[ad_1]

WH Smith hit by cyber security incident

Books-to-stationery retailer WH Smith has been hit by a cyber attack.

WH Smith has told the City that a “cyber security incident” has resulted in illegal access to some company data, including current and former employee data.

WH Smith, which operates shops on the high street and at airports and railway stations, says it has immediately launched an investigation, engaged specialist support services and notified the relevant authorities.

WH Smith says that its customer accounts and databases are not affected, though.

In a statement to the City, it says:

WH Smith takes the issue of cyber security extremely seriously and investigations into the incident are ongoing. We are notifying all affected colleagues and have put measures in place to support them.

There has been no impact on the trading activities of the Group. Our website, customer accounts and underlying customer databases are on separate systems that are unaffected by this incident.

Such attacks are a growing problem for UK businesses, with a number of high profile hacks in recent weeks.

In January, Royal Mail was hit by a cyber incident which caused “severe service disruption” to international exports for almost six weeks.

Retailer JD Sports also warned in January that around 10 million people might have had their addresses, phone numbers and email addresses stolen in a cyber attack.

Key events

BoE’s Pill: UK economy may be stronger than anticipated

The UK economy may be slightly stronger than the Bank of England estimated at the start of February, its chief economist says.

Huw Pill is speaking at Wales Week in London, at the Institute of Directors. And he points out that data released since the Bank’s Inflation Report was issued on 2 February has been better than expected.

Pill says:

Survey indicators that have become available since the publication of the forecast have surprised to the upside, suggesting that the current momentum in economic activity may be slightly stronger than anticipated.

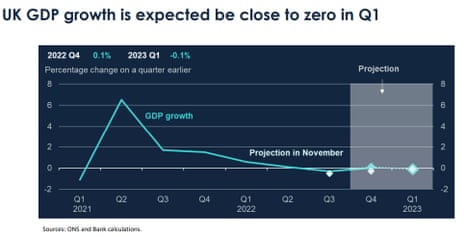

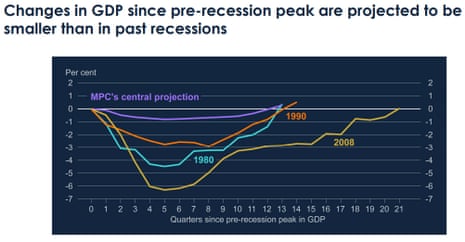

In that February report, the Bank’s forecasts had predicted that real GDP would fall slightly over the coming quarters, as high energy prices and higher market interest rates continue to weigh on spending.

But, the downturn is expected to be rather milder than previous recessions, Pill points out with this chart:

A week after the Bank’s February report, the UK avoided falling into recession after growth stagnated in the final quarter of 2022.

Pill also points out that private sector regular pay growth – which was published after the MPC’s forecast was finalised – was slightly higher than forecast at the end of last year.

But, he adds, some “high-frequency indicators of wages” have fallen quite sharply recently.

Back in the UK, the Institute for Fiscal Studies has spotted signs that the over-50s are returning to the jobs market.

The IFS has analysed the latest UK labour force data, and spotted “a sharp and statistically significant uptick” in 50- to 64-year-olds moving out of inactivity and back into the workforce in October-December.

In total, 197,000 50- to 64-year-olds moved out of inactivity in the latest quarter – and more than half had been out of wok for less than three years. That, the IFS points outs, means they left the jobs market once the pandemic hit.

If it’s the start of a trend, it could be a boost to chancellor Jeremy Hunt who has urged the over 50s to stay in the workplace rather than “going to the golf course.”

Xiaowei Xu, a senior research economist at IFS, explains:

“New data from the end of 2022 suggest that we may be seeing an uptick in older people returning to the workforce, and that more may follow. If ‘unretirements’ continue, this could ease pressures on the labour market. But if the return is triggered by the cost of living crisis, it is no cause for wider celebration – it is a response to people becoming poorer.

“The more important question beyond the immediate term is whether future cohorts will follow recent cohorts in retiring early. The forthcoming Budget should take a broad view of labour force participation, rather than just focusing on undoing what has happened since 2020.”

Shares in cryptocurrency-focused lender Silvergate have dropped by nearly 50% at the start of trading in New York, after it warned that it could go out of business.

In a regulatory filing today, Silvergate said it does not expect to file its annual report, or Form 10-K, by the deadline of 16 March.

Its shares have dropped to $7.03 each, down from $13.54 last night.

California based Silvergate has been hit by the collapse of the FTX empire late last year and the tumble in the value of many crypto coins.

It says that since the end of last year, “a number of circumstances have occurred” which will negatively impact the timing and the unaudited results previously reported in the Earnings Release on 17th January.

