellen saying there was no blanket deposit guarantee being weighed. Crude futures

CL00,

were struggling to hold onto $70 per barrel.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Central bank decisions continue to trickle in from around the world, including the Swiss National Bank making a half-point rate hike. The Bank of England is expected to lift rates by a quarter-point after a hot inflation print.

Jobless claims and new-home sales are the highlight of the economics calendar.

The regional banks including First Republic Bank

FRC,

and PacWest Bancorp

PACW,

were trading higher in premarket trade. The Fed at 4:30 p.m. will release data for the second time on its new facility, the Bank Term Funding Program, after $2.1 billion of usage in its first few days of operation.

Coinbase Global

COIN,

late Wednesday disclosed that the Securities and Exchange Commission is close to bringing an enforcement action over issues including its staking service.

Best of the web

Anxiety strikes the $8 trillion market for mortgage-backed securities after SVB’s collapse.

The bank crisis could cast a pall over the commercial real estate market.

A study finds being a loyal employee will just subject you to extra work.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

GME, |

GameStop |

|

TSLA, |

Tesla |

|

FRC, |

First Republic Bank |

|

AMC, |

AMC Entertainment |

|

BBBY, |

Bed Bath & Beyond |

|

NVDA, |

Nvidia |

|

COIN, |

Coinbase Global |

|

AAPL, |

Apple |

|

NIO, |

Nio |

|

AMZN, |

Amazon.com |

The charts

Deutsche Bank

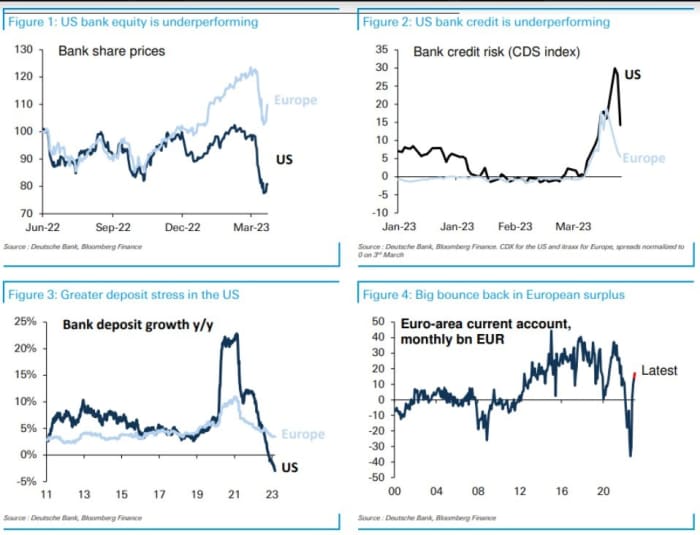

Why did Powell sound a bit more worried that European Central Bank President Christine Lagarde did last week, when the ECB hiked by 50 basis points? Deutsche Bank head of fx research George Saravelos put together these charts. “All of the above is supportive of our view that the negative impact on credit creation of the recent bank stress will be bigger in the U.S. compared to Europe and that a turn in Fed tightening will likely happen before the ECB. Related to this, a flip in U.S. curve moves from flattening to steepening is one of the most important indicators we have used as a bearish signal for the dollar.”

Random reads

A dog toy shaped like a bottle of Jack Daniel’s has provoked a Supreme Court debate.

As Credit Suisse collapsed, a few of its bankers went on an outdoor adventure trip with Bear Grylls.

Yeesh, researchers in Australia have found a “super-size” species of a pretty scary looking spider.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)