Business valuation is often called as Company valuation, it is the process of determining the fundamental value of a business. The valuation process analyzes all areas of the company or business, to determine its value and the value of its departments or units.

Company valuation can be used to determine the fair value of a business for a number of reasons, including sales value, determining partnership ownership, taxes, and even for divorce proceedings. Owners often turn to professional business appraisers to objectively assess the value of the business.

keys Points:

- Company valuation determines the economic/fundamental value of a company or business

- Business valuations can be used to determine the fair value of a business for a number of reasons, including sale value, partnership formation, taxes, and even divorce

- There are several methods of valuing a company, such as looking at its market capitalization, earnings multiple, or book

Basics of business valuation:

Business valuation is a topic in corporate finance. A business valuation is usually done when a company wants to sell all or part of its business or wants to merge with or acquire another company. Business valuation is the process of determining the current value of a business using objective measurements and evaluating various aspects of the business.

A company valuation may include an analysis of the company’s management, capital structure, future earnings prospects or the market value of assets. The tools used for valuation can vary by valuer, company and industry. Common methods of business valuation include financial statement reviews, discounted cash flow models, and similar business analysis.

Valuation is important for tax reporting also. The Internal Revenue Service (IRS) requires businesses to be valued based on their fair market value(FMV). Some tax-related events, such as the sale, purchase or gift of shares in a company, will be taxed based on the valuation.

Important:

Determining the true value of a company is an art and a science; a number of formal models are available, but the choice of the correct model and the relevant input data can be somewhat subjective. Evaluation method

Business Valuation Methods:

A company can be valued in several ways. You will learn about several of these methods below.

Market value method:

Market value is the simplest method of valuing a business. It is calculated by multiplying the company’s share price by the total number of outstanding shares. For example As of October 16th, 2022, Microsoft Inc. Trades for $228.56

With a total of 7.46 billion shares outstanding, the company is valued at $228.56 x 7.46 billion = $1.705 Trilllon.

Revenue multiplier method:

Using the multiple revenue business valuation method, revenue streams generated over a period are applied to a multiplier that depends on the industry and economic environment. For example, a technology company might be valued at 3x earnings, while a services company might be valued at 0.5x earnings. For example the Price to earnings ratio of Apple on 18-10-2022 (Trailing twelve months) is 23.81 and its EPS(TTM) = 6.05 per share, so current price as on 18-10-2022 is 23.81*6.05 = 144.05 and if we assume that the EPS will grow to 8.60(there are methods which can be used to forecast the future EPS , however for simplicity we are making an assumption) then its value after 1 year would be = 23.81 * 8.60 = 204.766 per share. And the business value would simply be the product of per share value and number of share.

Times Income Method:

Earnings multiples can be used to get a more accurate picture of a Business’s true value, rather than the multiple-by-revenue method, since a company’s earnings are a more reliable indicator of its financial success than sales revenue. The earnings multiplier adjusts future earnings based on cash flows that can be invested over the same period at the current interest rate.

In other words, it adjusts the current price-to-earnings ratio to accommodate current interest rates.

Discounted cash flow (DCF) method:

DCF business valuation method is similar to earnings multiples. The method is based on projections of future cash flows and adjusted to obtain the company’s current market value. The main difference between the discounted cash flow method and the earnings multiple method is that inflation is taken into account when calculating the present value.

Book/Accounting value model:

It is the value of a company’s equity as shown on its balance sheet. Book value is calculated by subtracting a company’s total liabilities from its total assets.

Liquidation value:

Liquidation value is the net cash the company would receive today after liquidating its assets and paying off its liabilities.

Football field map method:

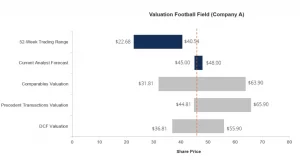

Investment bankers typically draw up a football field chart to summarize the range of company values based on the various valuation methods used. Below is an example of a football pitch diagram often included in investment banking brochures.

As you can see, the chart summarizes the company’s 52-week trading range (i.e., the stock price, assuming it’s public), the stock analyst’s price range for that stock, the value range for comparable valuation models, the precedent range trading analysis, and finally the DCF valuation method. The orange dotted line in the middle is the average estimate for all methods.

Option Based Business valuation method:

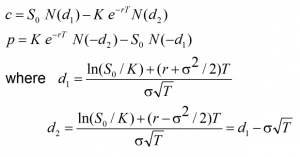

Option Based Valuation is a little complicated approach because it uses stochastic models like Black-Scholes equations. This method is generally used by the lenders to access the worth of business at the maturity of the debt or used when there are option embedded in the company’s business for example company has developed a drug and applied for the patent but its future revenue will depend on whether the patent is granted to the company or not. Here is the formula.

Where;

S0 = current market cap of company

k = value of debt

T = tenure of debt

r = risk free rate

Q = Implied Volatility

You can go through this document to know more about Option based valuation

This is not at all an exhaustive list of business valuation methods in use today. Other methods include replacement value, distributed value, asset-based valuation, and more.

More From financetin