That includes the sale of additional investment securities beyond what was previously anticipated, to repay its outstanding advances from the Federal Home Loan Bank of San Francisco.

Silvergate says:

The Company sold additional debt securities in January and February 2023 and expects to record further losses related to the other-than-temporary impairment on the securities portfolio.

These additional losses will negatively impact the regulatory capital ratios of the Company and the Company’s wholly owned subsidiary, Silvergate Bank (the “Bank”), and could result in the Company and the Bank being less than well-capitalized.

In addition, the Company is “evaluating the impact that these subsequent events have on its ability to continue as a going concern for the twelve months following the issuance of its financial statements”, it adds.

City experts are warning that more London-listed companies are considering a move to the New York stock exchange.

The decision by FTSE 100-listed building materials group CRH to consider moving its primary listing to New York, covered this morning here, is part of a broader trends, they say.

Bloomberg reports that City dealmakers are handling frequent inquiries from clients asking how they could shift across the Atlantic.

They say:

Just this week, it was revealed that two major companies had picked the US for their main listings ahead of London — CRH Plc, one of Europe’s biggest building materials companies, and Softbank-owned Arm Ltd., a jewel of Britain’s technology industry. It was the latest blow to the UK’s Conservative government which says it’s determined for London to prosper post-Brexit.

One senior banker said a shift in listings away from London has become the most common talking point among companies, and nearly all their clients with main revenue streams outside Britain were considering a move. Even some members of the benchmark FTSE 100 index are thinking about transferring their listings to New York, according to people with knowledge of the matter, who asked not to be identified discussion private information.

“Unless London can be restored to its position as a default financial center,” said Oliver Lazenby, a partner at Freshfields Bruckhaus Deringer LLP, “then the trend away from London, and in particularly toward New York, will likely continue.”

3,000+ National Express West Midlands bus drivers to strike

More than 3,000 National Express West Midlands bus drivers have voted overwhelmingly to strike over pay, with disruption scheduled to start in two weeks time.

The Unite union has announced that the workers, who voted by 96% for industrial action, will begin all out continuous strike action on Thursday 16 March, the day after the spring budget.

Unite says National Express is only offering workers a real-terms pay cut.

Unite general secretary Sharon Graham said:

“National Express is sitting on mountains of cash and can absolutely afford to give a pay rise to its staff that reflects rocketing living costs. It needs to do just that.

Unite defends our members jobs, pay and conditions to the hilt and the National Express workforce has their union’s total and unflinching support during these strikes.”

National Express reported this morning that underlying operating profits more than doubled last year, to £197.3m.

However, on a statutory basis it made an operating loss of £158.5m, up from a £36.2m loss in 2021.

Somewhat ironically, National Express told shareholders today that it “benefited from strikes elsewhere in public transport in 2022”.

During 2022, it reported a 23% increase in passenger journeys across the Group, with “sustained growth in passenger demand” in Spain, Morocco, the UK and Germany.

Unite regional officer Sulinder Singh says the entire West Midlands bus network will shut due to the strike action, and urges the company to offer a beter pay deal:

“National Express’ greed is the reason why the entire West Midland’s bus network will be shut down and it bears the responsibility for the disruption that will be caused. Our members do not want to strike but National Express has left them with no choice.

The company needs to put forward an offer that our members can accept – it can clearly afford to.”

The number of Americans filing new claims for unemployment support has dropped, a sign that the US jobs market remains solid.

In the week ending February 25, there were 190,000 new ‘initial claims’ for jobless insurance, the US Labor Department reports.

That’s a drop of 2,000 from the previous week’s level of 192,000, and more than the 195,000 which economists expected.

This has lifted the dollar, pushing the pound down to $1.194, down almost a cent today.

The largest increases in initial claims for the previous week were in Kentucky (+6,099), New Jersey (+1,063), Kansas (+545), Pennsylvania (+496), and District of Columbia (+378), while the largest decreases were in California (-4,706), Michigan (-2,521), New York (-2,105), Minnesota (-1,479), and Wisconsin (-1,420), the report shows.

AB InBev, the world’s largest brewer, has reported its first drop in beer volumes since the pandemic, despite the benefit of the football World Cup late last year.

AB InBev, which makes Stella Artois and Budweiser, reported today that its US business was hit by poor weather in December, while its Chinese operation was still impacted by Covid-19 restrictions last year.

It revealed that volumes decreased by 0.6% over the final quarter of 2022, compared against the same period last year.

But, the company also reported earnings that beat analysts’ estimates helped by sales of higher-end beer.

Fourth-quarter earnings rose 7.6%, on an EBITDA basis, due to a 10.2% jump in revenues to $14.67bn due to higher prices.

