[ad_1]

There’s been a lot of buzz lately regarding another 2008 housing crisis unfolding in 2023.

I’m hearing the phrases underwater mortgage and foreclosure again after more than a decade.

To be sure, the housing market has cooled significantly since early 2022. There’s no denying that.

You can mostly thank a 6% 30-year fixed-rate mortgage for that. Roughly double the 3% rate you could snag a year prior.

But this alone doesn’t mean we’re about to repeat history.

Goldman Sachs Forecasts 2008 Style Home Price Drops in Four Cities

The latest nugget portending some kind of massive real estate market crash comes via Goldman Sachs.

The investment bank warned that four cities could see price declines of 25% from their 2022 peaks.

Those unfortunate names include Austin, Phoenix, San Diego, and San Jose. All four have been hot places to buy in recent years.

And it’s pretty much for this reason that they’re expected to see sharp declines. These markets are overheated.

Simply put, home prices got too high and with mortgage rates no longer going for 3%, there has been an affordability crisis.

Properties are now sitting on the market and sellers are being forced to lower their listing prices.

A 6.5% Mortgage Rate By the End of 2023?

Of course, it should be noted that Goldman’s “revised forecast” calls for a 6.5% 30-year fixed mortgage for year-end 2023.

It’s unclear when their report was released, but the 30-year fixed has already trended lower since the beginning of 2023.

At the moment, 30-year fixed mortgages are going for around 6%, or as low as 5.25% if you’re willing to pay a discount point or two.

And there’s evidence that mortgage rates may continue to improve as the year goes on. This is based on inflation expectations, which have brightened lately.

The last couple CPI reports showed a decline in consumer prices, meaning inflation may have peaked.

This could put an end to the Fed’s interest rate increases and allow mortgage rates to fall as well.

Either way, I believe Goldman’s 6.5% rate is too high for 2023. And that might mean their home price forecast is also overdone.

Mortgage Performance Remains “Exceptionally Healthy”

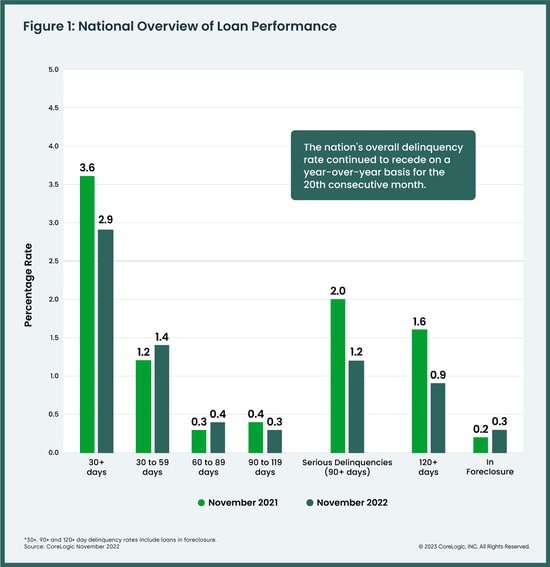

A new report from CoreLogic found that U.S. mortgage performance remained “exceptionally healthy” as of November 2022.

Just 2.9% of mortgages were 30 days or more delinquent including those in foreclosure, which is near record lows.

This represented a 0.7 percentage point decrease compared with November 2021 when it was 3.6%.

And foreclosure inventory (loans at any stage of foreclosure) was just 0.3%, a slight annual increase from 0.2% in November 2021.

At the same time, early-stage delinquencies (30 to 59 days past due) were up to 1.4% from 1.2% in November 2021.

But on an annual basis mortgage delinquencies declined for the 20th straight month.

One big thing helping homeowners is their sizable amount of home equity. Overall, it increased

by 15.8% year-over-year in the third quarter of 2022.

That works out to an average gain of $34,300 per borrower. And the national LTV was recently below 30%.

Negative Equity Remains Very Low

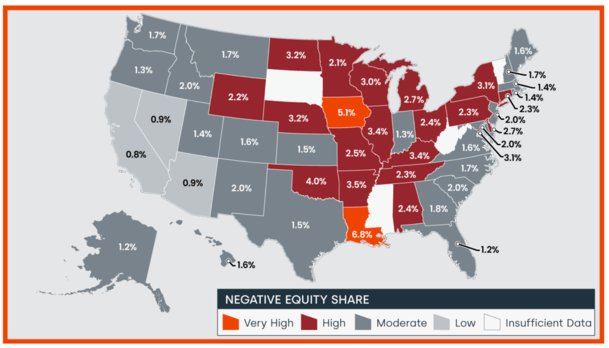

During the third quarter of 2022, 1.1 million mortgaged residential properties, or 1.9% of the total, were in a negative equity position.

This means these homeowners owe more on their mortgage than the property is currently worth.

Back in 2008, these underwater mortgages were a major problem that led to millions of short sales and foreclosures.

And while negative equity increased 4% from the second quarter of 2022, it was down 9.8% from the third quarter of 2021.

If downward pressure remains on home prices, I do expect these numbers to worsen. But considering where we’re at, it’s not 2008 all over again.

Per CoreLogic, negative equity peaked at a staggering 26% of mortgaged residential properties in the fourth quarter of 2009. We are at 1.9%.

Even if it rises, many homeowners have fixed interest rates in the 2-3% range and no interest in selling.

Back then, you had every incentive to leave the house and its toxic adjustable-rate mortgage.

The CFPB Wants Lenders to Make Foreclosure a Last Resort

Back in 2008, there wasn’t a Consumer Financial Protection Bureau (CFPB). Today, there is.

And they’re being tough on lenders and mortgage servicers that don’t treat homeowners right.

Last week, they also released a blog post urging servicers to consider a traditional home sale over a foreclosure. This is possible because so many homeowners have equity this time around.

But even before it gets to that point, servicers should consider a “payment deferral, standalone partial claim, or loan modification.”

This allows borrowers to stay in their homes, especially important with rents also rising.

The main takeaway here is that lenders and servicers are going to be heavily scrutinized if and when they attempt to foreclose.

As such, foreclosures should remain a lot lower than they did in 2008.

Today’s Homeowners Are in Much Better Positions Than in 2008

I’ve made this point several times, but I’ll make it again.

Even the unfortunate home buyer who purchased a property in the past year at an inflated price with a much higher mortgage rate is better off than the 2008 borrower.

We’ll pretend their mortgage rate is 6.5% and their home value drops 20% from the purchase price.

There’s a very good chance they have a 30-year fixed-rate mortgage. In 2008, there was an even better chance they had an option ARM. Or some kind of ARM.

Next, we’ll assume our 2022 home buyer is well-qualified, using fully documented underwriting. That means verifying income, assets, and employment.

Our 2008 home buyer likely qualified via stated income and put zero down on their purchase. Their credit and employment history may have also been questionable.

The 2022 home buyer likely put down a decent sized down payment too. So they’ve got skin in the game.

Our 2022 buyer is also well aware of the credit score damage related to mortgage lates and foreclosure.

And their property value will likely not drop nearly as low as the 2008 buyer. As such, they will have less incentive to walk away.

Ultimately, many 2008 home buyers had no business owning homes and zero incentive to stay in them.

Conversely, recent home buyers may have simply purchased their properties at non-ideal times. That doesn’t equal a housing crash.

If mortgage rates continue to come down and settle in the 4/5% range, it could spell even more relief for recent buyers and the market overall.

Oddly, you could worry about an overheated housing market if that happens more so than an impending crash.

When I would worry is if the unemployment rate skyrockets, at which point many homeowners wouldn’t be able to pay their mortgages.

[ad_2]

Source link