AB InBev says:

Corona and Stella Artois led the growth of our global brands with a revenue increase of 18.6% and 11.7% respectively, outside of their home markets.

Budweiser grew by 2.5% outside of the US, despite the impact of COVID-19 restrictions in China, the brand’s largest market

Underlying profit hit $1.7bn (£1.4 billion) for the final quarter of 2022, despite continued pressure from cost inflation.

In Europe, the brewer saw revenues increase by double-digits as it benefited from the recovery of demand from pubs, restaurants and bars, as well as continued growth for premium drinks.

ECB: Too early to declare victory on inflation.

The minutes of the European Central Bank’s last meeting in February have been released, and show that policymakers remained concerned about inflation.

During the meeting, on 1st and 2nd February, members of the governing council agreed that although the rate of headline inflation had slowed since October, “inflation was still far too high”.

The minutes say:

While the good news ought to be welcome, it was argued that the December assessment of the inflation outlook had not fundamentally changed. Core inflation was still at levels foreseen in December. Therefore, it was much too early to declare victory.

This morning’s inflation data, showing that annual CPI in the eurozone only fell slightly in February from 8.6% to 8.5%, suggests they were right.

Those are not good inflation numbers for eurozone February inflation. Annual headline inflation saw a miniscule drop to 8.5%, driven entirely by energy (itself partly distorted by policy measures in addition to easing commodity prices). Core inflation *rose* to 5.6%.

1/3 pic.twitter.com/FRlrl7HLjG— Thomas Dvorak (@thomdvorak) March 2, 2023

At the meeting, the ECB voted to raise its key interest rates by half a percent, or 50 basis points.

Chief economist Philip Lane also recommended communicating that the ECB intended to raise rates by another 50 basis points at its meeting in March, to fight inflation.

But policymakers were split over this, with some expressing reservations about communicating plans for the March meeting, as did ultimately happen.

The minutes of February’s meeting also show that ECB policymakers doubted the vew in the markets that inflation pressures were easing, saying:

Two factors raised doubt about the markets’ benign view of inflation.

First, the growing signs that a technical recession in the euro area had become less likely. And second, the reopening of China’s economy.

One reason for caution, it seems, is that European companies have been successful at lifting their prices, driving inflation.

The minutes say the ECB should monitor price growth as closely as wage increases:

Developments in unit profit growth remained very strong, which suggested that the pass-through of higher costs to higher selling prices remained robust.

It was therefore widely stressed that developments in profits and mark-up warranted constant monitoring and further analysis on an equal footing with developments in wages.

oh hi @ecb in the spirit of transparency and expectations anchoring, would be great if you could share those internal slides showing it’s corporate profits, not wages, driving inflation https://t.co/JX8Le8A72x

— Daniela Gabor (@DanielaGabor) March 2, 2023

Russia to extend capital controls, central bank chief says

Speaking of Russia…. the country’s central bank chief has said today that capital controls on cash withdrawals of foreign currency and transfers abroad will be extented.

Governor Elvira Nabiullina told a banking forum near Moscow that current economic conditions meant that existing capital controls must remain in place.

Nabiullina explained (via Reuters):

“Deadlines for restrictions like limits on withdrawing cash currency from bank accounts, money transfers abroad, and restrictions on withdrawals by non-residents from ‘unfriendly’ countries are approaching.

“All of them will be extended.”

Russia introduced strict controls on currency operations last year in response to Western sanctions following the invasion of Ukraine, to support the value of the rouble.

Some have been lifted or eased, after the rouble recovered from its slump in February and March 2022.

Billionaire Deripaska Warns Russia May Run Out of Money in 2024

Billionaire magnate Oleg Deripaska warned today that Russia could run out of funds in 2024 and needs investment from “friendly” countries, as sanctions imposed by the West following the fullscale invasion of Ukraine bite.

Speaking at the Krasnoyarsk Economic Forum in Siberia today, Deripaska said:

“There will be no money already next year.

We will need foreign investors.”

Bloomberg, who reported Deripaska’s comments, says he also warned that Russia faces “serious” pressure from sanctions.

Bloomberg explains:

Funds are now running low and “that’s why they’ve already begun to shake us down,” said Deripaska, founder of United Co, Rusal International PJSC, the biggest aluminium producer outside China.

Deripaska’s comments are among the most outspoken by a prominent business leader as the government looks to turn the screws on large companies after ending last year with a record fiscal deficit and the budget still deep in the red to start 2023.

Authorities are already planning to raise additional budget revenue with proposed changes to how they tax oil companies and may wrest more money from other commodity producers by means of a one-time levy.

Even after recent high-profile hacks, like that on Royal Mail, it is “highly worrying” that vulnerabilities still plague companies like WH Smith, says Keiron Holyome, VP UKI & Emerging Markets at Canadian software company BlackBerry.

Holyome explains:

Organisations need better cyber hygiene as criminals are increasingly being attracted by stores of sensitive data and information.”

Cyber criminals are waiting for organisations and the public to drop their guard. We must not let them seize the opportunity.”

Businesses should not have to suffer the effects of cyberattacks, Holyome argues:

Endpoint detection and response (EDR) focused solutions take action too late and do not prevent breaches. Prevention is the best strategy. With a prevention-first and AI-driven approach, malware can be stopped in its tracks. “

Many cyber-attacks are being conducted by ransomware gangs, points out Jake Moore, Global Cyber Security Advisor at security firm ESET,

Following WH Smith’s cyber attack, Moore explains:

“Large companies are regularly targeted but it is significant to have a succession of big names being brought down recently. If company data has been accessed, it could be used as a bargaining tool to maximise the cybercriminals’ ransom demands.

The fact it potentially includes employee information it could increase the amount dramatically. It is likely that if this was a ransomware attack then the restoration process worked efficiently. However, attackers now tend to steal sensitive information as insurance in case their encryption plans are not as successful or impactful.”

Transcripts released last month showed that Royal Mail had rejected an “absurd” ransom demand for $80m (£67m) from hackers linked to Russia following its cyber attack in January.

The cyber attack at WH Smith shows that no company is immune to such data breaches, warns Ceri Shaw, chief delivery officer at digital skills academy CodeClan.

Shaw says all businesses must take the threat of data breaches seriously, and implement measures that protect their employees’ and customers’ information from the ‘ever-present threat’ of cyber-attacks are an ever-present threat.

There are several practical steps that companies can take to minimise the risk of a data breach, Shaw explains:

Firstly, any data stored on computers and storage devices, as well as data in transit over networks, should be safeguarded. The best way of doing this is to encrypt any sensitive data – such as customer information and financial data – to help protect your organisation against any hackers and unauthorised access.

If your organisation uses any software and security systems, they should be frequently updated to make certain that any vulnerabilities are being patched. Across the organisation, strong and unique passwords should be used to minimise any risk. A password manager is a highly useful tool that will help produce and memorise strong passwords.

Finally, training should be in place for all employees on how to distinguish and prevent cyber threats, along with a plan in place on how to restore systems and contain the breach if one was to occur.

Responding with speed to a cyber-attack will help minimise any risks and disruption, while helping restore levels of consumer confidence.

WH Smith hit by cyber security incident

Books-to-stationery retailer WH Smith has been hit by a cyber attack.

WH Smith has told the City that a “cyber security incident” has resulted in illegal access to some company data, including current and former employee data.

WH Smith, which operates shops on the high street and at airports and railway stations, says it has immediately launched an investigation, engaged specialist support services and notified the relevant authorities.

WH Smith says that its customer accounts and databases are not affected, though.

In a statement to the City, it says:

WH Smith takes the issue of cyber security extremely seriously and investigations into the incident are ongoing. We are notifying all affected colleagues and have put measures in place to support them.

There has been no impact on the trading activities of the Group. Our website, customer accounts and underlying customer databases are on separate systems that are unaffected by this incident.

Such attacks are a growing problem for UK businesses, with a number of high profile hacks in recent weeks.

In January, Royal Mail was hit by a cyber incident which caused “severe service disruption” to international exports for almost six weeks.

Retailer JD Sports also warned in January that around 10 million people might have had their addresses, phone numbers and email addresses stolen in a cyber attack.

Eurozone inflation higher than expected in February, at 8.5%

Just in: inflation across the euro area only eased slightly last month, as the cost of living squeeze continued to hit households.

Euro area annual inflation is expected to be 8.5% in February 2023, down from 8.6% in January according to a flash estimate from Eurostat.

That’s higher than expected – economists had forecast inflation would drop to 8.2% last month.

Households were hit by accelerating food price inflation, while energy prices eased slightly.

Eurostat says:

Food, alcohol & tobacco is expected to have the highest annual rate in February (15.0%, compared with 14.1% in January), followed by energy (13.7%, compared with 18.9% in January), non-energy industrial goods (6.8%, compared with 6.7% in January) and services (4.8%, compared with 4.4% in January).

Core inflation, which excludes energy, food, alcohol and tobacco, rose to 5.6% per year from 5.3% last month:

Core inflation in the Eurozone jumped from 5.3 to 5.6%, oof… Still, quick seasonal adjustment suggests this is mainly due to base effects as the monthly growth rate showed a small decline. pic.twitter.com/8njkBFCFaN

— Bert Colijn (@BertColijn) March 2, 2023

[ad_2]

Source link

(This article is generated through the syndicated feed sources, Financetin doesn’t own any part of this article)